Tech's massive outperformance

The tech sector has significantly outperformed other stock market sectors over the past few months, and the reason is obvious. What crises like coronavirus do is accelerate existing trends because they exacerbate flaws in flailing business models and accentuate advantages in strong business models. Growth trends such as AI, cloud computing, e-commerce, tech have been helped by the crisis, while non-future trends like energy and retail have suffered.

*By "growth", I'm not referring to a financial markets sense of the word. I'm referring to "what areas of the economy/world are the future".

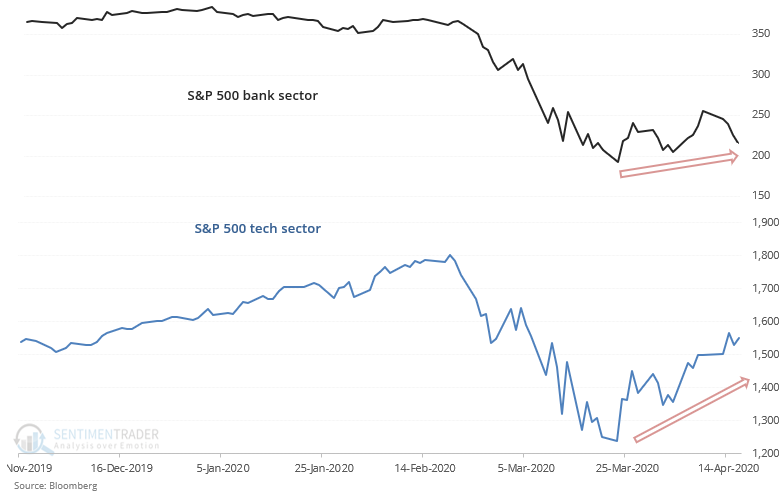

For example, tech has massively outperformed banks during the recent rally. The S&P 500 tech sector is up more than 25% while the bank sector is up less than 13%:

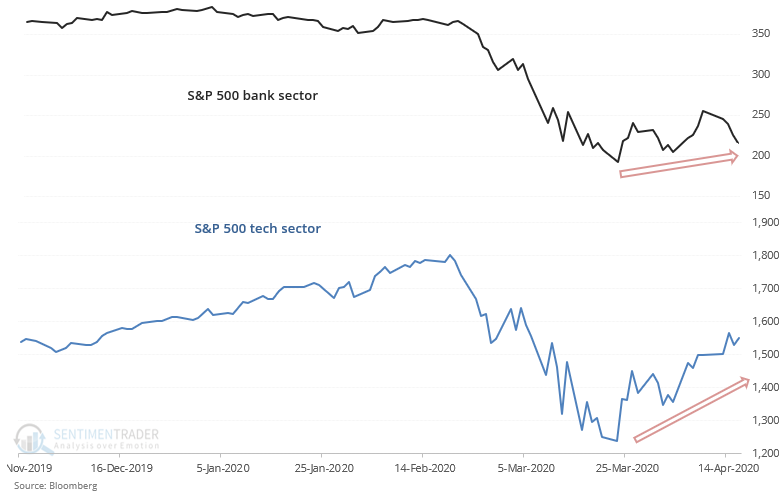

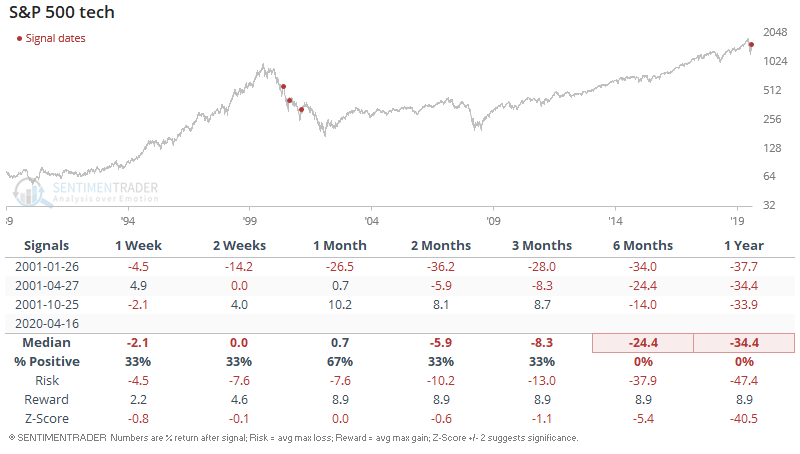

A cursory glance at historical cases demonstrates that this only happened during the 2001 recession/bear market, when tech retreated from its 1990s bubble and underperformed other sectors like banks:

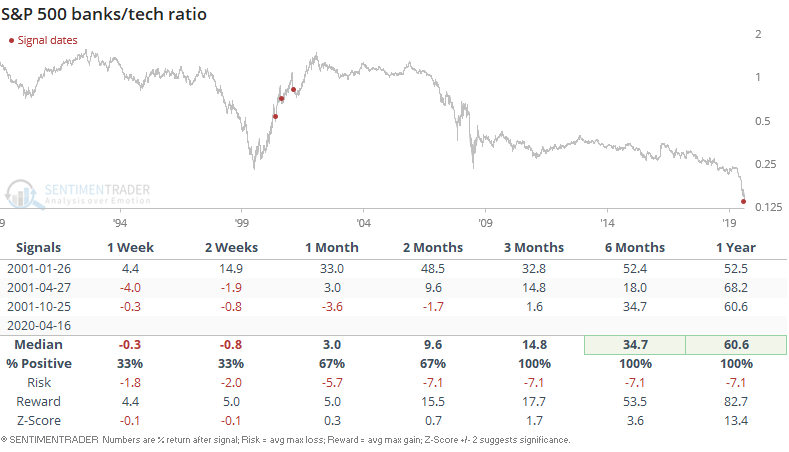

Here's what the S&P 500 bank sector did next:

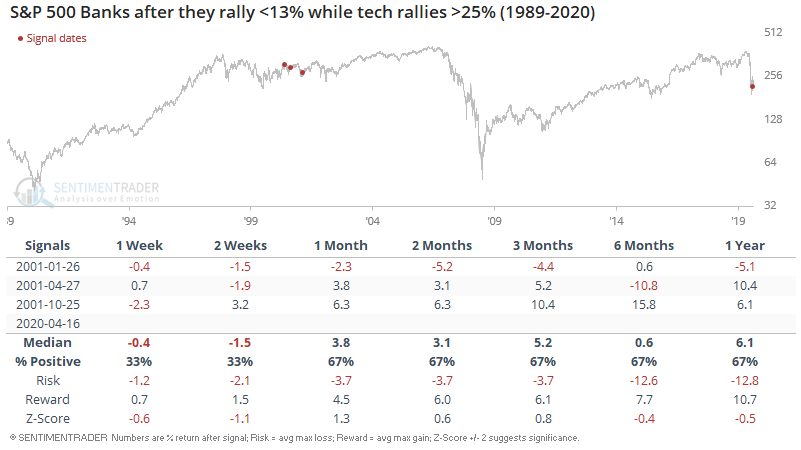

Here's what the S&P 500 tech sector did next:

Does this mean that tech is about to underperform other sectors because it has outperformed "too much"? Maybe. Maybe not.

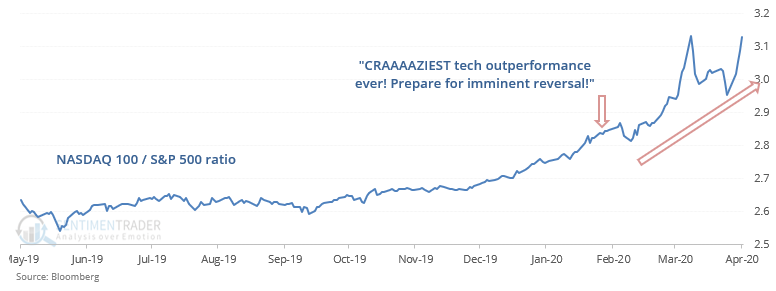

It's very easy to create a case for "THIS IS THE CRAZIEST TECH OUTPERFORMANCE EVER! PREPARE FOR AN INEVITABLE REVERSAL!" But need I remind you - these phrases were also said by the media and financial marketers on social media in January/February ("CRAZIEST NASDAQ/S&P RSI EVER!!! PREPARE FOR UNDERPERFORMANCE!")

Instead, what has tech done? It outperformed. Here's the thing:

- Sector underperformance/outperformance isn't so much determined by technicals as it is determined by the underlying fundamentals of each industry. This is why tech was extremely overbought relative to other sectors in January/February, yet it became even more overbought.

- Does this mean that tech will continue to outperform? I don't know. And that is the key point. It's ok to admit what you don't know. The only people who need to pretend like they are always in-the-know are gurus and wannabe-gurus. As Nassim Taleb says in Black Swan, for gurus it doesn't matter if they're right or wrong. What matters is the manner in which they deliver their "insights". The more confident they sound, the more their followers will believe them. This is why gurus never waiver in their market outlook. If they're wrong, just sweep the mistakes under the rug (and block people who call out your mistakes)!

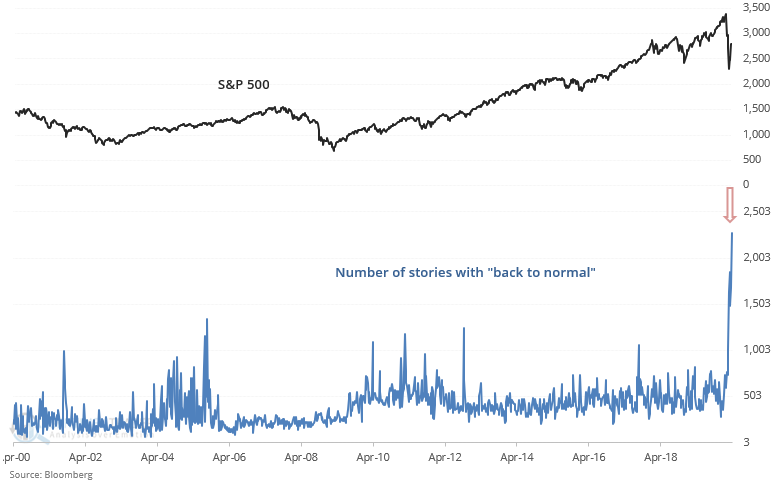

And finally, here's something to think about. The number of media stories mentioning "back to normal" is at an all-time high. Is this a bearish sign for stocks?

Once again, I can spin a convincing narrative for why it's bullish/bearish for stocks. The honest answer? "I don't know".