The Biotech Spring into Summer Event

In a recent series of articles (here, here, here and here) I wrote about the energy sector in April. As it turns out, energies are not the only sector that tends to "bloom" in spring. Today we turn our attention to the biotech sector.

Ticker FBIOX

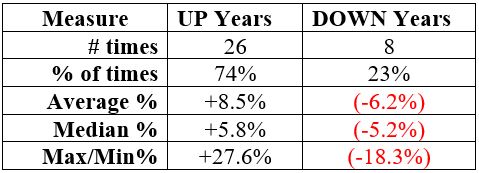

For testing purposes, I will use ticker FBIOX (Fidelity Select Biotech sector fund). On one hand, this is an actively managed fund and does not track an index. On the other hand, it has a longer history than the ETFs that track the biotech sector. So for our testing purposes we will use this fund as a proxy for the biotech industry. Other highly correlated ETFs and funds appear in a table below. Before making any investments in the biotech sector an investor should take the time to compare and contrast the various products available to get a sense of what exactly they hold.

FBIOX started trading in December 1985. The seasonally favorable period we will consider extends from:

- The close on April trading day #10

- Through the close on June trading day #3

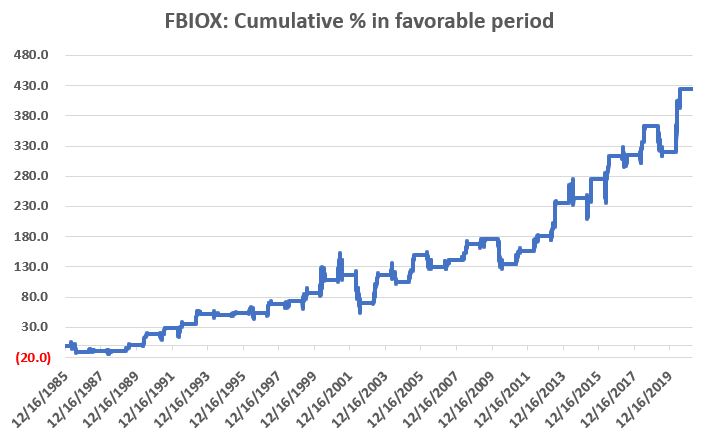

The chart below displays the cumulative % price return for FBIOX during this period from 1986 through 2020.

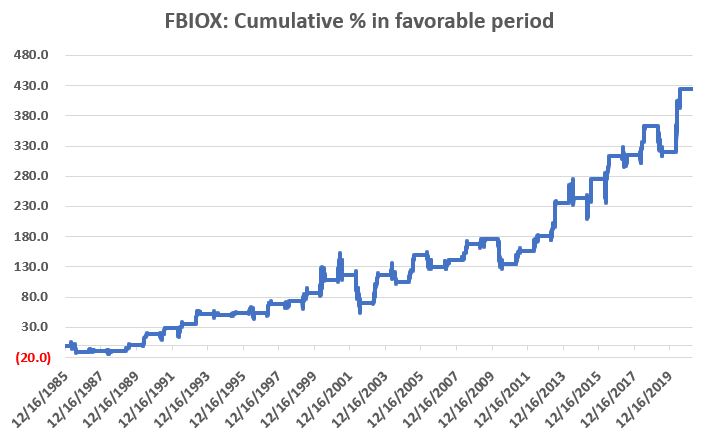

The table below displays the relevant facts and figures. Note that one year showed no gain or loss.

Alternatives

For traders who prefer to trade vehicles that track a specific index, some possibilities for consideration are found in the table below.

Summary

This favorable period in 2021 extends from the close on 4/15 through the close on June 3rd.

Does any of this mean that biotech stocks are set to move higher? Not necessarily. But historically speaking, during the upcoming timeframe that's been the way to bet.