Surge In Financials At 52-Week Highs

One of the most notable developments in stocks in recent days has been the surge in the number of stocks reaching 52-week highs. As noted in Thursday's report, across the NYSE and Nasdaq exchanges, we're seeing one of the largest breakouts in 30 years.

That's often a good sign long-term, but outside of nascent bull markets, which this is not, it's best viewed as a sign of short- and even medium-term exhaustive buying pressure.

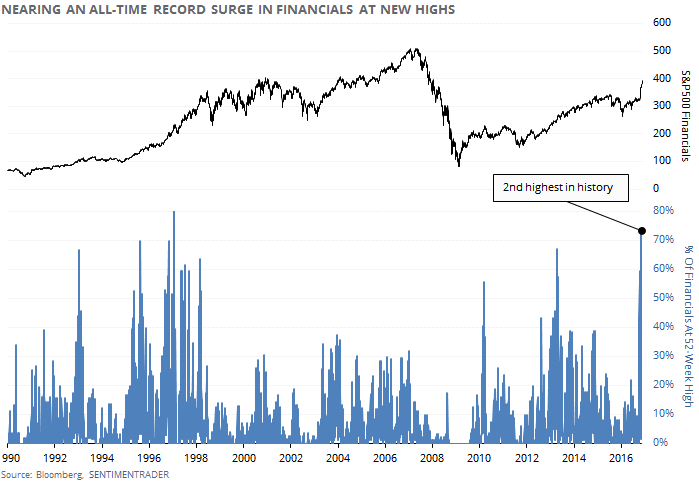

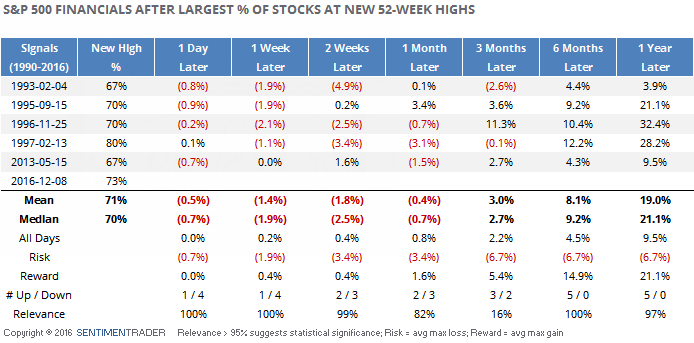

And nowhere is that more acute than in financials. Data for Thursday now show that the S&P 500 financial sector has 73% of their members trading at a 52-week high, an astounding figure that is the 2nd-highest since 1990. Only February 13, 1997, saw more financials at a new high at the same time.

After that surge, financials pulled back by over 3% in the next couple of weeks. That wasn't unusual. The table below shows the 5 largest surges in 52-week highs among financial stocks, and essentially every time, the sector pulled back. There is no doubt that momentum is impressive in the sector - the problem is that it seems to have entered panic mode and that rarely lasts.

On an unrelated note, we've been watching what appears to be a single large trader in the Rydex family of mutual funds. For most of this year, s/he has been moving into and out of the Nova fund, which tracks movement in the S&P 500. The trader will shift between $40 - $130 million into and out of the fund in a single day, and much of that money seems to find its way into the Tempest fund that profits on a decline in the S&P.

For the most part, s/he has been smart money. When the trader jumped into Nova and/or out of Tempest, thus making a bullish bet on stocks, the S&P rallied over the next week 15 out of 20 times and sported an average return of +0.7%.

When the trader moved out of Nova and/or into Tempest (betting on a decline), then the S&P rallied only 10 out of 21 times, averaging a return of -0.1%.

On Thursday, this trader moved $137 million out of Nova, their largest move yet, betting on a decline in stocks.