The Impact of Option Strategy Selection

In this article, I highlighted the application of two separate option strategies to the same opportunity. In a nutshell, they involved making a bearish play on an ETF.

- One strategy (bear put spread) focused on maximizing profitability

- One strategy (bear call spread) focused on the probability of profit

It should be noted that in most cases, there is no "definitive" best strategy. In each situation, the trader must decide their primary objectives (the amount of money they might make versus the likelihood of making any money at all) and act accordingly. To illustrate an example of the potential differences in reward versus risk, let's update our two hypothetical trades.

THE BEAR PUT SPREAD

The first example trade was a hypothetical trade established on 6/14 using put options on ticker CORN.

A bear put spread involves buying one put option at a given strike price and simultaneously selling another put option at a lower strike price. This strategy is referred to as a "debit spread" because you pay money out of your trading account to enter the position.

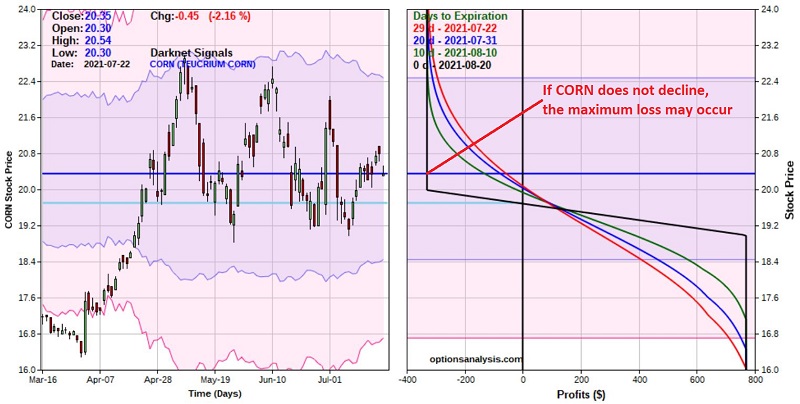

The current status of this example trade and the current risk curves appear in the two figures below.

Things to note:

- Ticker CORN trading at $20.35 a share

- 29 days left until option expiration

- Maximum profit potential = $770 (if CORN is below $19 a share at option expiration)

- Maximum risk = -$330 (if CORN is above $20 a share at option expiration)

- Current open loss = -$55

As you can see in the risk curve chart above:

- If CORN does NOT decline in price below $20 in the next 29 days, the maximum loss of -$330 will occur if the position is held until expiration

- CORN must drop from $20.35 to $19 in the next 29 days for the maximum profit to be achieved

THE BEAR CALL SPREAD

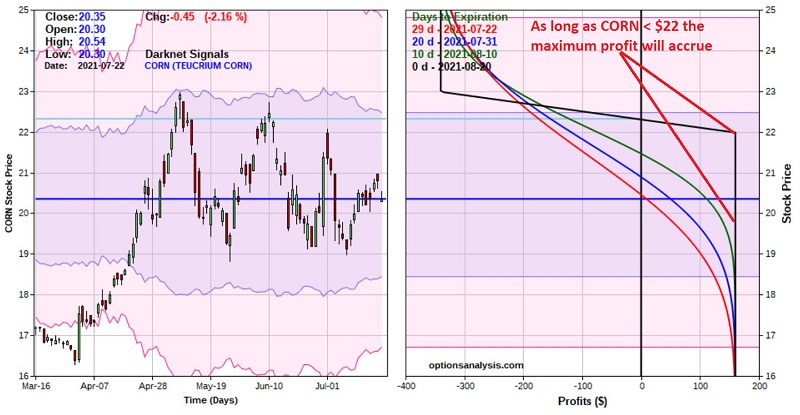

The second example trade was a hypothetical trade established on 6/14 using call options on ticker CORN. The current status of this trade and the current risk curves appear in the two figures below.

A bear call spread involves selling one call option at a given strike price (typically at an out-of-the-money strike price above the current price of the underlying security) and simultaneously buying another call option at a higher strike price. This strategy is referred to as a "credit spread" because you receive money into your trading account when you enter the position.

Things to note:

- Ticker CORN trading at $20.35 a share

- 29 days left until option expiration

- Maximum profit potential = $160 (if CORN is below $22 a share at option expiration)

- Maximum risk = -$340 (if CORN is above $23 a share at option expiration)

- The breakeven price is $22.32 a share for CORN

- Current open profit = $10

As you can see in the risk curve chart above:

- If CORN does NOT rise in price above $22.32 in the next 29 days, this trade will show a profit

- If CORN does NOT rise in price above $22.00 in the next 29 days, this trade will earn the maximum profit of $160

- If CORN advances above $23 at option expiration, then the maximum loss of -$340 could be incurred.

SUMMARY

The bear put spread was a bet on lower prices. Because CORN has so far risen in price instead, the bear put spread is in some trouble and MUST witness a decline in the price of CORN shares to avoid a loss/generate a profit.

The bear call spread was a bet on anything EXCEPT sharply higher prices. Because CORN has only risen a little since entry, this trade is still well within its profit zone. The profit will grow with each passing day UNLESS CORN begins to rise significantly.

In sum, when choosing an options trading strategy, the key is to match the strategy to your primary objective. Typically this involves assessing the tradeoff between:

- Maximizing profitability

- Probability of profit

In many cases, there are no right or wrong decisions - only hard choices to be made.