Taiwan (TWSE) - Oversold to Overbought Reversal Signal

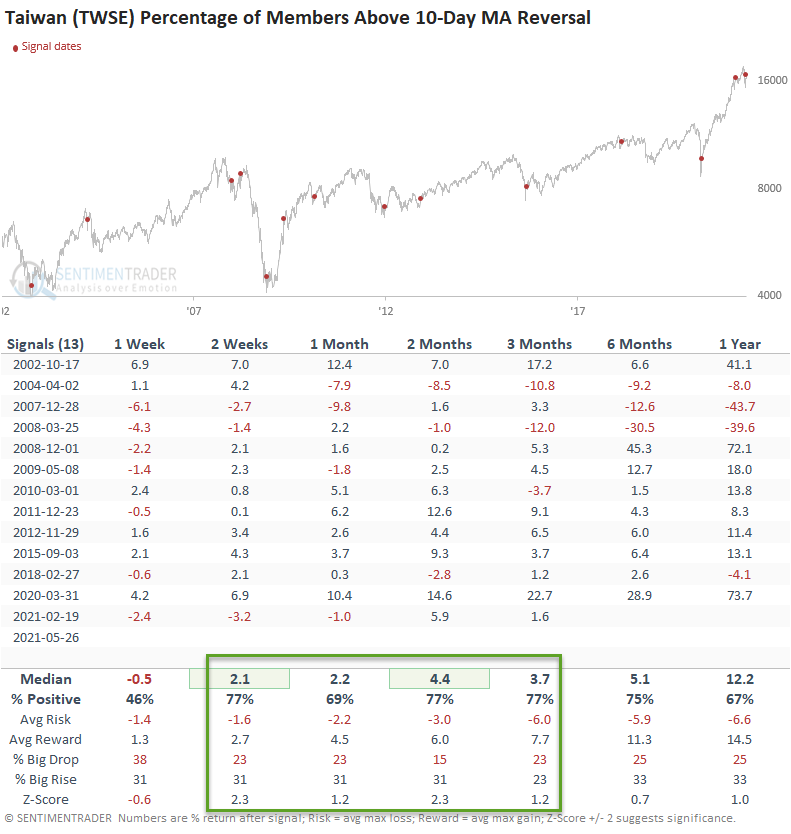

The percentage of Taiwan Index (TWSE) members trading above their respective 10-day moving average registered an oversold to overbought reversal buy signal on 5/26/21.

THE CONCEPT

The oversold to overbought reversal signal identifies instances when the percentage of members trading above their respective 10-day moving average reverses from oversold to overbought in a user-defined number of days or less. The model will issue an alert based upon the following conditions.

CONDITIONS FOR BREADTH SIGNAL

- If the Percentage of Index members cross below 15%. i.e., reset oversold condition

- If the percentage of Index members goes from <= 15% to >= 90.5% in 8 days or less, then buy

Please see my note from 3/29/21 for more information on the signal concept.

Let's take a look at the current chart and historical signal performance.

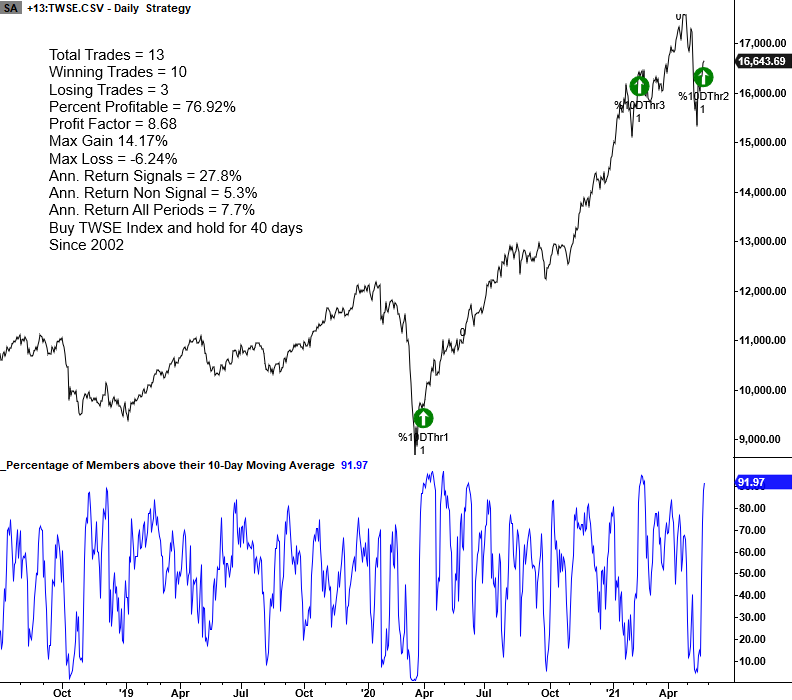

CURRENT CHART

HOW THE SIGNALS PERFORMED

Results look good in the 2-13 week timeframe. However, the 1-week results suggest that the initial momentum takes a break in the short term.

With several mean-reversion signals and a new momentum thrust signal, the Taiwan Index (TWSE) looks constructive.

MEAN REVERSION SIGNAL NOTES

Taiwan (TWSE) RSI Buy Signal

Taiwan (TWSE) Bollinger Band Buy Signal

Taiwan - Mean Reversion Opportunity