The Dollar Pain Trade

Following the Federal Open Market Committee's explanation of their thinking on the economy and interest rates, the U.S. dollar exploded to the upside. It followed through for a few days before pulling back this week.

Speculators have been short the dollar (meaning "smart money" commercial hedgers have been net long), suggesting that the pain trade is to the upside. A "pain trade" is a move that will seemingly hurt the most participants, usually when they've positioned too far in one direction or the other. This doesn't always work very well in the dollar or other trending currencies, but it seemed to have an impact over the past week.

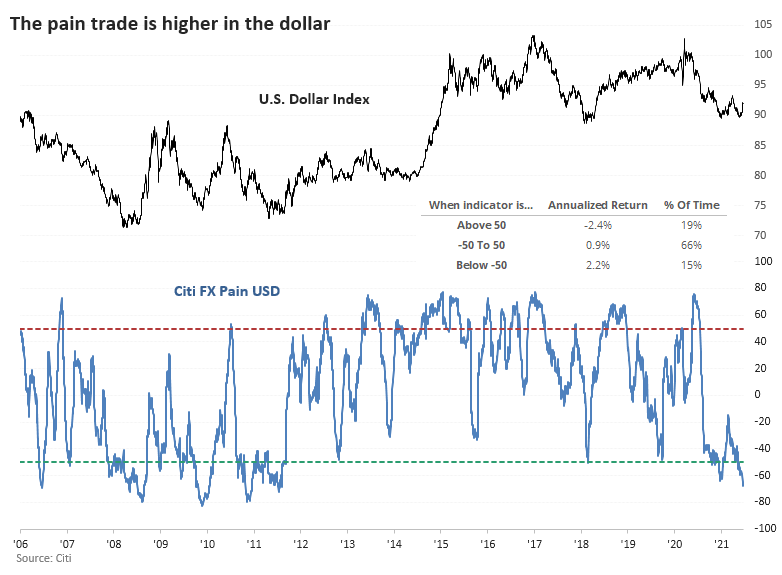

Citigroup calculates a similar metric called FX Pain. Per Bloomberg:

The Citi FX Positioning Alert Indicators infer positioning of active currency traders from relationships between exchange rates and currency managers' returns. A positive reading suggests that currency traders have been net long the currency and a negative reading suggests that currency traders have been net short the currency.

NEAR-RECORD PAIN IF DOLLAR RALLIES

This measure recently dove below -60, the lowest in almost a decade, suggesting that traders are heavily positioned for a dollar decline.

We can see from the chart that whenever FX Pain for the buck is below -50, the dollar returned an annualized +2.2%. That doesn't seem like much, but it's a pretty decent return for a currency. Conversely, it returned an annualized -2.4% when FX Pain was above +50, so a pretty decent contrary relationship there.

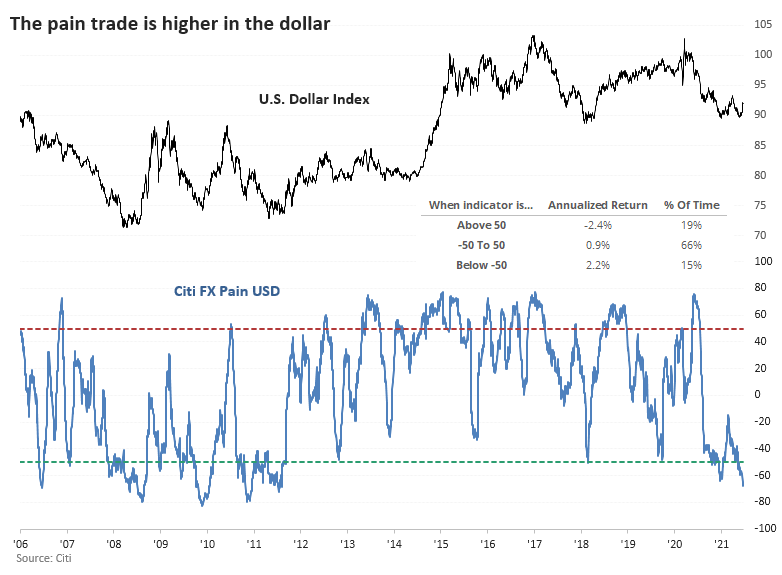

There is a similar message being given from Hedge Fund Exposure to the dollar. When it has been below 25%, the dollar's annualized return was +2.6%.

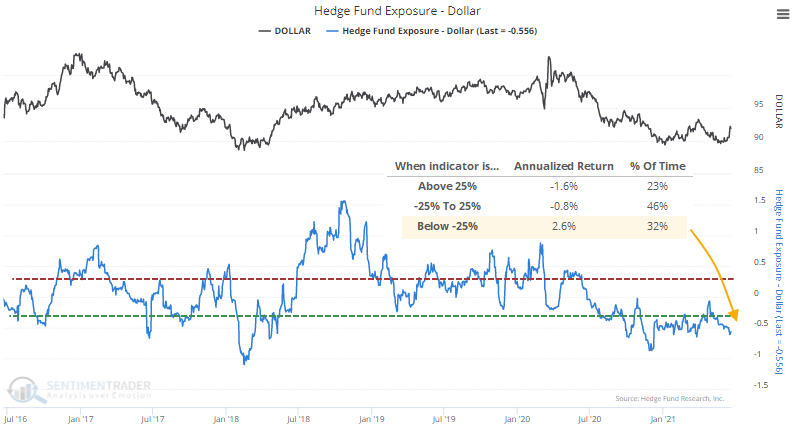

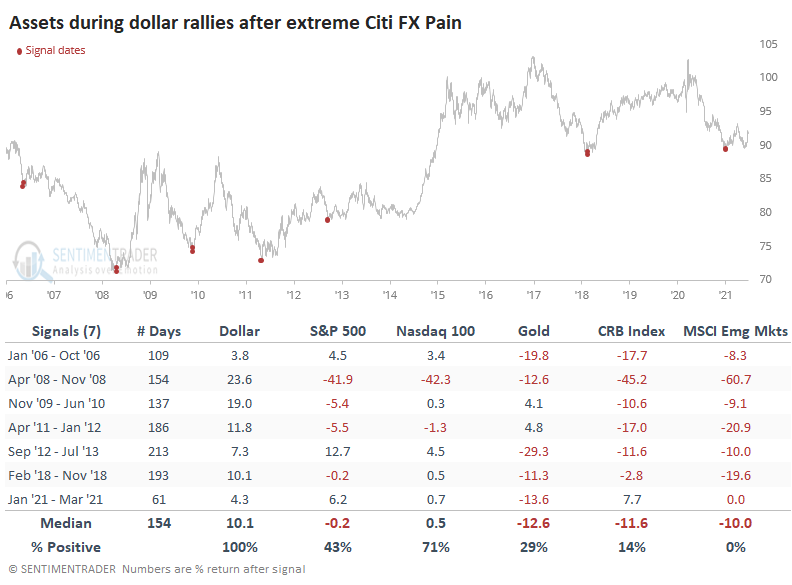

Let's assume that this pain trade is going to result in a similar setup this time. We'll go back and look at each time when FX Pain dropped deep into negative territory and look at the subsequent rallies in the dollar.

WHAT A DOLLAR RALLY MEANS FOR OTHER ASSETS

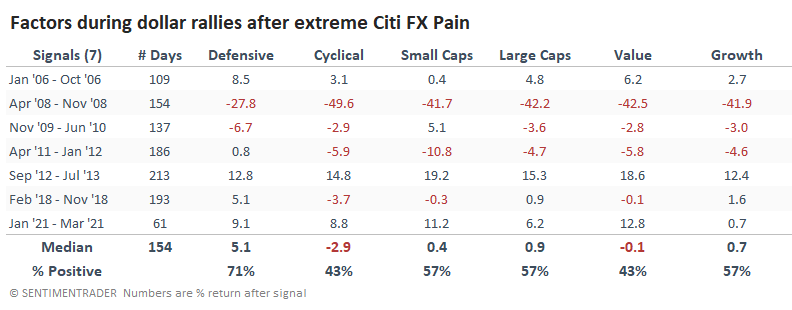

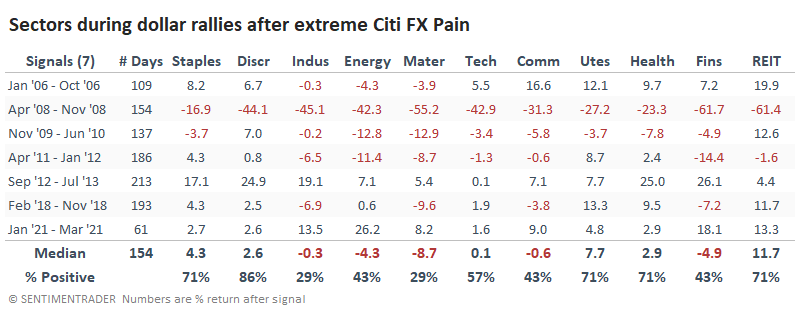

On average, the dollar rallied for 154 trading days, with a median gain of just over 10%. The table below shows how other assets and indexes performed during those stretches.

It was a mixed bag for stocks, with the big exception being the depths of the financial crisis. Big tech stocks in the Nasdaq 100 fared better overall. Not surprisingly, the assets with the most consistent negative correlation to the dollar did terribly. Gold, commodities, and especially emerging markets all suffered losses. If the dollar reacts as it has during the past 15 years, then it will be a major headwind to those three markets.

In terms of major equity factors, there wasn't anything that stood out overly compelling. Defensive stocks fared the best, with the others all showing "meh" returns.

For major sectors, Discretionary stocks did well, with the lone exception being the financial crisis. We don't see this kind of behavior very often, but defensive sectors like Utilities and Health Care did well along with Discretionary stocks. The worst performers were Industrials and Materials, with only two gains out of seven attempts (though those two were big exceptions).

After other bottoms coinciding with these dollar pain trades, the buck sometimes chopped around for a few weeks after an initial surge. The biggest caveat would be a complete give-back of all the recent gains, which would be entirely out of character with the regimes above. If traders are going to follow through the way they have during recent reversals, we should see minimal losses in the dollar and a series of higher highs. That's going to be painful for gold bugs and investors trying to hold cheaper emerging market stocks.