The love for junk (bonds)

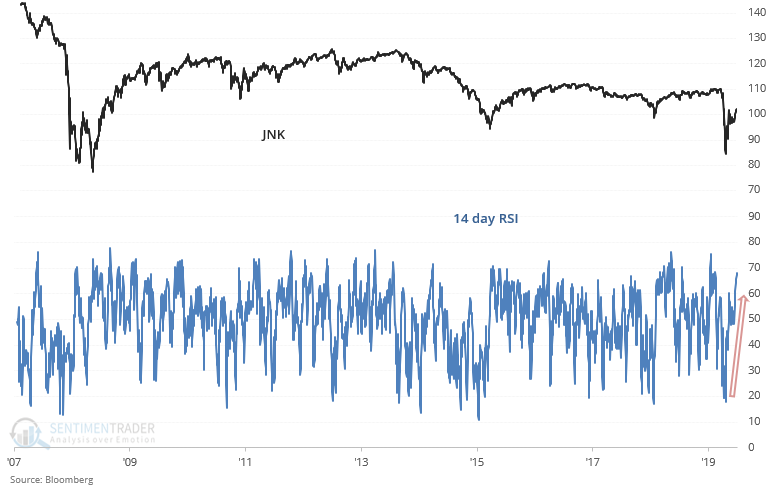

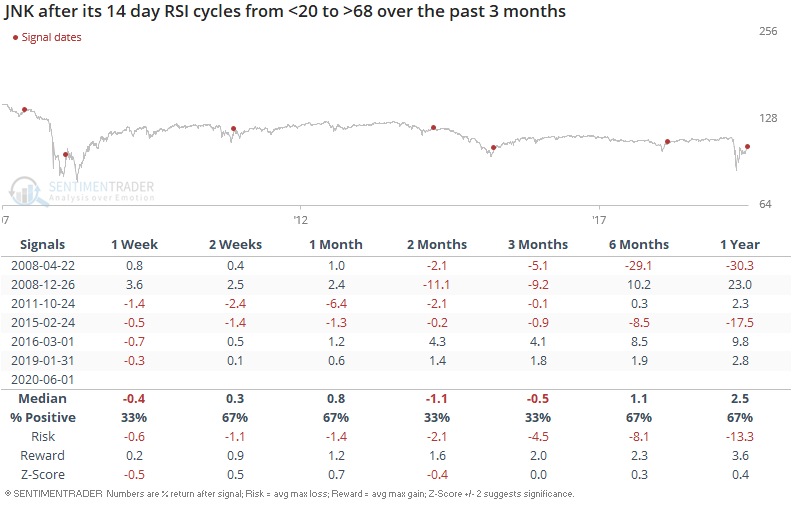

Junk bonds continue to rally, pushing sentiment to the highest level in more than a decade. JNK's 14 day RSI has cycled from extreme oversold territory (under 20) to almost overbought territory (68):

When this happened in the past, JNK usually fell over the next few weeks and months, although it was hard to pinpoint when the pullback/correction would begin:

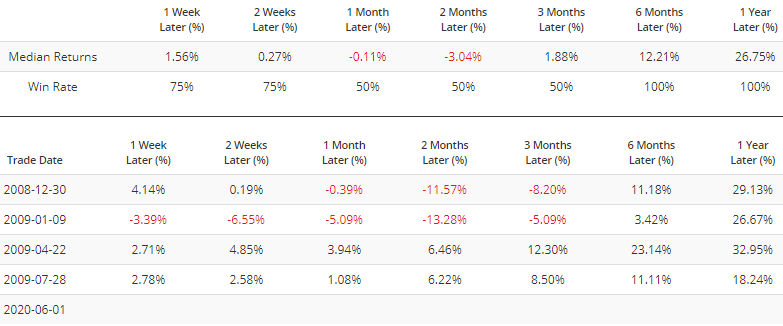

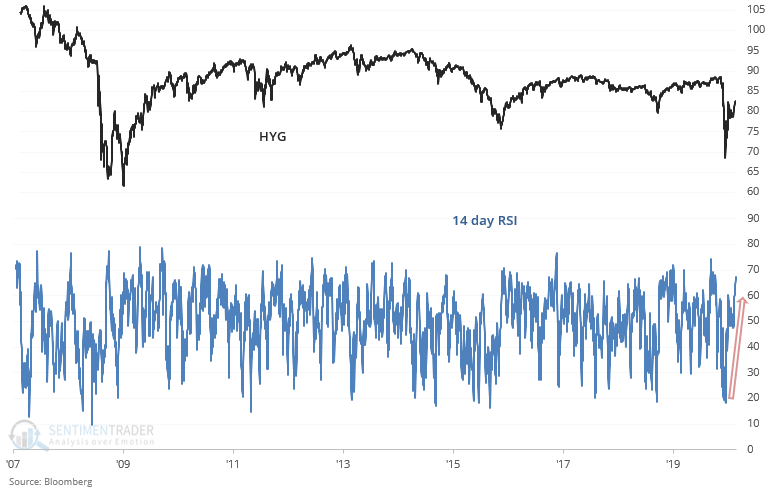

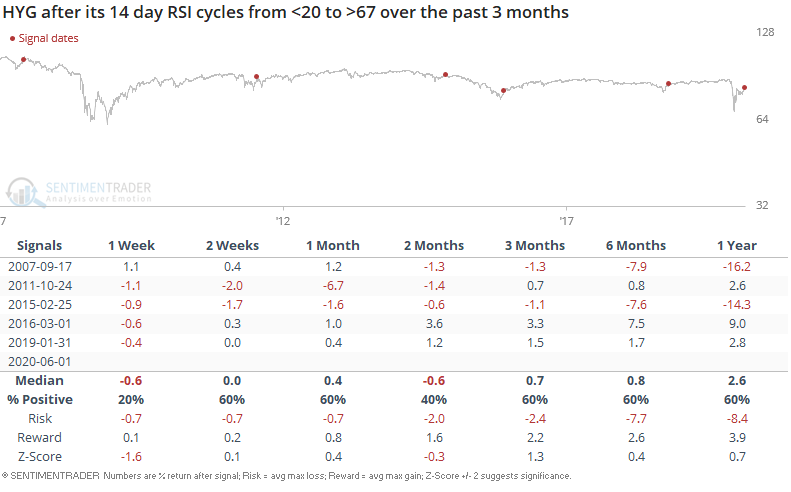

Similarly, HYG's 14 day RSI has cycled from extremely oversold to almost overbought:

This was a minor bearish factor for HYG over the next week:

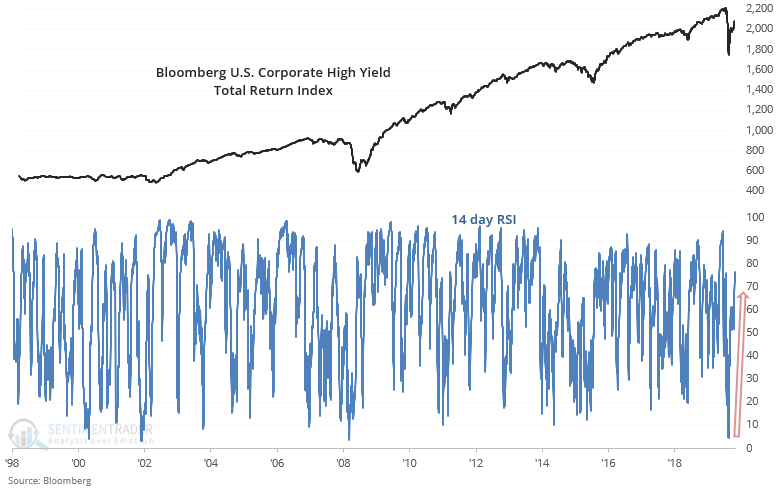

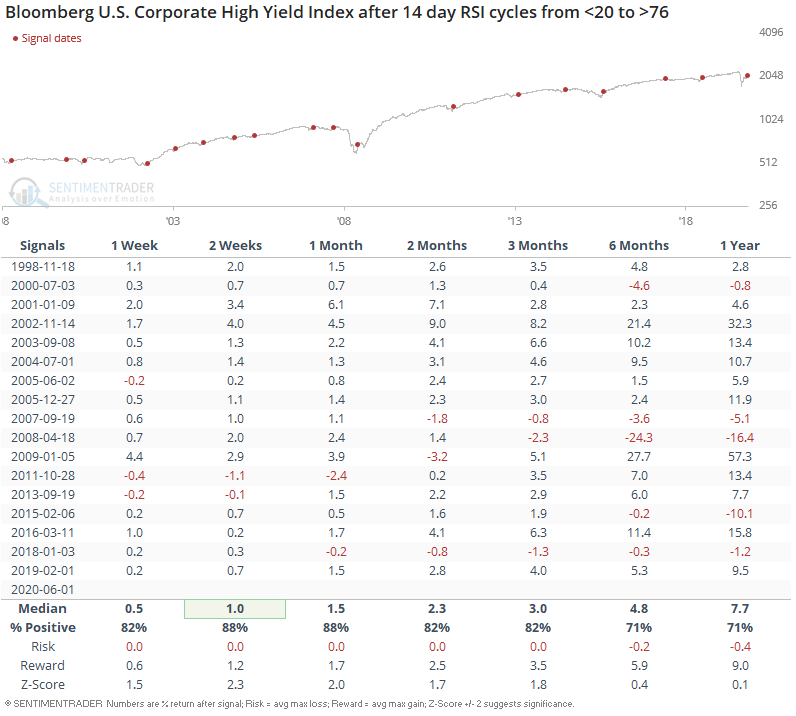

The issue with HYG and JNK is that their historical data is limited. We can run a similar analysis on the Bloomberg U.S. Corporate High Yield Total Return Index, which also cycled from oversold to overbought territory:

When this happened in the past, it wasn't a consistently bearish factor for the High Yield Index on any time frame:

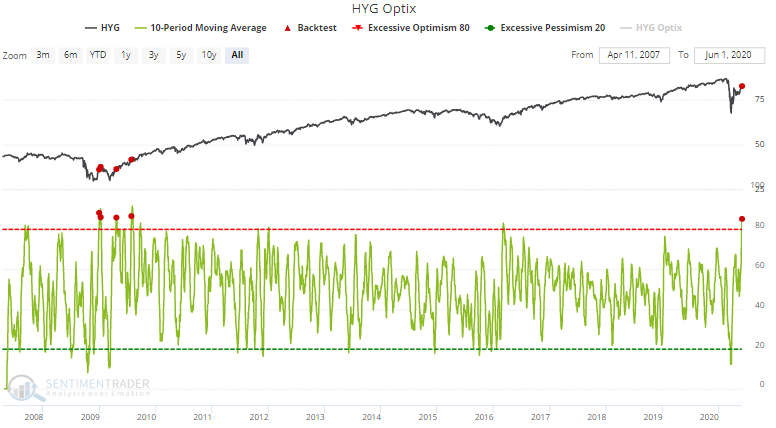

The rally in junk bonds has pushed our HYG Optimism Index's 10 day average through the roof (currently at 85):

The last time this happened was more than a decade ago. Back then, it was neither consistently bullish nor consistently bearish for HYG over the next few weeks and months: