The only weakness in junk is that there is no weakness

Given the paroxysm of speculative activity over the past 1-2 months, we've been keeping an eye on some other markets that have had a decent tendency to provide a heads-up that risk appetite was starting to wane.

One of those is the high-yield bond market. Watching for deterioration there gives us a sense as to whether bond investors are starting to price in more defaults, which can often happen before stock investors take notice.

So far, there isn't much evidence of that. Fund flows in HYG have been quite negative (but not as negative as investment-grade funds like LQD or Treasury funds like TLT). But that hasn't had much of an impact on the internal health of that market.

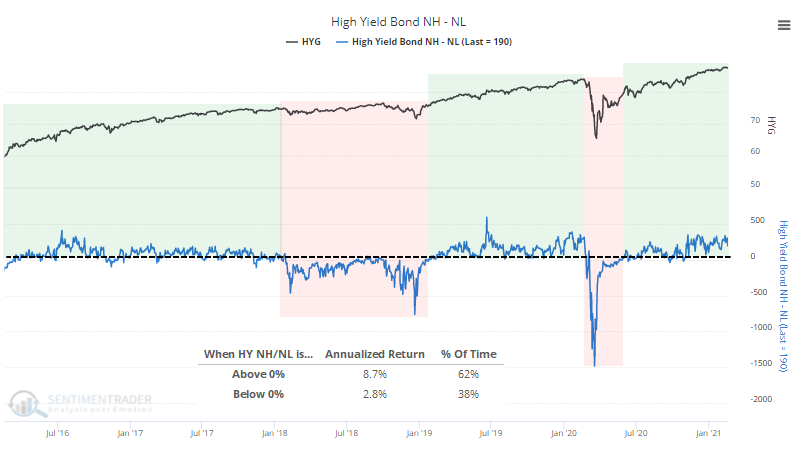

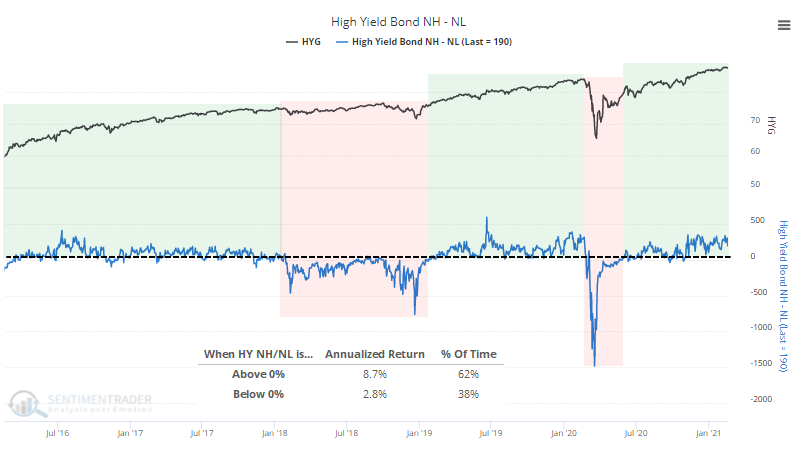

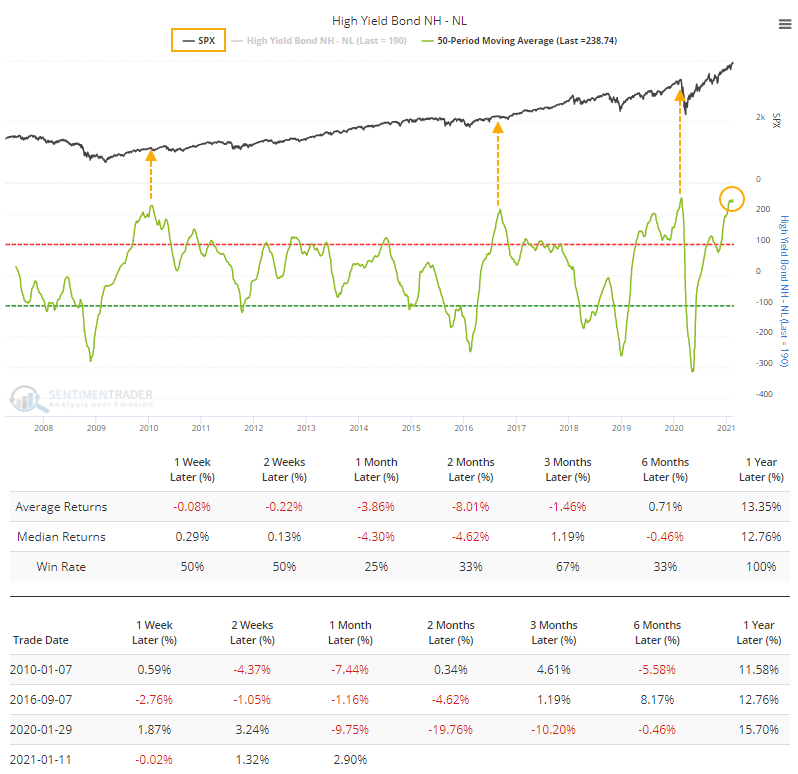

One of the primary gauges for that is the net percentage of high-yield bonds that are hitting 52-week highs minus those falling to 52-week lows. If it's positive, then it's a good sign for both high-yield bonds and the stock market.

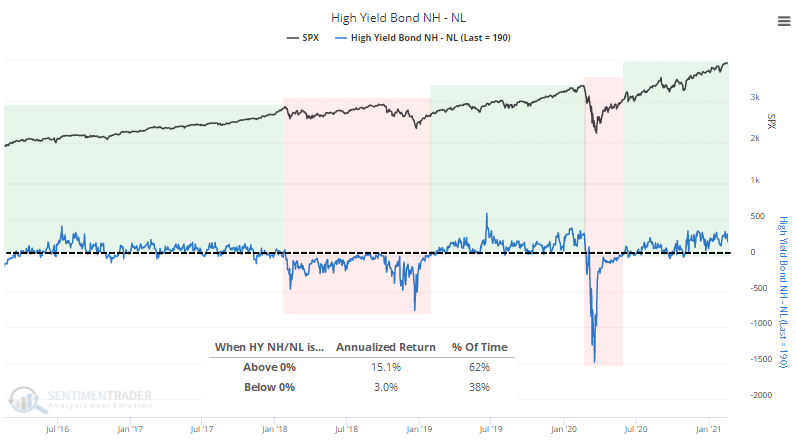

The S&P 500 has held up well when this is positive. The difference in its annualized return is stark depending on whether there are more junk bonds hitting new highs or new lows. The fact that this is still well above zero indicates a healthy junk-bond market, or at least one that buyers are still supporting, and that has indicated good forward returns.

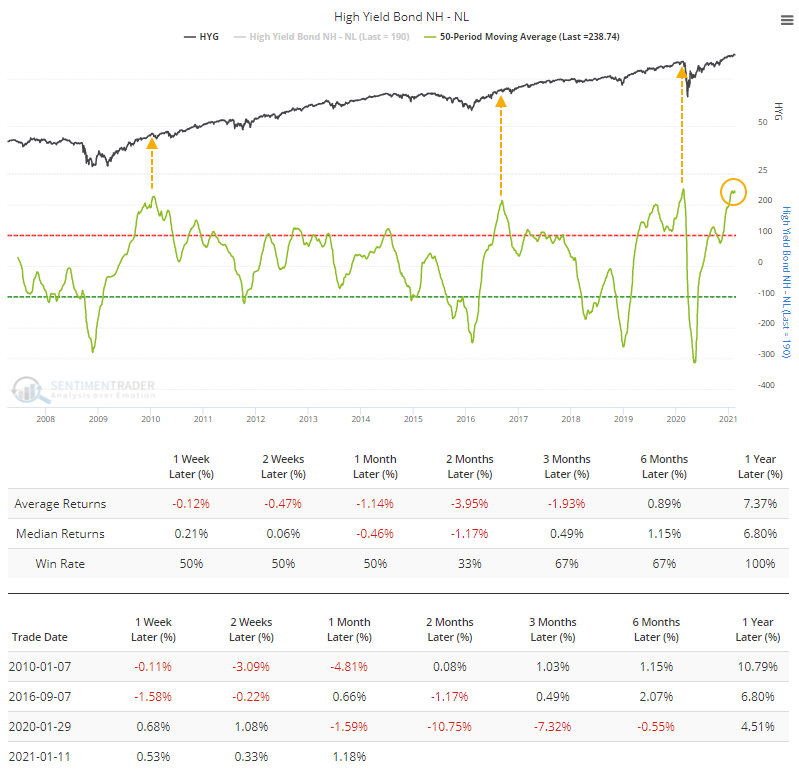

The biggest caveat is simply that things have been so positive for so long.

The 50-day average of net new highs is now the highest in at least 14 years. Other times it first reached a very high level, HYG struggled over the next couple of months according to the Backtest Engine. It first became extreme a little over a month ago, so it has been defying gravity since then. It has been a challenge for it to levitate much longer.

It was the same suggestion for the S&P 500. The Backtest Engine shows losses across most time frames.

Each of those times, while forward gains were limited, by the time that losses in bonds (and stocks) were enough to push the net percentage of bonds much below the zero line, the bulk of the selling pressure was nearly done, at least time-wise. Last year, of course, the losses were deep but it's relatively safe to say that was an unusual circumstance.

Like a lot of what we've been looking at, this suggests that things have been so good for so long, that it's unlikely to lead to large, sustained gains from here. But the momentum has been so strong that if we do see some multi-week or multi-month selling, buyers won't go away easily.