The right sectors aren't leading this rally

A little over a week ago, we looked for signs of a thaw outside of the direct ones we could see in the broader market. There weren't many.

One of the ways to see if the rebound is sustainable is to look at the sectors leading out of the decline. Through the first week, it wasn't very encouraging, since the sectors that typically lead out of true bottoms weren't leading then.

A concern popping up now is noted by the Wall Street Journal:

“In past bear markets, you tend to have a change in leadership—the stocks that led you into a bear market weren’t the kinds that led you out,” [Mr. Larson] said.

This has been a common refrain. Because big tech stocks did so well leading up to the peak, and several of them have done so well lately, then it suggests we haven't really seen the kind of rotation that marks the end of bear markets.

We'll try to answer 2 questions:

- Is it a worry that some of the stocks leading now also led during the bull market?

- Are the "right" sectors leading us out of the March bottom?

What we'll do is look at the returns in the major S&P 500 sectors for the year leading up to a bull market peak. Then we'll look at the returns in each sector in the first 20 days following a low and compare the correlations. If the old saw is true, then there should be a consistently negative correlation as new sectors take the lead coming out of the bear market bottoms.

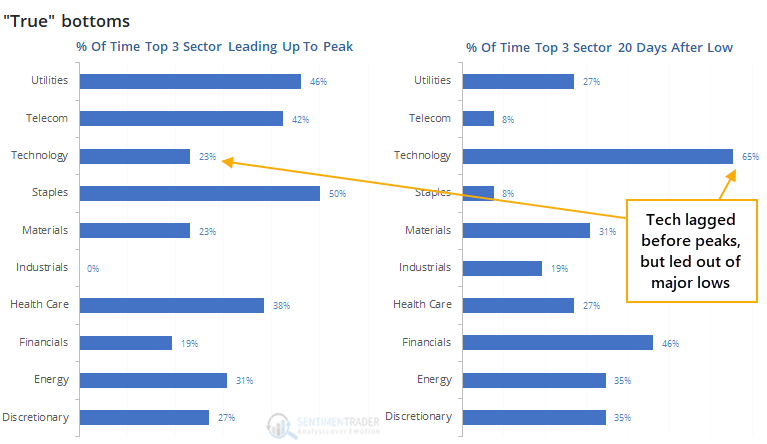

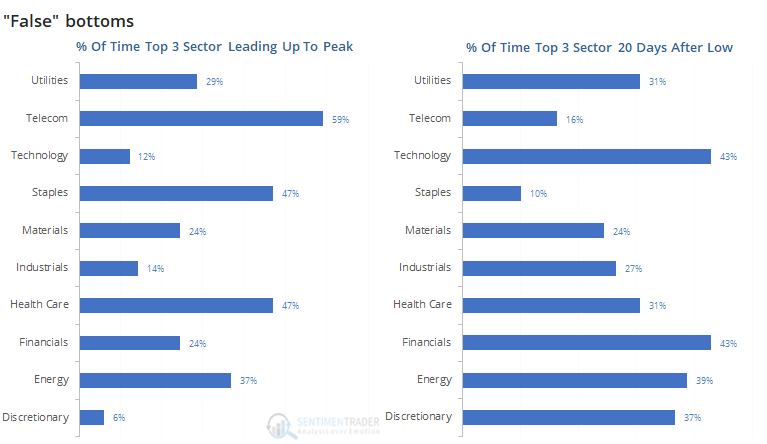

In the year leading up to bull market peaks, defensive sectors tended to lead. Below, we can see the percentage of time each sector was among the top 3 performers during the year preceding the peak. We can compare that to the percentage of time each sector was in the top 3 in the 20 days following major lows that didn't see a lower low within the next year.

Technology was the most consistent leader in the first month of bottoming, followed by financials and a tie between energy and discretionary. While staples was a leading sector before half of the major peaks, it was a leader only 8% of the time when coming out of the low. So in that sense, there was a negative correlation between leaders heading into the bear market and leaders coming out of it.

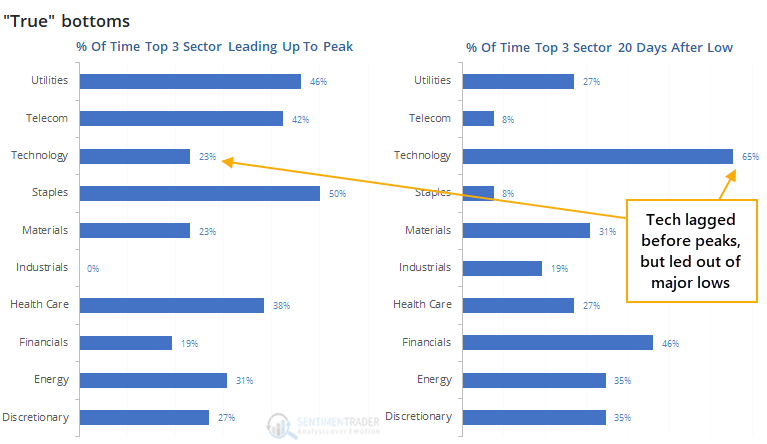

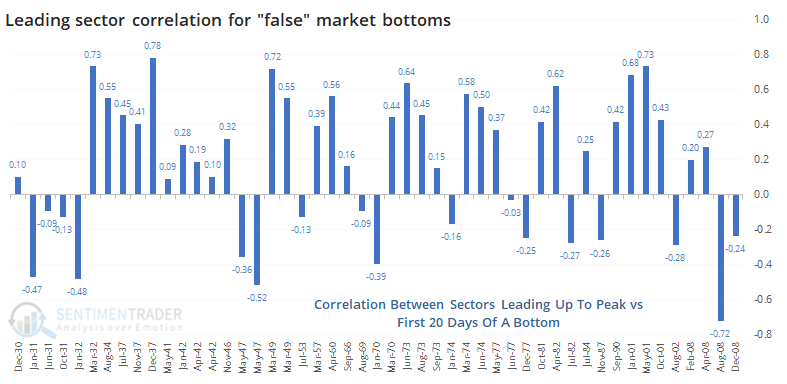

But other than a sector or two, it wasn't very consistent. Below, we can see the correlations for "true" bottoms. These are times when the S&P rallied for at least 20 days from a 52-week low and didn't see a lower low within the next year. It compares the rank of each sector in the year leading up to the bull market peak versus the rank in the first 20 days coming out of the next major low.

The theory doesn't really hold up, and there was a lot of variety. On average, there was a +0.23 correlation between sectors leading up to the peak and sectors leading out of the bottom.

If the theory was correct, then we should have seen a negative correlation. And if that's the case, then we're in good shape, because there's a -0.61 correlation between sector ranks now and sector ranks leading to the February peak. This would be the most negative correlation out of all prior "true" bottoms.

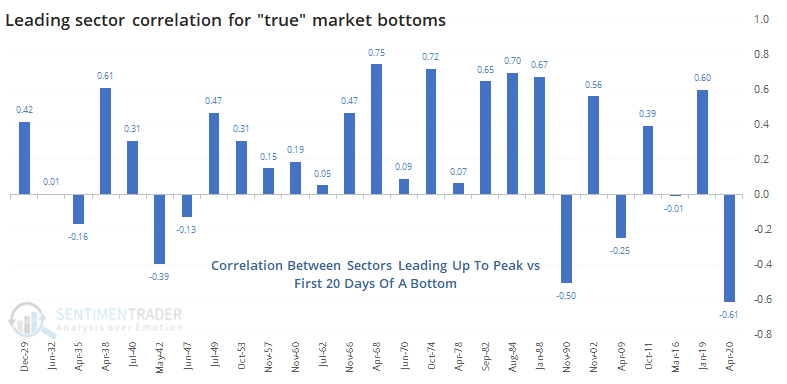

Heading into the February peak, tech was a leader, which is unusual. But several defensive sectors were also leaders, which is more common to see.

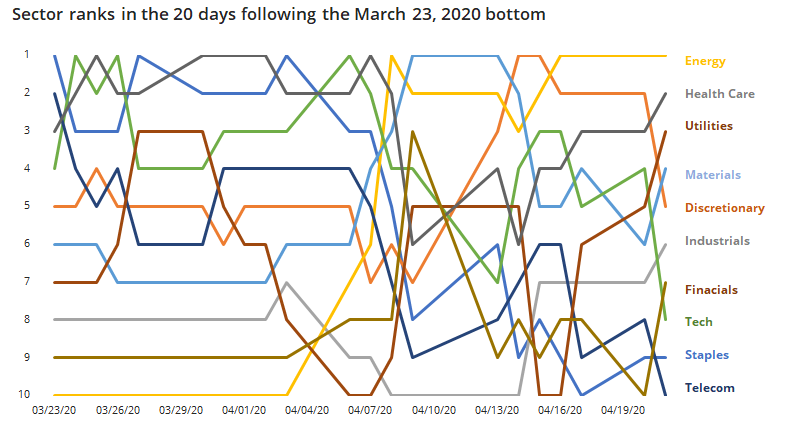

In the 20 days since the bottom, there has been a wild shuffling of the ranks. Curiously, energy stocks have come out on top so far, followed by health care and utilities. Tech's place has continued to slip in recent days. This is a bit disturbing - it's not the most classic mix of sectors to power the initial leg of a new, sustained bull market.

Now, let's look at "false" bottoms.

In the year leading up to the peak before a bear market, defensive sectors still had a strong tendency to be leaders. When stocks bounced during failed rally attempts, there was much more of a spread between sectors. Tech and financials still held the lead, but other sectors were more represented than during "true" bottoms.

If we look at the correlation between sectors leading into the peak and sectors leading coming out of a "false" bottom, again it was mostly positive. There was a lot of variation, and the average correlation was actually lower than for "true" bottoms.

Leading up to the February peak, the sector ranks had a 0.67 correlation to the types of sectors seen before "true" bottoms and only a 0.17 correlation to the peaks before "false" bottoms. So, that's good, maybe.

But the sector ranks over the past 20 days have only a 0.02 correlation to that seen after "true" bottoms and a slightly higher correlation of 0.16 to "false" bottoms. Not a major edge there, but a bit disappointing.

To answer question #1: No, it's not a worry that some of the stocks leading now also were leading during the bull market.

There is a positive correlation between sectors leading the last leg of a bull market and sectors leading in the first month out of a new bull market. So, we can dismiss that theory.

What's more disturbing is that some of the classic sectors to lead the first kick-off of a successful bull market - technology, financials, discretionary, and energy, are somewhat lagging now. The sectors that currently have the best ranks against the others are more defensive in nature, and it's a mix more commonly seen in the first month of "false" bottoms.

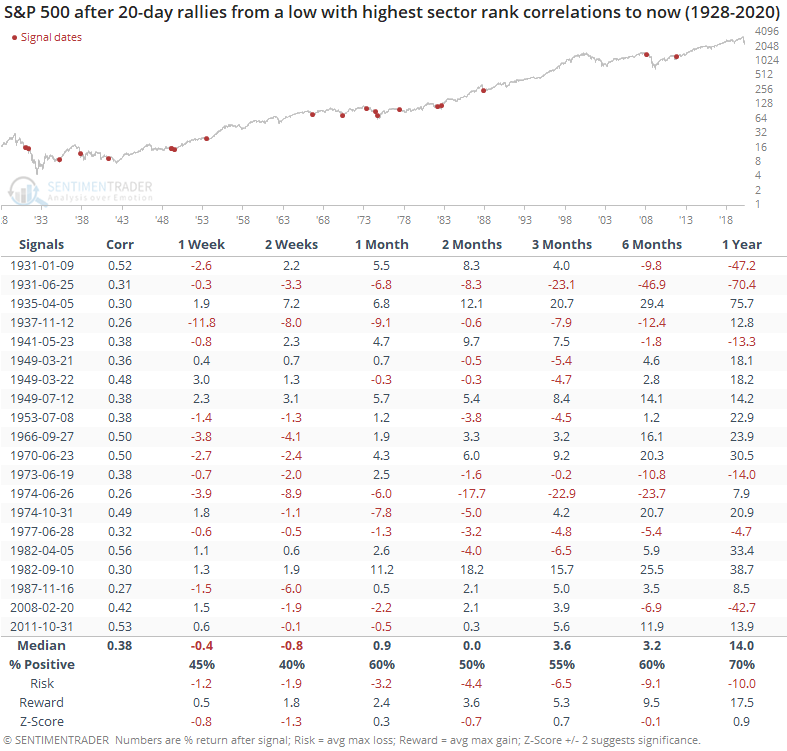

If we look at the S&P's future returns following the 20-day rallies from a low that had the highest sector rank correlations to what we've seen over the past 20 days, then we get the following.

Shorter-term returns tended to be negative, with the S&P adding to its gains over the next two weeks only 40% of the time. The risk/reward ratio skewed to the negative side up to three months later, and risk was relatively high even up to a year later, so none of that is good news.

To answer question #2: There isn't really a "right" sector, but it is a slight worry that more defensive sectors are leading now.

Following rallies with the highest sector rank correlations to what we've seen over the past 20 days, returns were relatively weak, especially shorter-term. Even in the months ahead, risk was higher than average. It would have been better to see other sectors leading the rally over the past month. Tech and financials don't have to lead out of a bottom, but they've been among the leaders out of the most lasting bottoms. Bulls should hope that some of the higher-beta sectors start to assert some leadership.