Stock Returns After Crude Collapse

In the Daily Report on Tuesday, we took a look at several studies showing the historic collapse in crude oil prices. As the drop in that market continues to reverberate, broader financial media is taking the usual fear-laden tack that it will lead to a jump in high-yield bond defaults (which is probable) thus leading to a big decline in the broader stock market.

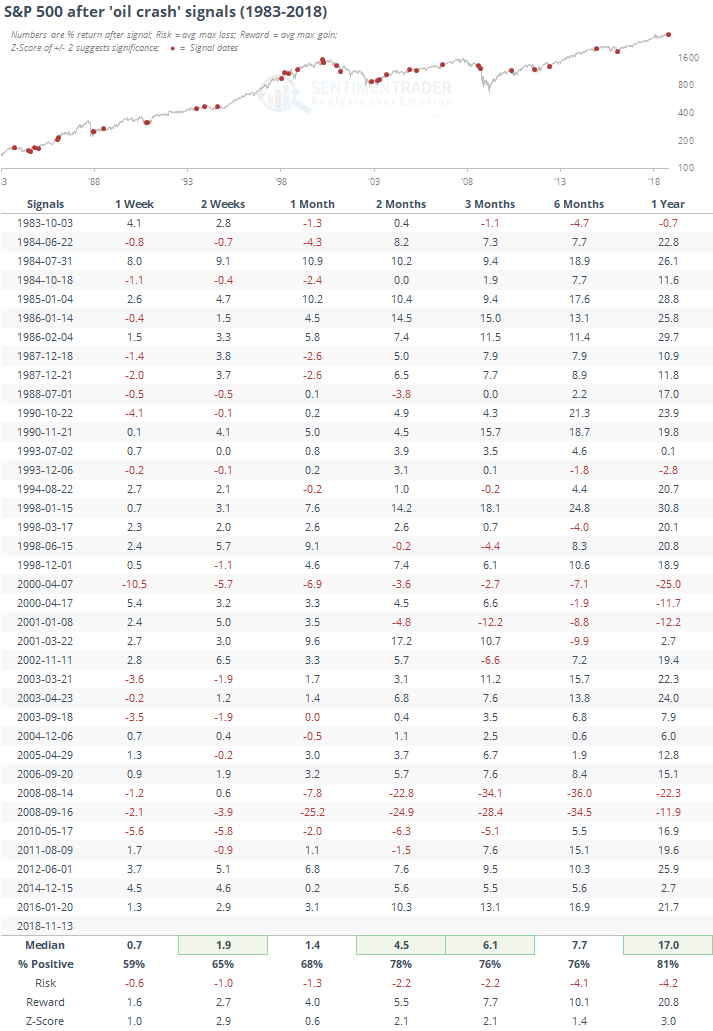

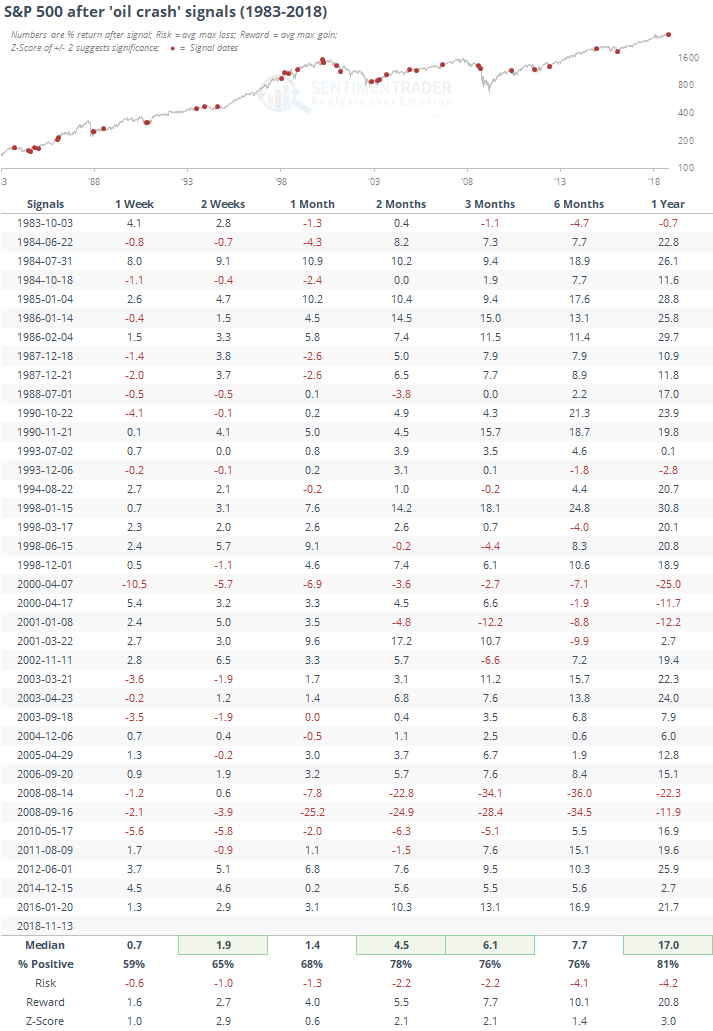

If we take every date from the three studies from Tuesday and look at the S&P 500's performance going forward instead of oil's, then we get the following.

Not too bad. Over the next 2-3 months, the S&P rallied after these crash signals more than three quarters of the time, with excellent average returns and a decent risk/reward ratio.

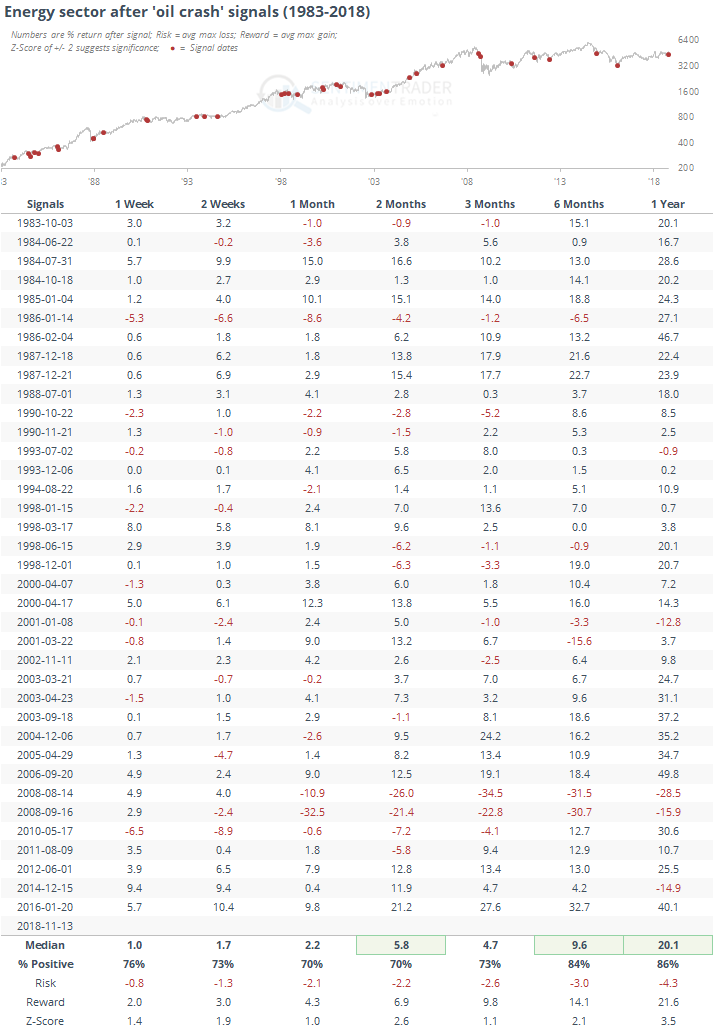

How about energy stocks? A drop in crude should lead investors to sell the stocks of companies largely dependent on the price of the underlying commodity (though in reality it's not nearly that linear).

Energy stocks actually performed better than the S&P 500 going forward. Over the next 6 months, the sector averaged a return of nearly 10%, more than 2 standard deviation above a random 6-month return. Risk/reward was excellent. There were a couple of large negatives, during the depth of the 2001 and 2008 bear markets, but otherwise the prospects were very good.

There are some signs that the sudden extreme gyrations in energy futures contracts is due to funds being out of position and scrambling to cover. Maybe it's as simple as that, and doesn't have anything to do with grand macro risk-off shifts that will morph into a bear market. That was the case in 2008 but otherwise the fear of contagion was wholly unjustified.