Stocks Have A Participation Problem

Debt declines

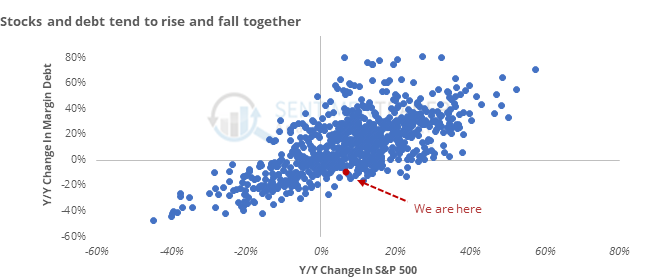

When stocks rally, investors tend to borrow more against their shares. There is a high positive correlation between changes in stock indexes and changes in margin debt.

That’s breaking down this year, though. As stocks have rallied, investors have held back on their debt. It’s not as good (or bad) a sign as one might think.

Bulls will suggest this is a “wall of worry” and means that stocks are heading higher. Bears will say it’s troubling evidence of risk aversion leading to losses. They’re both right, in a sense, but the bulls would be “more right.”

Participation problems

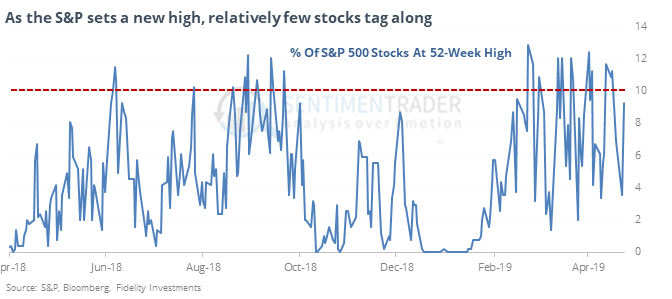

The most important stock index in the world hit a new high on Tuesday, but relatively few of its stocks went along for the ride. A curiously low number of stocks in the index hit a 52-week high along with the index, and relatively few of them managed to even climb above their short-, medium-, and long-term moving averages.

That’s not a sell signal by any means, but future returns were much better after new highs with better participation, with future returns doubling - or more - those times when participation was less impressive like it is now.

Dollar deluge

Stocks aren’t the only asset breaking out. The U.S. Dollar Index just hit a two-year high. This is not what typically happens when economic surprises have been so negative. Other times it hit a two-year high for the first time in at least six months, it was mostly unsuccessful at holding up. Six months later, the dollar added to gains only 40% of the time, averaging -1.1%.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.