Tech's Relative Weakness Suggests More To Come

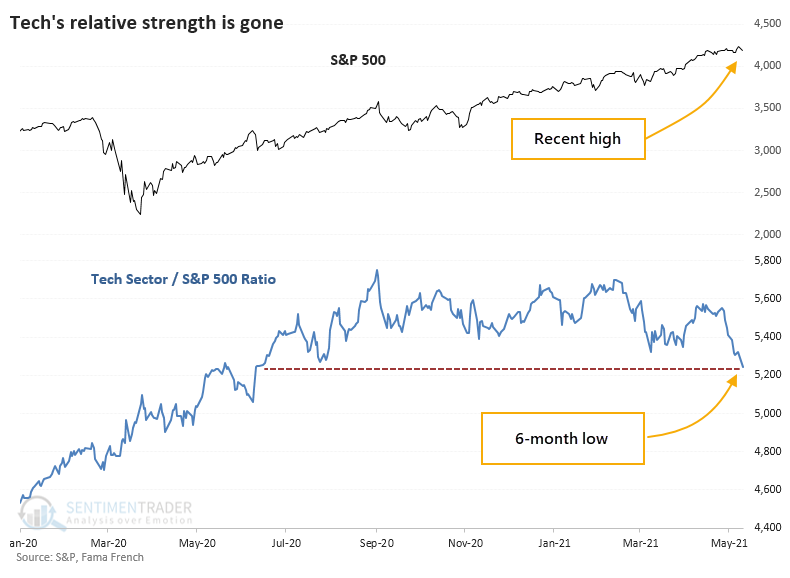

Tech was in the driver's seat for much of the past year. After an option-fueled blowoff in February, those stocks have treaded water, at best, while other parts of the market recover enough to trigger a nearly 80-year extreme in new highs.

This relative weakness in tech stocks has been enough to push the ratio between them and broader indexes nearly to the lowest level in a year. This does not often happen when indexes like the S&P 500 were sitting at all-time highs a few short days ago.

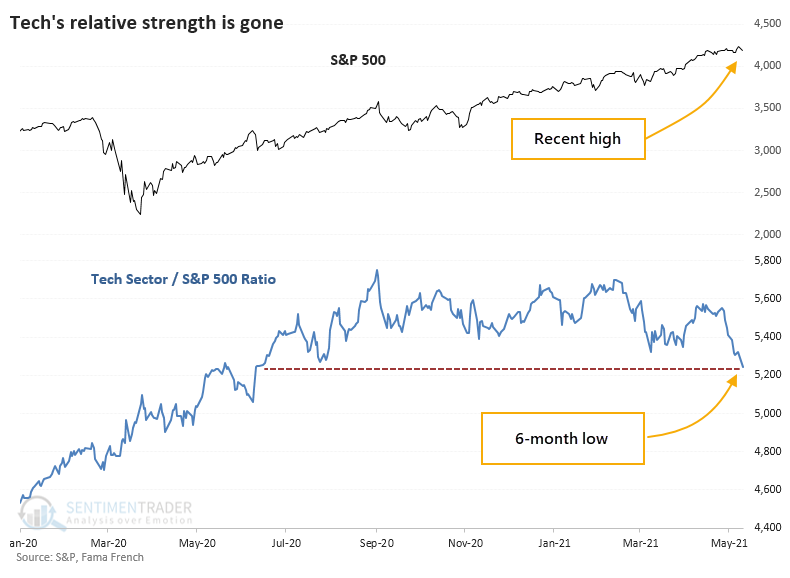

FUTURE RETURNS WERE CHALLENGED

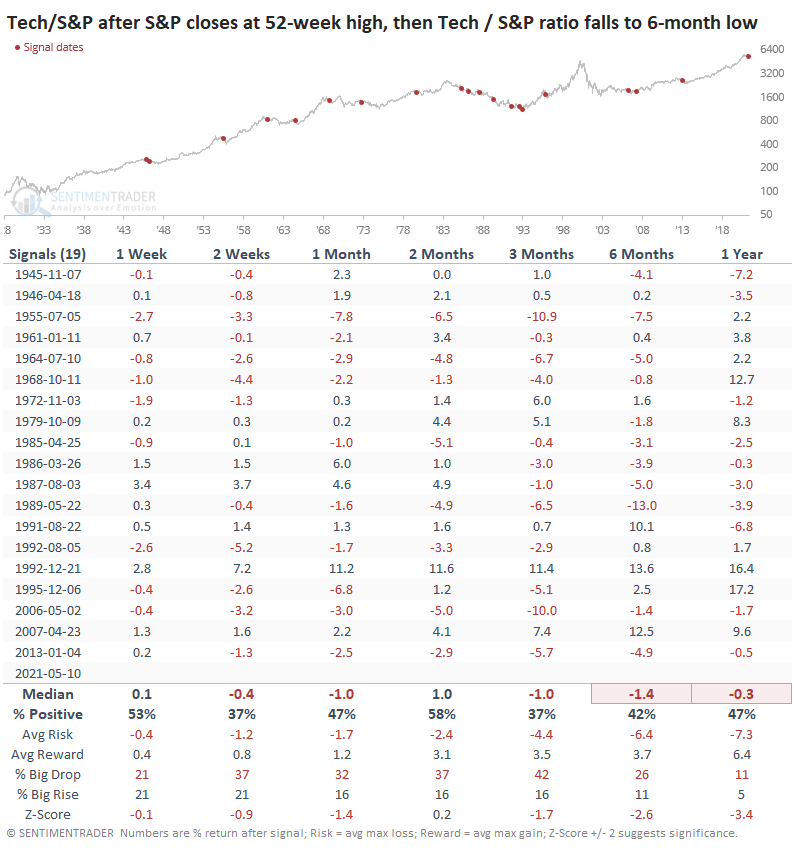

Whenever the S&P 500 had been at a 52-week high, then within 3 days, the ratio of Tech to the S&P fell to a 6-month low, the S&P showed weak short-term returns, but it didn't have much of a consistent impact beyond that.

The last two instances, in 2007 and 2013, didn't lead to anything nefarious. Before that, though, the last 6 signals all preceded short- to medium-term losses.

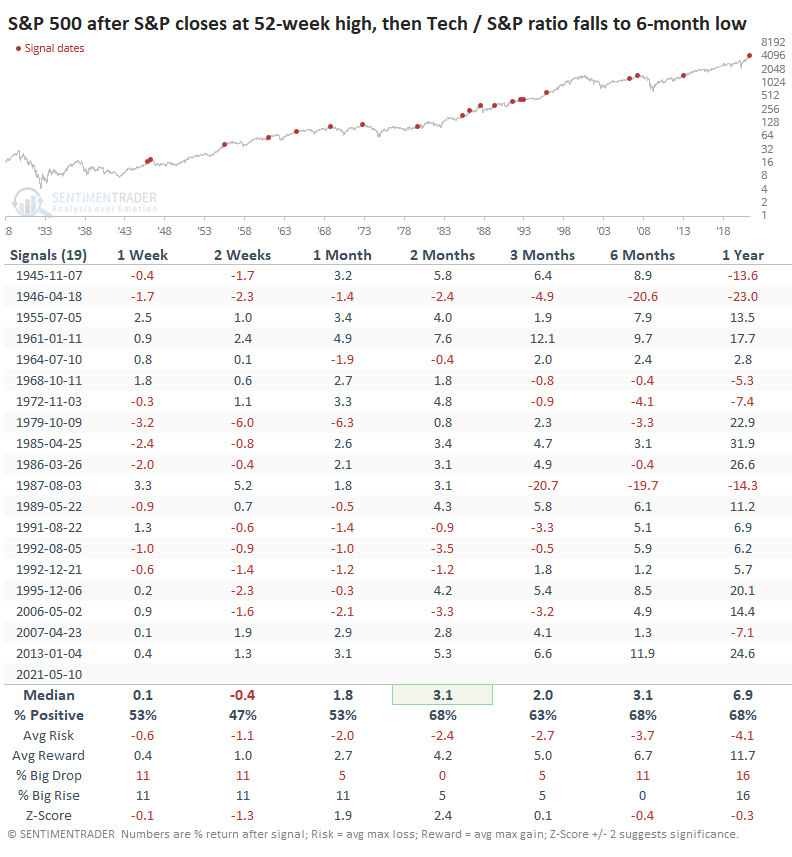

It was a considerably worse sign for the Technology sector, though. Over the next 6 months, it showed a negative average return, was positive less than half the time and suffered risk about equal to reward.

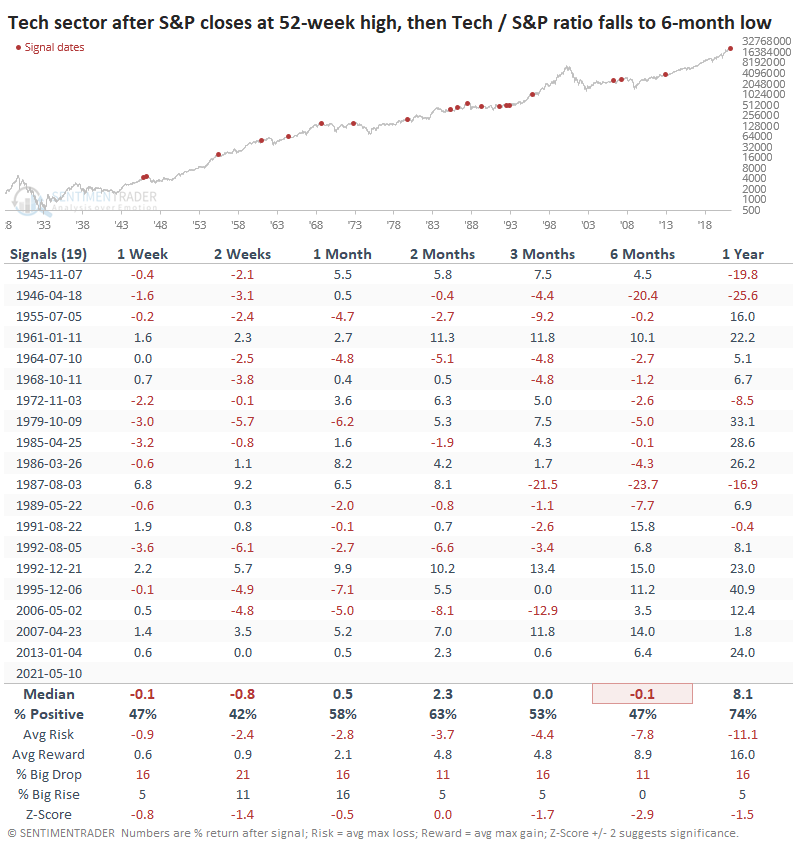

TECH USUALLY DIDN'T RESUME LEADERSHIP

The tendency for Tech to show weaker returns means that the ratio of Tech to the S&P showed a consistently negative bias.

Across almost all time frames, the ratio was negative, and significantly so over the medium- to long-term. Over the past 30 years, there were only 2 exceptions when Tech managed to turn itself around from relative weakness and become a leader again. The others all failed.

A common market tactic is to focus longs on leading groups and shorts on trailing ones. That works, except for those major turning points when the relationships hit an extreme and mean-revert. There isn't much we see lately that suggests Tech is at that point, so we should continue to see these stocks underperform a broader basket.