Stocks Are Stuck As Turnover Explodes

This is an abridged version of our Daily Report.

Stuck exactly in the middle

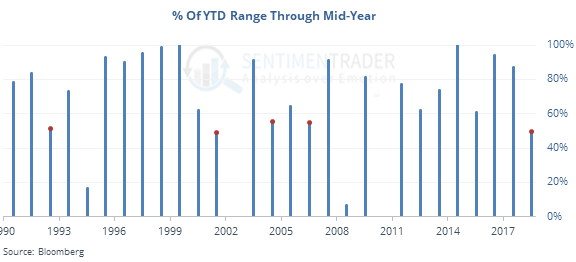

The S&P ended its first half stuck exactly at the midpoint of its year-to-date high and low.

It’s more typical for stocks to be near the upper or lower end of their range by mid-year. Similar years led to weak returns over the next 1-2 months, but not beyond that.

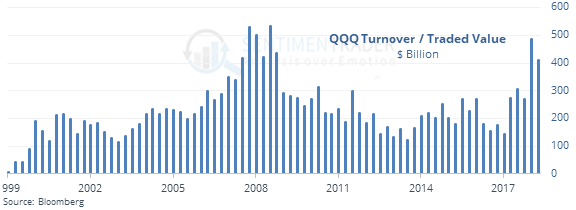

Turnover trouble

Stocks are seeing a big jump in the dollar value of shares turned over. Among stocks in the S&P 500, the only times the dollar value of volume was this year was approaching the last two bull market peaks. Same for the Nasdaq 100 trust, QQQ.

This is a warning sign of speculative behavior in highly-priced stocks.

Now coffee is really hated

The Optimism Index on coffee has sunk to a lowly 15, a level that is rarely seen in any commodity. Over its history, the Backest Engine shows that coffee rallied over the next month 71% of the time.

Powering up

The 10-day Optimism Index on the utilities fund XLU is now the highest since early 2016.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |