Tech's back to back gains unlikely to repeat

In September, we saw that energy was not only the most-hated sector in 2020, it was the most-hated of any sector of all time.

The flip side is that when there's a sector that does very poorly, there's usually another that does very well. This year, of course, that's the technology sector. It was the best sector last year, too.

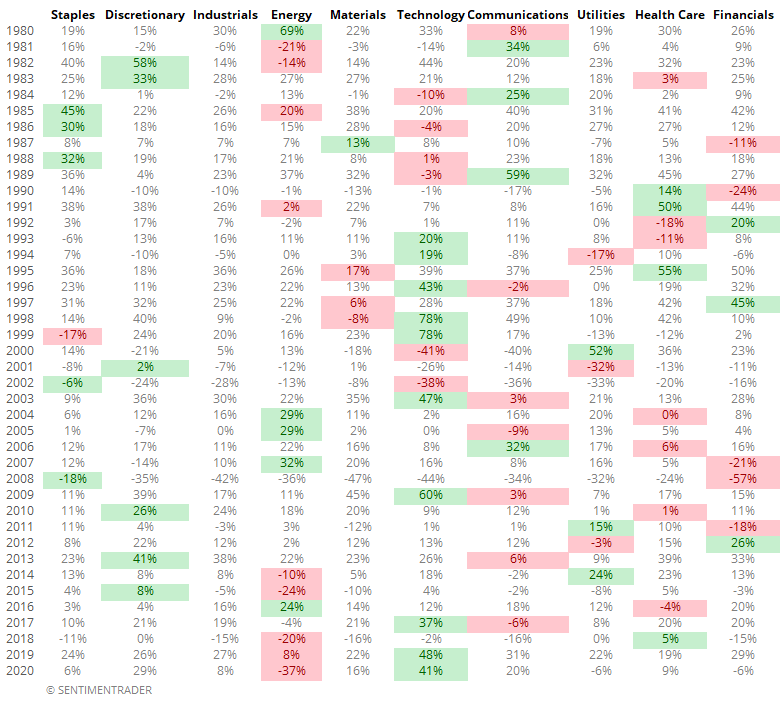

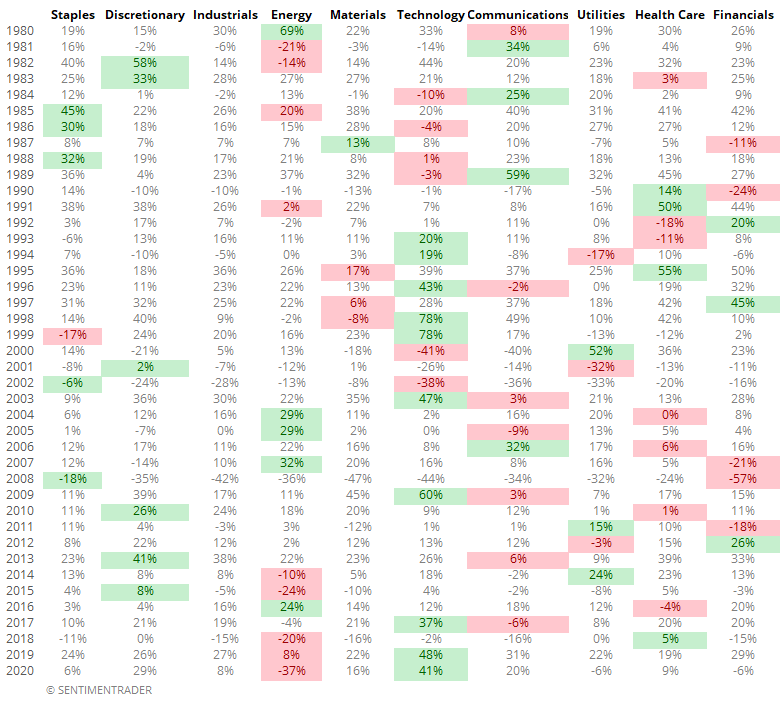

Below, we can see each sector's yearly returns since 1980. The top sector for that year is highlighted in green; the worst in red. The numbers aren't that important, with the biggest takeaway being just how random the colors are. There isn't a lot of continuity - the best sector one year usually isn't the best the next year. It's a little more common for the worst sector to repeat, but even that is fairly rare.

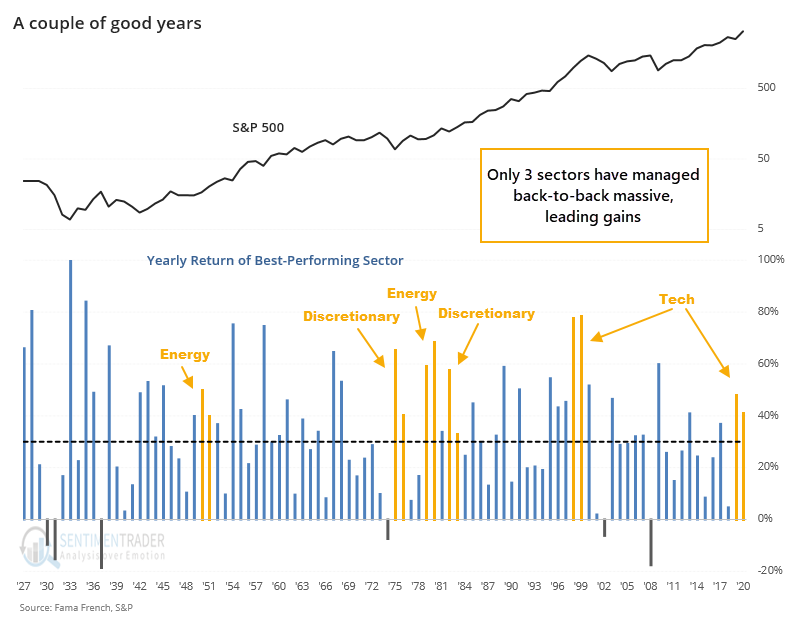

Looking at it visually, the chart below shows the yearly return of the best sector only each year since 1926. The highlighted ones show the sectors that managed to not only be the best sector out of the 10 major ones that year but also have a gain of at least 30% for the year. The only sectors that managed to do this were Energy (twice), Discretionary (twice), and Tech (twice).

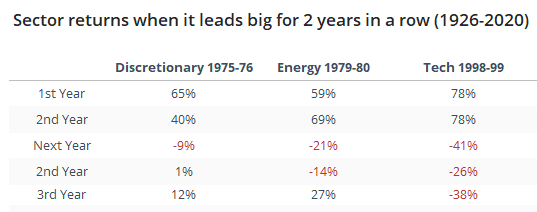

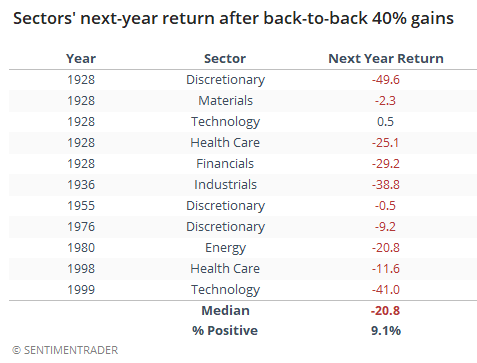

There were only three times a sector managed to be the best sector and have a gain of at least 40% both years. Those were Discretionary stocks in 1975-76, Energy in 1979-80, and Tech in 1998-99. We can see below that after Discretionary's big couple of years, the next year the sector returned -9%. After Energy's run, it returned -21% the next year. And when the tech bubble burst, it's next-year return was a wrenching -41%.

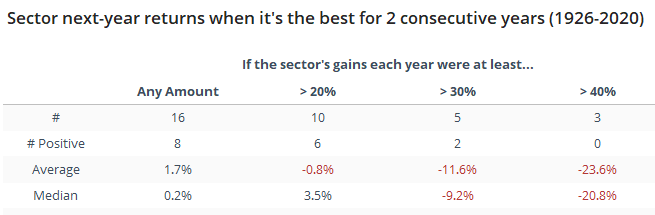

Below, we can see the next year's average performance over the next year when it's the best-performing sector on consecutive years, depending on how much of a gain it enjoyed both years.

There were 16 times a sector was the best-performing one on consecutive years. The next year, that sector was positive 8 times, but with a median return of only +0.2%. If it had gained at least 20% both years, then it was positive the next year 6 out 10 times, but again with a very low average return.

The biggest warnings, albeit with tiny sample sizes, were when the sector was not only the best-performing one in back-to-back years, but also enjoyed very large gains both years. In those cases, it was rare to see a positive return, and the overall averages were heavily negative.

If we ignore the idea that a sector has to be the best-performing one and instead just look at any sector which enjoyed back-to-back years with at least 40% gains, then we can see how unusual it was for that sector to show a positive return the next year.

Out of the 11 times a sector enjoyed a run like this, only once did that sector manage a positive return the following year...and that was a 0.5% gain. The others showed mostly moderate to large losses.

This should be a worry for those who are trying to extrapolate tech's massive wins in 2019 and 2020 into gains for 2021.