The Everything Rally

The everything rally

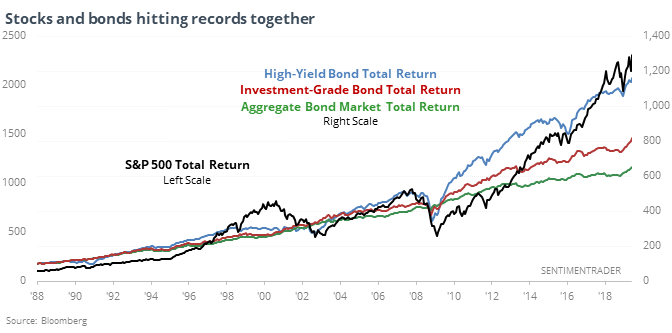

Total return stock and bond indexes are hitting all-time highs at the same time. They cover an array of stocks and bonds, suggesting extreme breadth of buying interest, as noted by Bloomberg.

When they’ve all hit records together, it has been an especially good longer-term sign for stocks. They rallied almost universally after these signals and over the next 2-6 months, there was only one date that showed a loss of more than 1%. For bonds, it wasn’t quite as consistently positive, but all of them showed gains most of the time across all time frames, with returns mostly above random.

Quick cycle

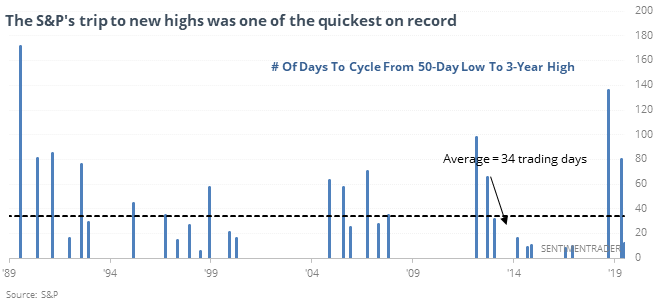

Yet again, stocks showed a tendency to cycle quickly from a selloff to new highs. For the S&P 500, it went from a 50-day low multi-year high in less than three weeks, nearly a record going back to 1928.

The median cycle from low to high has taken 34 days, so this was nearly three times faster than usual. Over the next month, it seems like sellers had a strong tendency to give up. From 1-4 weeks later, there was only a single loss, and the risk/reward was impressively skewed to the upside.

Dollar downtrend

The U.S. dollar’s 200-day average has been rising for a year, but the late-week selling has pushed the buck to a multi-month low and below its average. This has led to a rebound in the dollar in the past, but half of them didn’t last.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows that “smart money” hedgers have their largest exposure in years to cotton. They’re now holding 42% of open interest in gold net short. The Backtest Engine shows over the past 7 years that has led to gains in gold only 25% of the time over the next two months.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.