Tepid Earnings Reaction As SPY Loses Shares

This is an abridged version of our Daily Report.

Investors shrug at good earnings

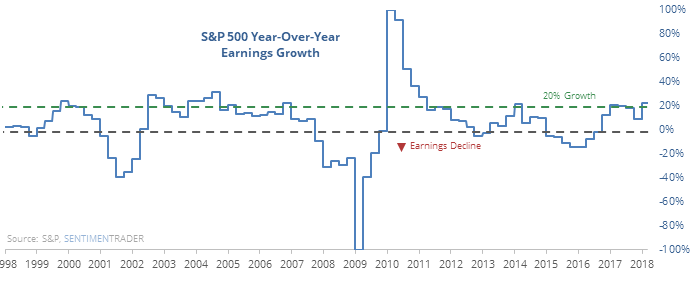

S&P 500 companies have reported excellent earnings growth, after several quarters that also saw growth.

While those earnings were reported to investors, though, the S&P 500 index barely budged after all the volatility. That has led to concerns that earnings can’t drive the market now, but that worry seems unfounded.

Traders flee SPY even as it rallies

During each of the past four sessions, demand for the SPY fund has ebbed, with shares outstanding dropping. That’s usual to see when SPY itself is rallying. This is not an indication of “smart money” traders fleeing the fund, if anything it has been the opposite.

Tech over Staples

Consumer Staples stocks are hugging a multi-month low while Technology stocks are just off their high. Going back to 1928, there have been 110 days when this has occurred while the S&P 500 was trading above its 200-day average.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.