Stocks have enjoyed a historic rally, and volatility remains high

Stocks have enjoyed a historic rally over the last quarter, and yet options traders still seem relatively nervous.

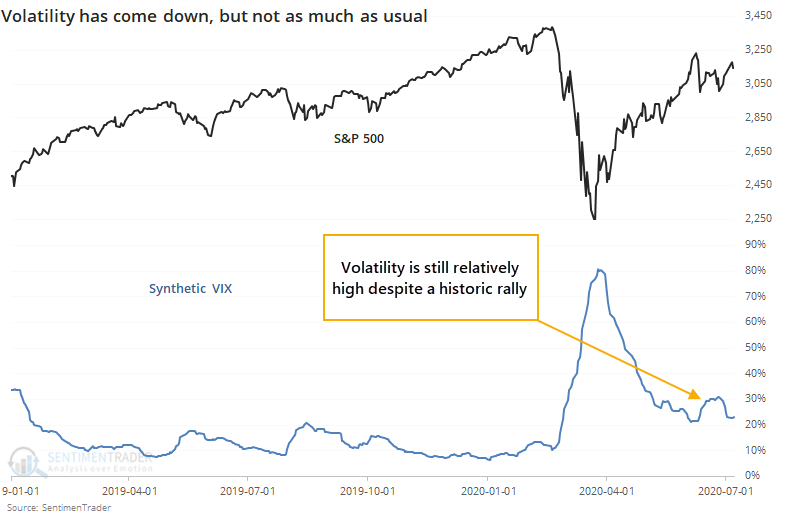

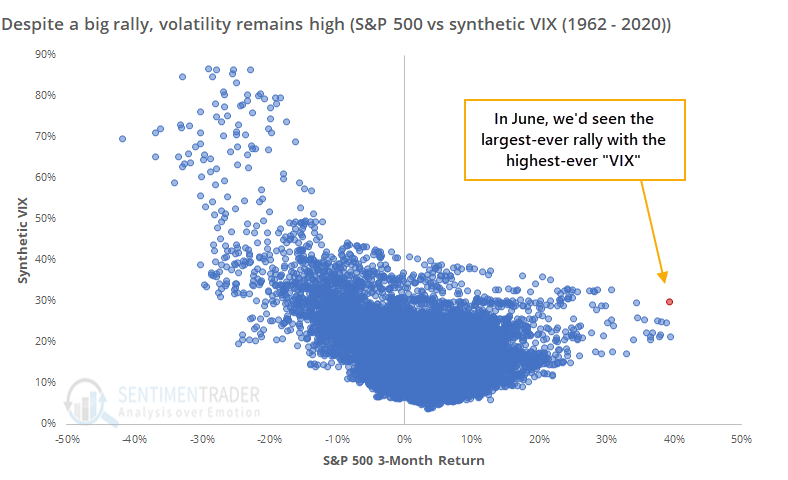

As noted by Bloomberg, the S&P 500 has rallied strongly over several months, but the VIX "fear gauge" is higher than it typically would be given such a large rise in prices.

"Typically when stocks rise, the VIX falls as traders look forward to less turbulence ahead, and vice versa. Yet the likes of Goldman Sachs Group Inc. consider the gap between the gauge and S&P 500 returns one of the largest on record, thanks in part to the dizzying speed of the cash-equity rally."

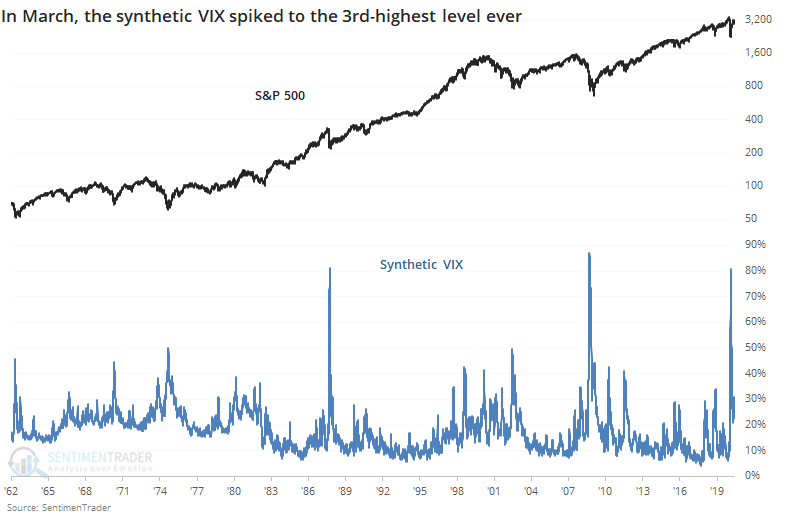

If we use the calculation for a synthetic VIX that we've used in the past, then we can see that we're still coming down from a historic spike, the 3rd-highest since 1962.

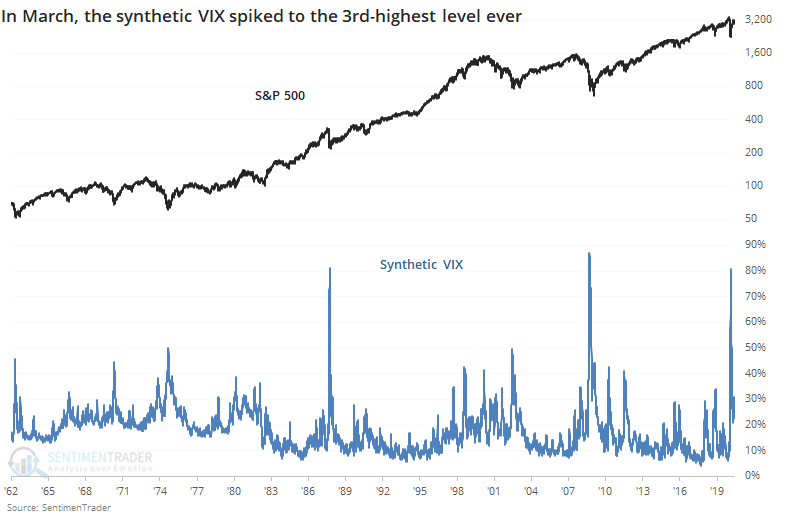

In recent months, stocks have rallied hard, and the synthetic VIX has declined significantly but still remains well above 20%.

When we plot the S&P's 3-month return against the level of the synthetic VIX, then we can see the outliers (especially in June), confirming the note by Goldman Sachs.

The biggest question, as always, is "so what?" Let's check to see if this has any bearing on future returns.

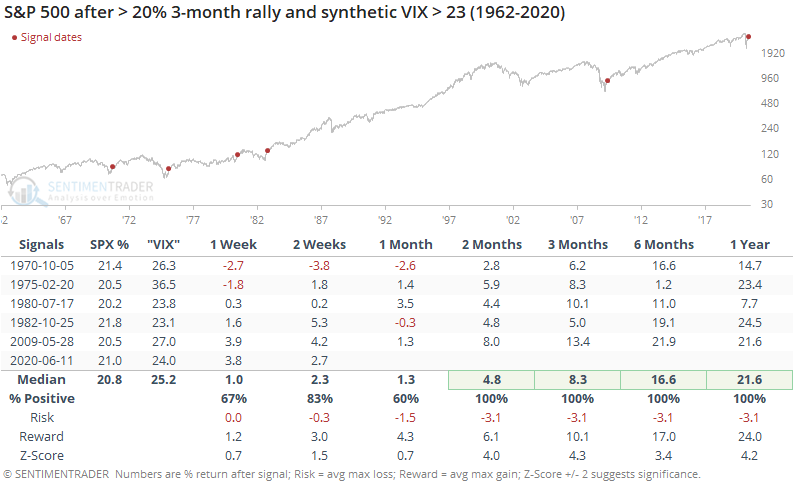

The table below shows every date since 1962 when the S&P 500 rallied at least 20% over a 3-month period, and yet the synthetic VIX remained above 23%.

This triggered nearly a month ago and remains in effect, even as the S&P's rate of growth has slowed. The prior signals did not show that it was a worry that volatility remained elevated even during a major rally.

From two months and beyond, the S&P continued its rally all 5 times, enjoying a heavily skewed risk/reward ratio. Every one of them triggered after major corrections when volatility spiked so much that it was still high months after stocks rallied strongly.

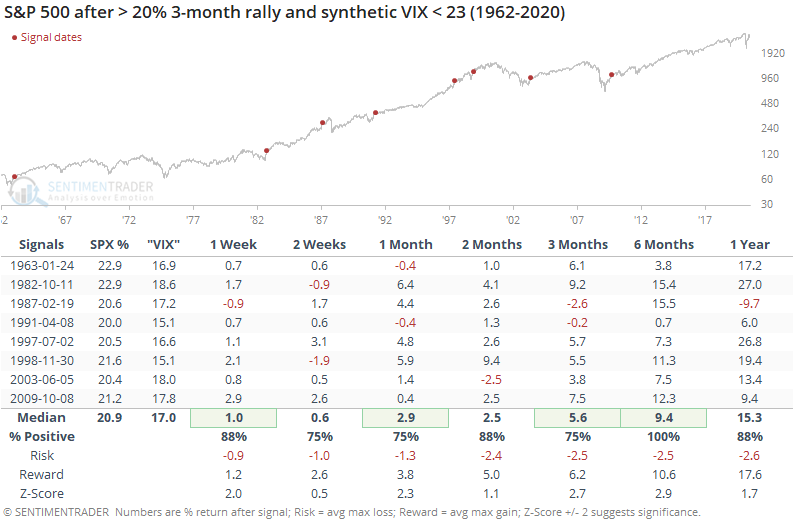

Now, let's check the other scenario when stocks rallied hard but the synthetic VIX fell to a lower level.

This wasn't a major worry, either. Shorter-term returns were better than when the synthetic VIX stayed high, but longer-term returns were lower.

The biggest takeaways are that:

- Extremely high levels of volatility like we saw in March almost universally lead to higher 6-12 month prices in stocks

- Very large 3-month rallies in stocks tend to lead to even-higher prices over the medium- to long-term

- Elevated volatility in spite of a large rally in stocks has not been a reason for worry