Stocks wobble, but options traders aren't losing faith

Arguably the biggest story in sentiment in recent weeks has been the behavior of speculative options traders. On Monday, we saw how much this kind of activity spiked heading into September and its potential impact on the broader market.

Financial media initially blamed this on the Softbank conglomerate. We've been arguing that Softbank was a straw man; rather, it has been the behavior of the smallest of traders that was the real driving force. That idea gained ground during the week, thanks in large part to Benn Eifert's explanation of how this could happen on Twitter.

The Narrative is shifting

As the week unfolded, Bloomberg noted:

Later, the Financial Times followed with:

Jason Zweig from the Wall Street Journal is always a good source for perspective:

And Barron's:

Even so, traders aren't letting up

Okay, so we knew heading into the week that the real story was the speculative activity of the smallest of options traders. It didn't seem to let up during the week. By Friday, options activity was still skewed toward calls, per Bloomberg.

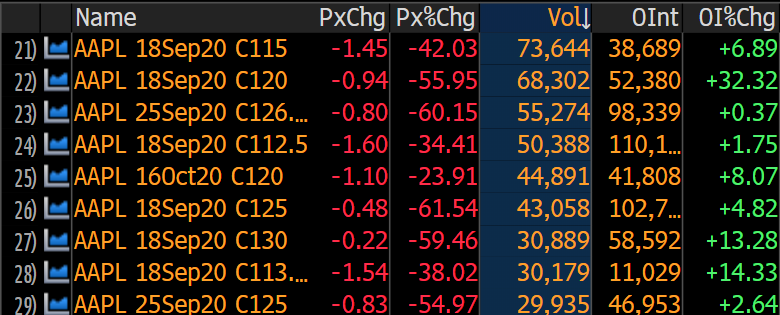

"An Apple call with a $120 strike price expiring on Friday traded nearly 200,000 times on Thursday, making it the day’s most-active option, according to data compiled by Bloomberg. Trading surged even as the value of the contract plunged over 87% to close at $113.49 on Thursday -- well below the option’s strike. Despite the burst, the option’s open interest only increased by about 10,000 contracts, suggesting that the vast majority of the trading volume was positions opened and closed the same day. To see such frenzied activity in what’s effectively a one-day option suggests that day traders are behind the flows, according to Charlie McElligott from Nomura Securities."

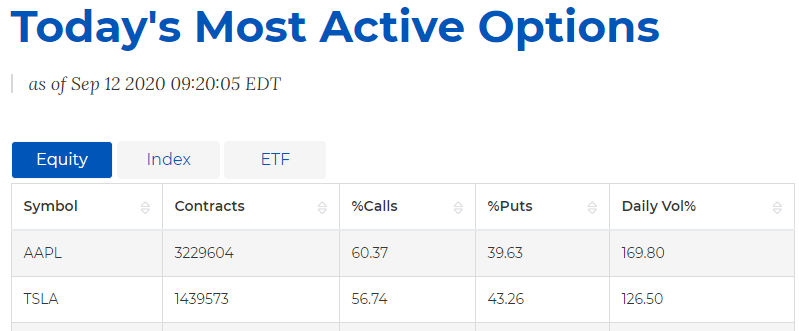

According to the OCC, the two most active options on Friday - by a very wide margin - were Apple and Tesla, two of the biggest speculative darlings heading into last week.

Bloomberg data shows that the most active call options are concentrated in the September 18 expiration. Apple calls are plunging in value with heavy volume, yet open interest is actually rising.

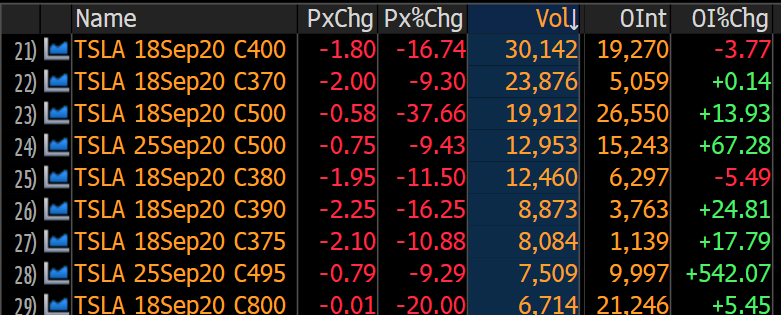

Same with Tesla.

Without being privy to the underlying trades, this would suggest that traders are not pulling back after getting burned, rather they're continuing to bet on higher prices.

Speculative activity still at records

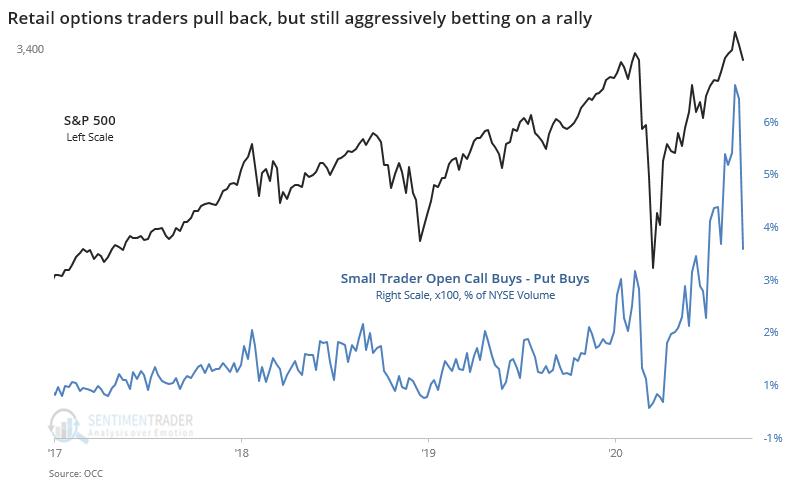

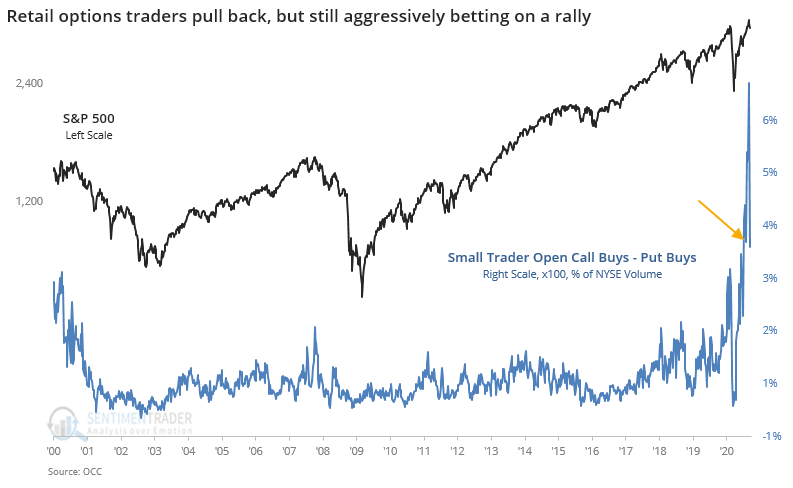

Looking at the weekly data, this is evident. Let's look at data for the smallest of options traders in the most comprehensive, objective way we can. This is the volume of opening call purchases minus opening put purchases, expressed as a percentage of total NYSE volume. To adjust for contract size, we'll multiply the options volume by 100.

Clearly, there was a big pullback in speculative volume last week, dropping off by more than 50% from the upside panic to start September. But when zooming out, we can see that last week was still higher than any previous record high, by far.

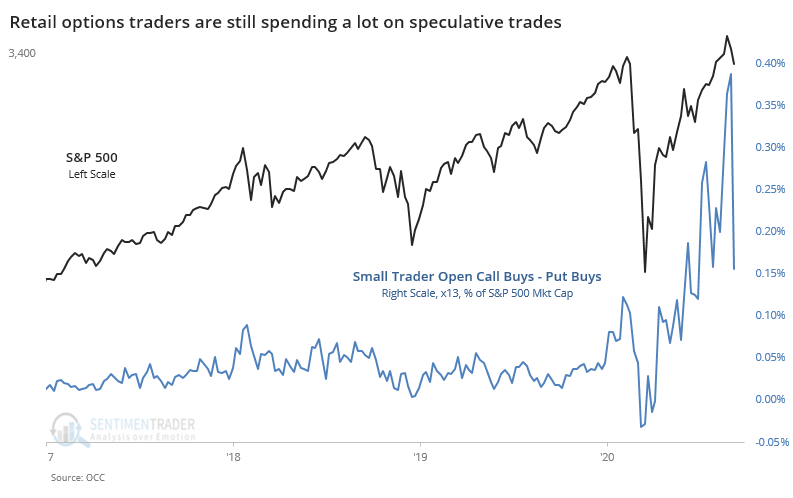

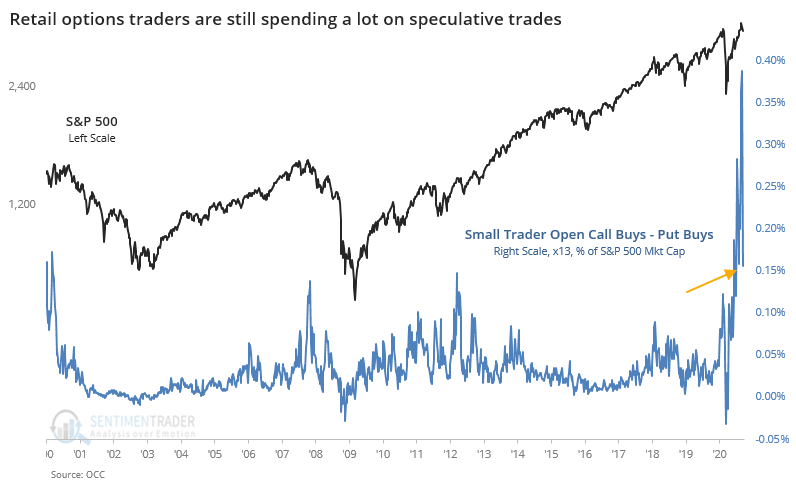

If we use premiums, the amount of money that traders actually spent to buy these options, then we can see pretty much the same story. There was a big drop-off last week in the estimated notional value of these speculative positions.

Even so, this past week's activity was still on par with the most speculative frenzies in the past 20 years.

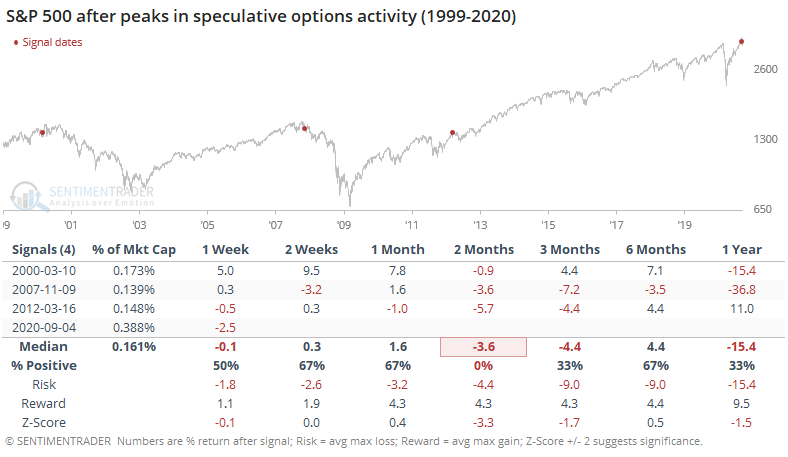

After the 3 other times when speculative activity peaked, stocks struggled in the months ahead.

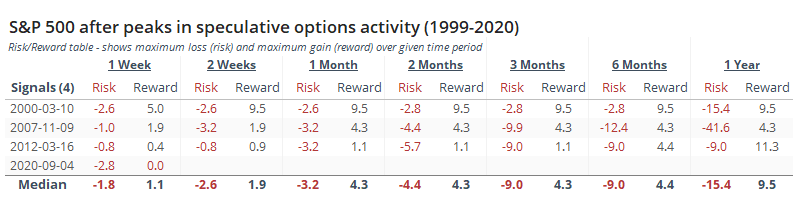

The risk/reward ratio was poor.

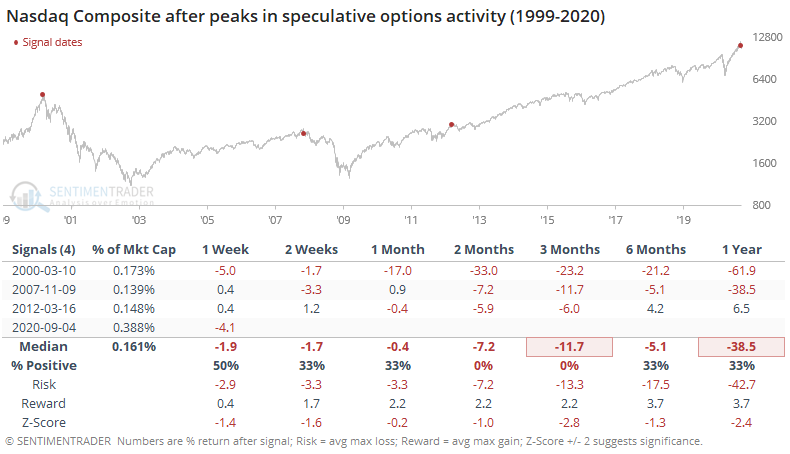

It was worse for the Nasdaq Composite.

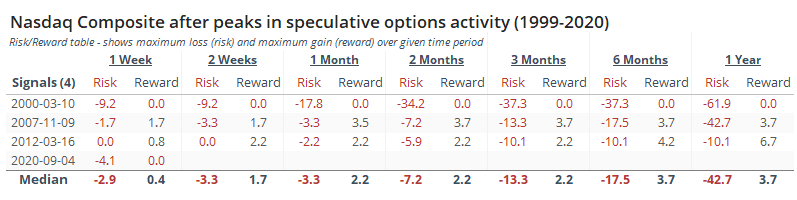

The risk/reward after these signals for the Nasdaq was atrocious.

The bottom line is that speculative options trading has been an issue for quite a while, and it hadn't really mattered. Coming into September, though, it moved into a whole other realm, and we're starting to see some cracks. The biggest worry is that this rush of speculative activity has created a big offsetting underlying position in the stocks, and that needs to be unwound as the options are closed or expire. Most of that will be happening in September. There isn't any way to think that this is a good sign for markets.