The IPO market is popping

Stocks are popping, and companies are itching to take advantage. So are their bankers.

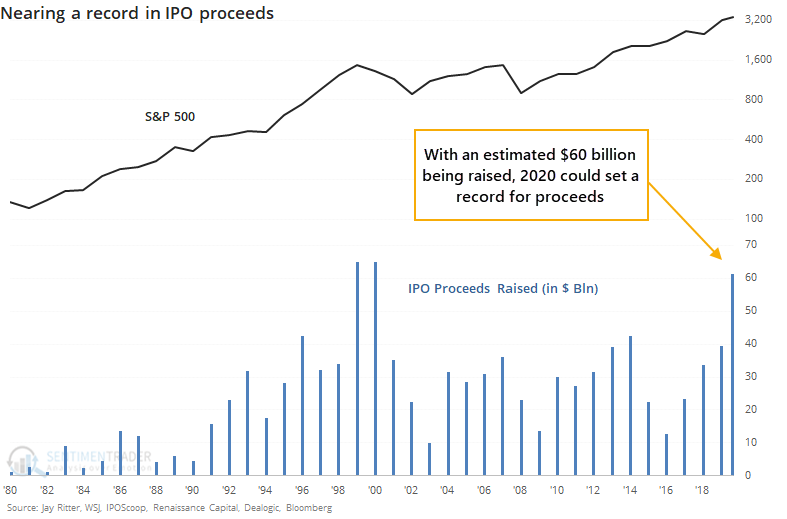

We've already seen that share issuance has spiked this year, and now Wall Street is seeing their opportunity to take full advantage as stocks continue to levitate. As the Wall Street Journal noted, we're on pace for a big uptick in IPOs brought to market, with a surge in the amount of money raised.

In terms of the raw number of new issues, it's still a far cry from the 1999-2000 heyday. But when accounting for the total value of shares issued, we could set a new record.

What's even more notable is the average gain that these new issues have enjoyed on their first day of trading, and how many first-day "doubles" there have been. It's a unique time in history, to be sure.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- More charts looking at the jump in the IPO market

- Gold has run far ahead of its usual pace given the drop in real 10-year interest rates

- South Korean stocks are showing high momentum

- Optimism on the LQD bond fund has suddenly plunged

- Speculators are heavily short the U.S. dollar