Tech's massive swings signal a long-term change

There has been a lot of rotation going on under the surface. We've touched on that in a few different ways, either looking at relative returns in indexes or factors like Growth versus Value (here and here).

Mark Hulbert, writing in Barron's, noted the Nasdaq's sudden snapback versus the Dow Industrials the other day. Once again, the Nasdaq surged relative to the Dow, adding to the count of outsized moves in recent months.

We certainly saw that at the top of the dot-com bubble. Over the three months prior to that top, there were no fewer than 14 trading sessions in which the Nasdaq's alpha over the Dow was at least two percentage points. No other three-month period over the past 50 years has seen as many large positive alphas between the two indexes.

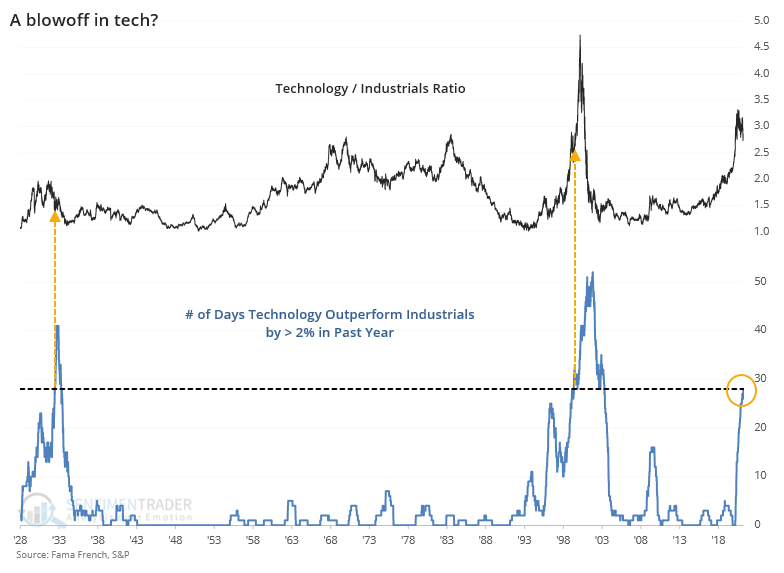

Going back further, we can look at the daily changes in the total return in Technology versus Industrial stocks. The chart below shows a running count of how many days there were in the past year when Tech outperformed Industrials by 2% or more. We're only focusing on days when Tech outperformed by a large degree - it's a similar picture when including 2% gains or losses.

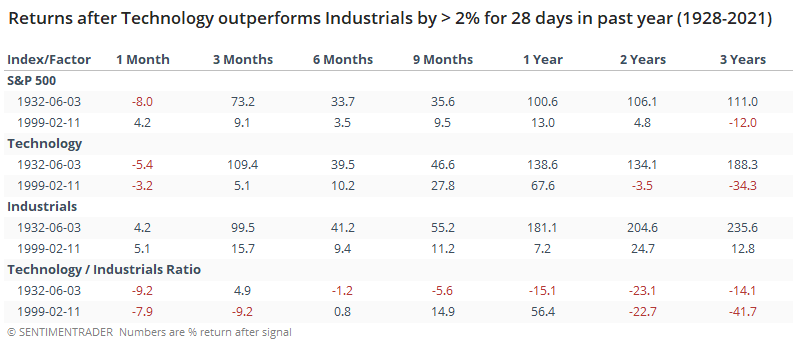

This was not a precise signal. It triggered after the peak between Technology and Industrials in the 1930s, and well before the peak in 1999. The table below shows forward returns for the S&P 500 and the relevant factors once this reached the current level of 28 days.

While it wasn't a good timing signal, the overriding message was clear, or at least as clear as it can be with a sample size of 2. Over the next 2-3 years, Technology greatly under-performed Industrials. This is much more of an environmental clue as opposed to any kind of actionable timing signal. It's another hint that the severe rotations among indexes, sectors, and factors in recent weeks and months are signaling a turn in long-term trends.