The never ending global stock market rally

Stocks continue to rally non-stop around the world, particularly in the Asia-Pacific region. The media claims this is due to the election's results, covid-19 vaccines, and Asia's new free trade bloc. Regardless of the reason, the past 2 weeks have seen strong sector shifts within the U.S. and broad-based rallies outside of the U.S.

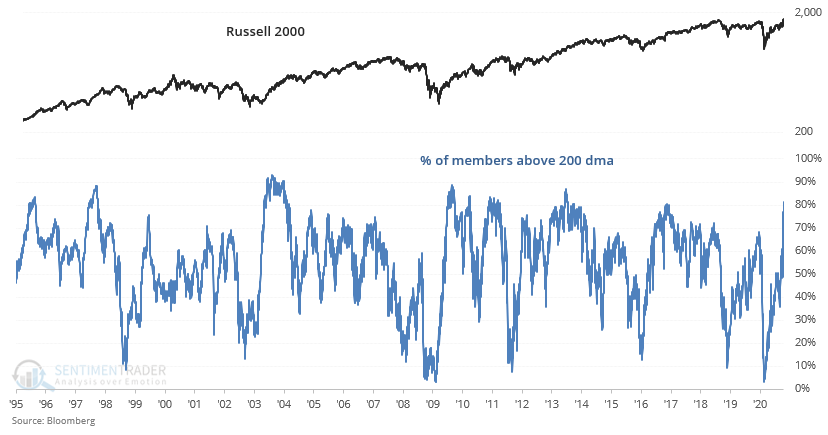

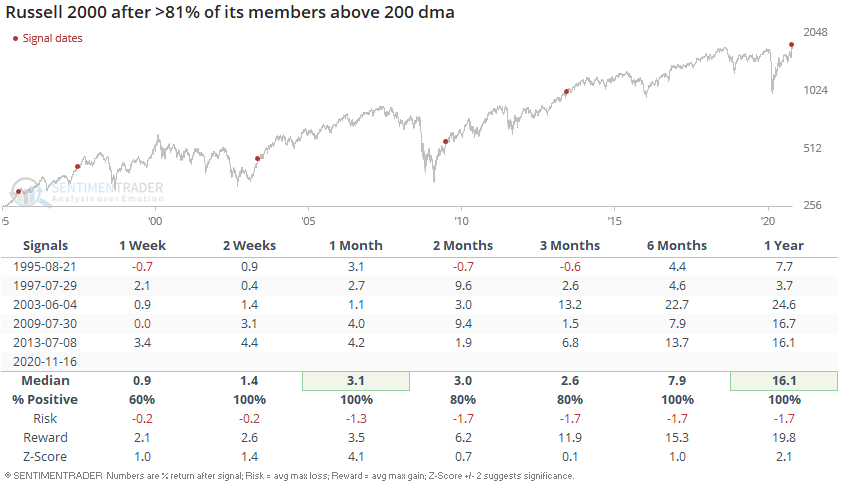

Small cap equities jumped higher, pushing the % of Russell 2000 stocks in a long term uptrend to its highest level in years.

Such strong momentum was typical of how prior bull markets began, which is why all 5 historical cases saw more gains over the next year:

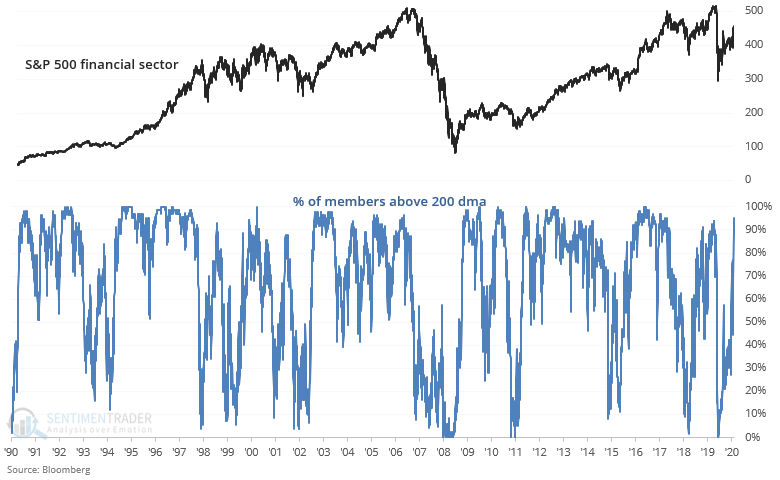

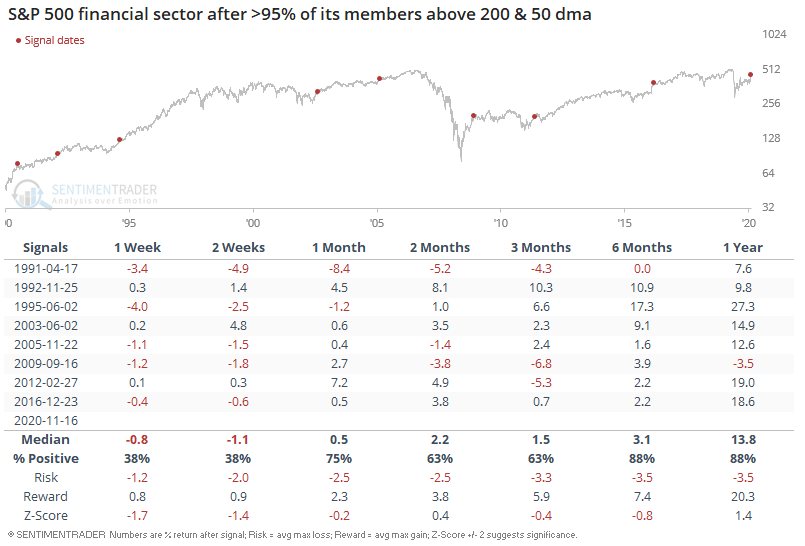

Sector rotation is noticeable among financial, energy, and industrial stocks. More than 95% of financial stocks are above their 50 and 200 dma's:

Once again, such strong momentum usually led to more gains for financial stocks over the next year:

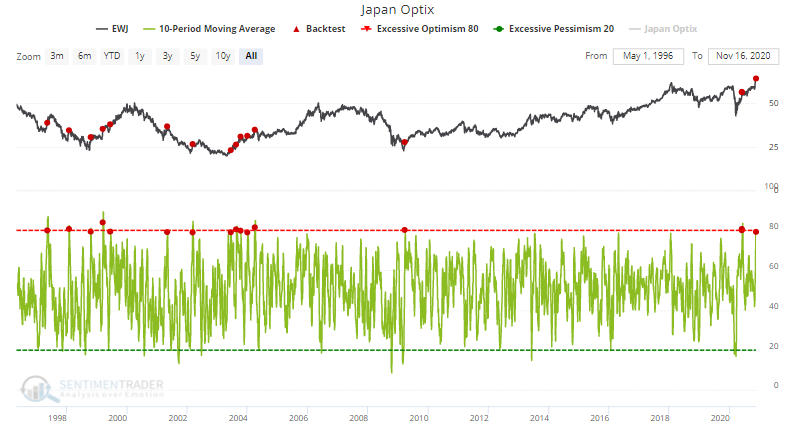

In Asia, Japanese Optix's 10 dma is at one of its highest readings ever:

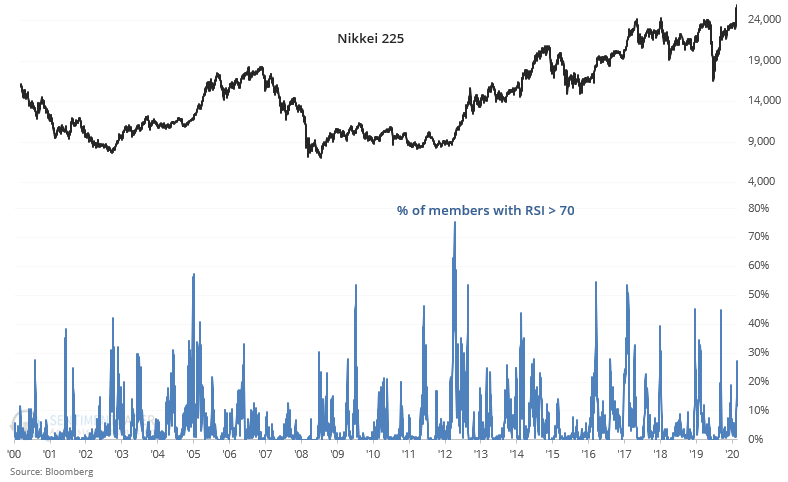

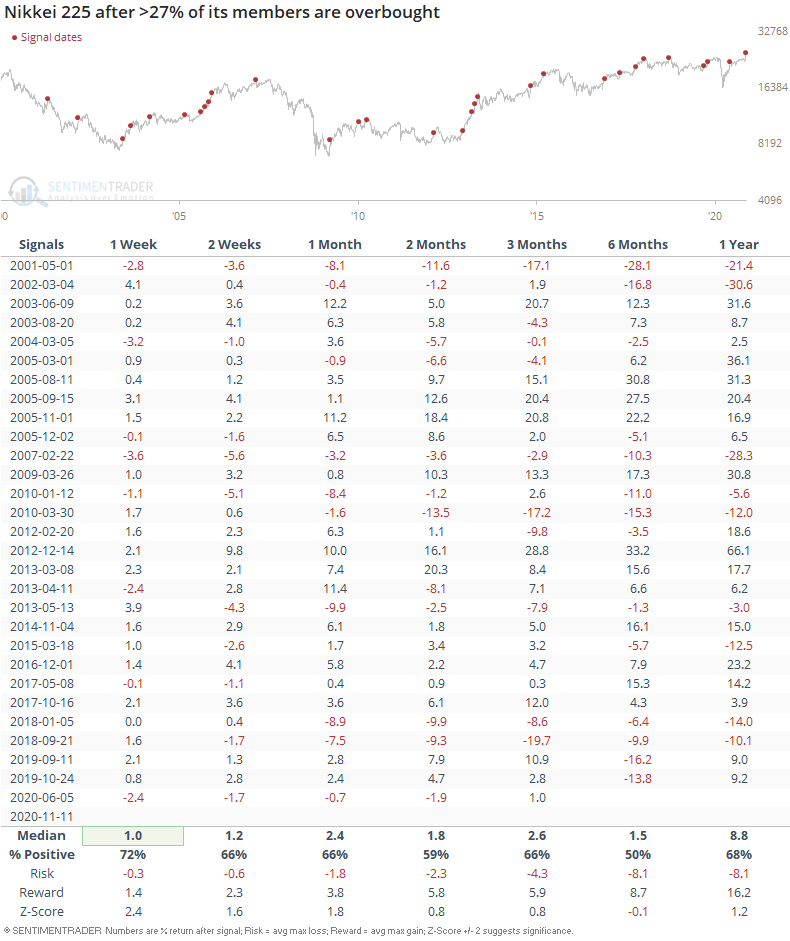

But contrary to what you may expect, this was not a consistently bearish factor for Japanese stocks. Almost 30% of Japanese stocks were recently overbought:

Once again, this was not a consistently bearish factor for Japanese equities on any time frame going forward:

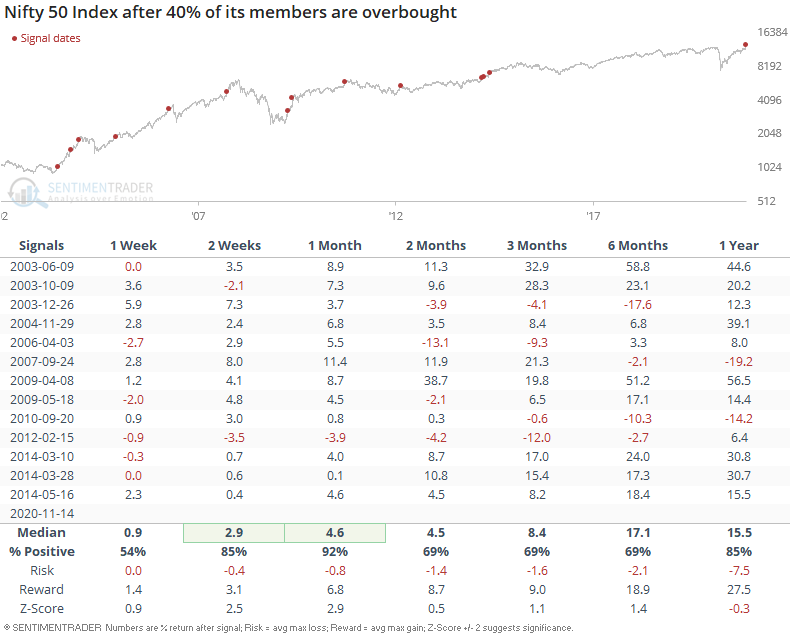

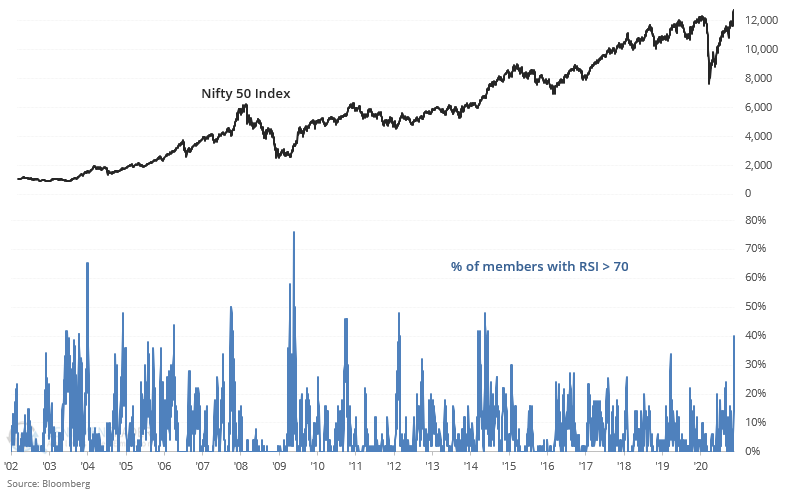

Elsewhere in Asia, 40% of Nifty 50 (India) stocks are overbought:

Once again, things are not always as they appear. Contrary to being a bearish sign for Indian equities, this was a short term bullish sign for the Nifty 50 over the next 2-4 weeks: