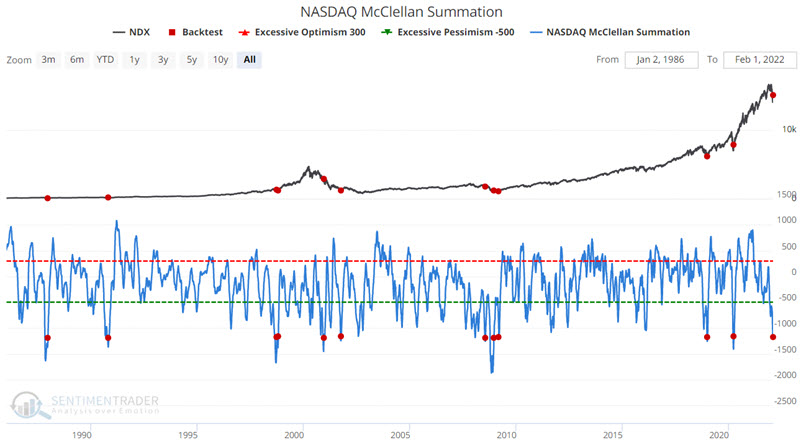

The Nasdaq's internal momentum is trying to recover

The Nasdaq McClellan Summation Index is curling up

The Summation Index is based on work pioneered by Sherman and Marian McClellan and is carried on by their son Tom. It is a longer-term look at the momentum of the underlying breadth of the market, adding each day's McClellan Oscillator reading to the day before. Momentum is positive when it is above zero; below zero, it is negative. It also works as an overbought/oversold indicator when it pushes above +500 or below -1000.

With many overbought/oversold, the catch is that one never really knows how low is low until after the fact. As a result, buying in at the first sign of a slightly oversold condition can result in losses as the market continues to plummet to its ultimate bottom. An alternate approach is waiting for signs of a reversal of an oversold condition before jumping in. That is the approach Jay took for this test.

The red dots in the chart below highlight those days when the NASDAQ McClellan Summation index crossed back above a reading of -1200. You can run this test in our Backtest Engine.

Of particular interest is the performance 1-month after each signal - with an 82% Win Rate.

| Stat box For only the 3rd time in its history, the 5-day average Optimism Index for the UNG Natural Gas fund has surged above 90%. The others were May 2009 and November 2018, per our Backtest Engine. |

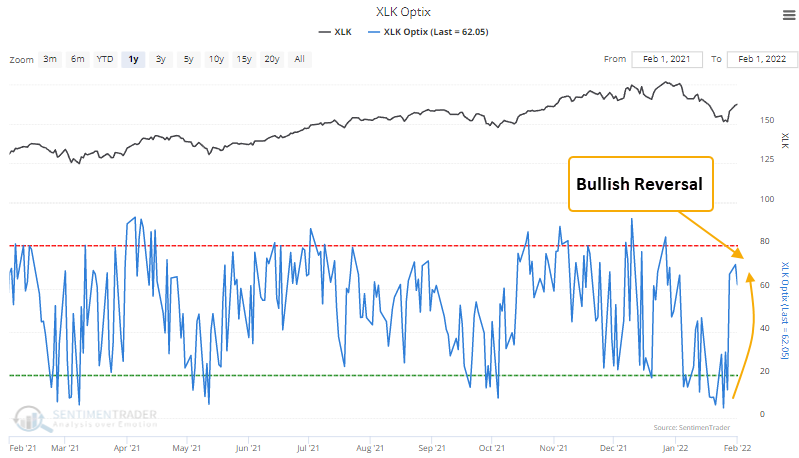

Technology sentiment is reversing

A trading model that uses our Optimism Index to identify when sentiment reverses from a period of pessimism issued a buy signal for the technology sector at the close of trading on Tuesday.

Dean's model looks at current sentiment relative to recent history for the XLK ETF. A new buy signal occurs when sentiment crosses back above neutral from extreme pessimism and market momentum is positive.

This signal has triggered 63 other times over the past 22 years. After the others, the technology sector's future returns, win rates, and risk/reward profiles were solid across almost all time frames.