Tech's consistent outperformance

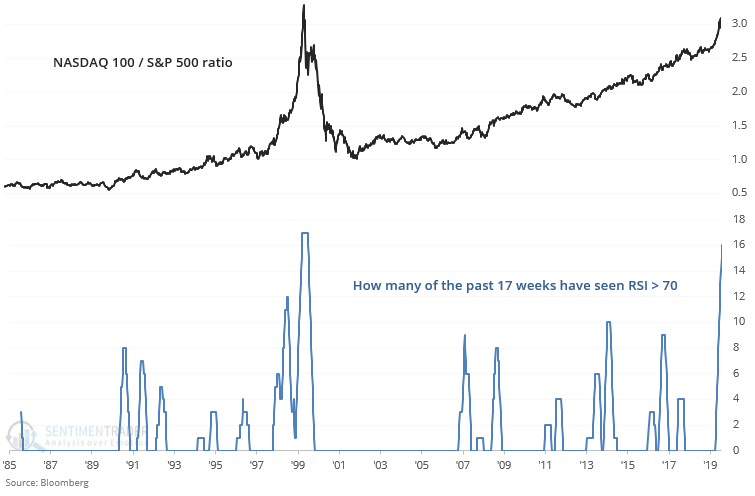

Tech stocks continue to outperform non-tech stocks. The NASDAQ 100/S&P 500 ratio continues to trend higher and is now where it was in 2000, at the height of the dot-com bubble. As a result, the ratio's 14 week RSI has been above 70 (overbought) for 16 of the past 17 weeks:

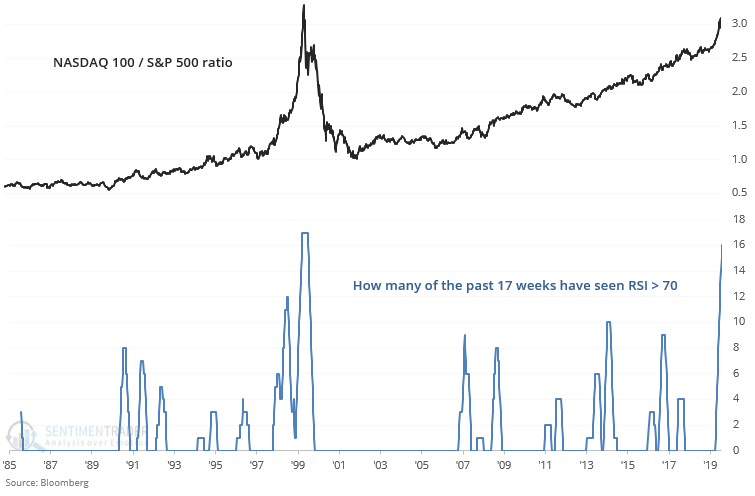

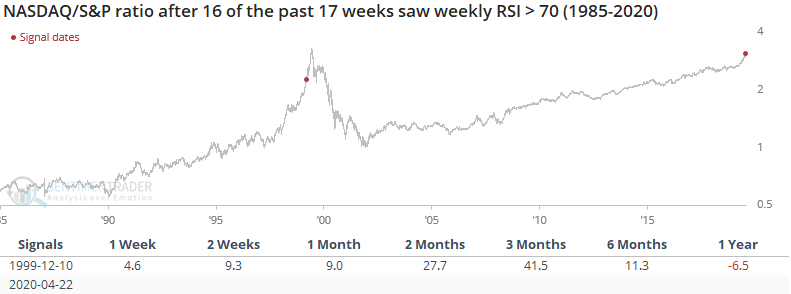

This was only matched by the height of the dot-com bubble. As you probably know, stocks started to fall significantly in late-2000:

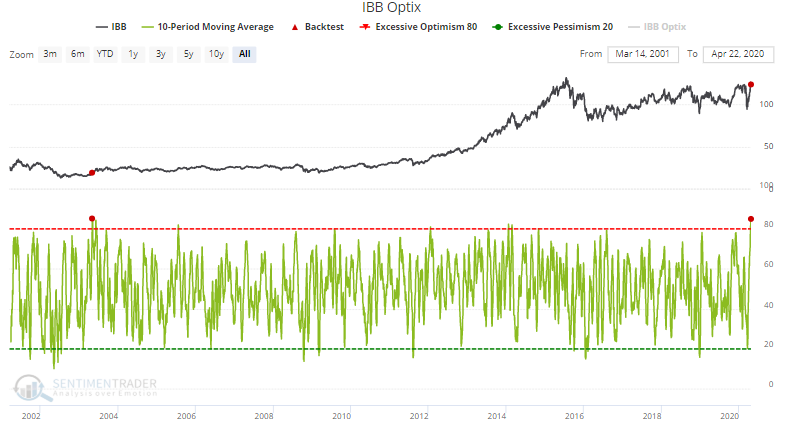

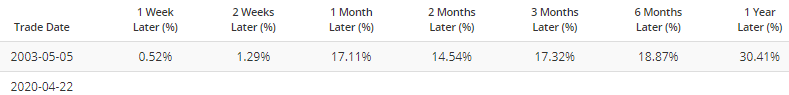

The sample size is small, so take this with a grain of salt. Sooner or later tech will underperform, but it's hard to know exactly when. One of the strongest sectors has been biotech, where IBB Optix's 10 day average is at the 2nd highest level it's ever been (85):

Once again, tech will eventually underperform relative to other sectors, but it's hard to know when.