The rise in rates reaches an extreme level

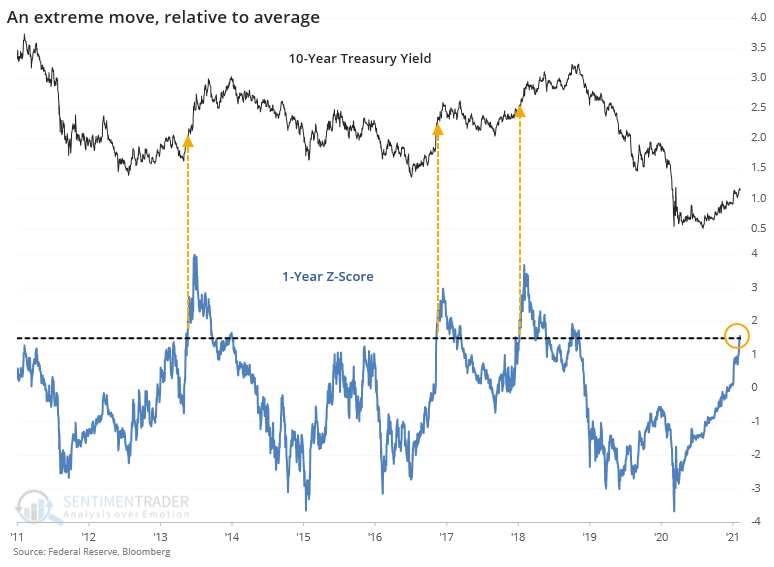

The march higher in the yield on 10-year Treasury notes took a breather in recent days, but it's mostly been a steady rise for most of the last 6 months.

So much so that the 1-year z-score, a measure of how unusual the move is relative to recent history, just reached 1.5 standard deviations for the 4th distinct time in the past decade.

The push higher in rates has been focused mostly on the longer end of the Treasury yield curve, so the 2-year / 10-year spread has also made an extreme move.

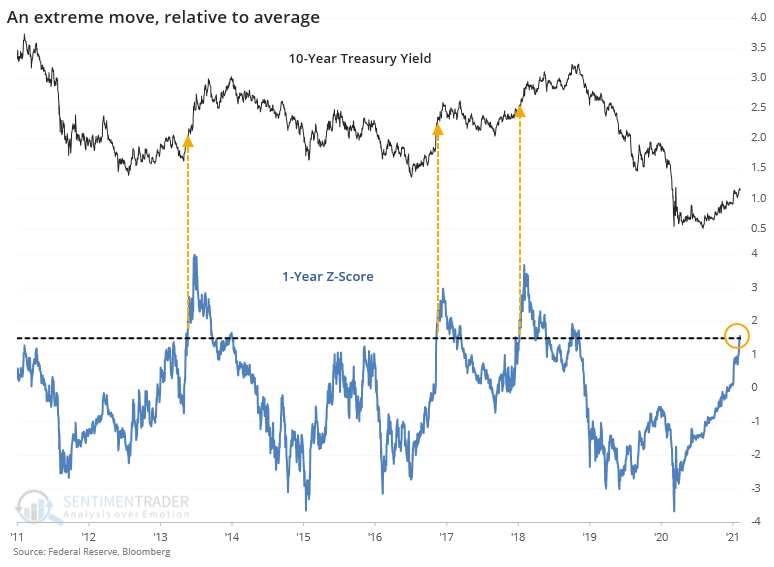

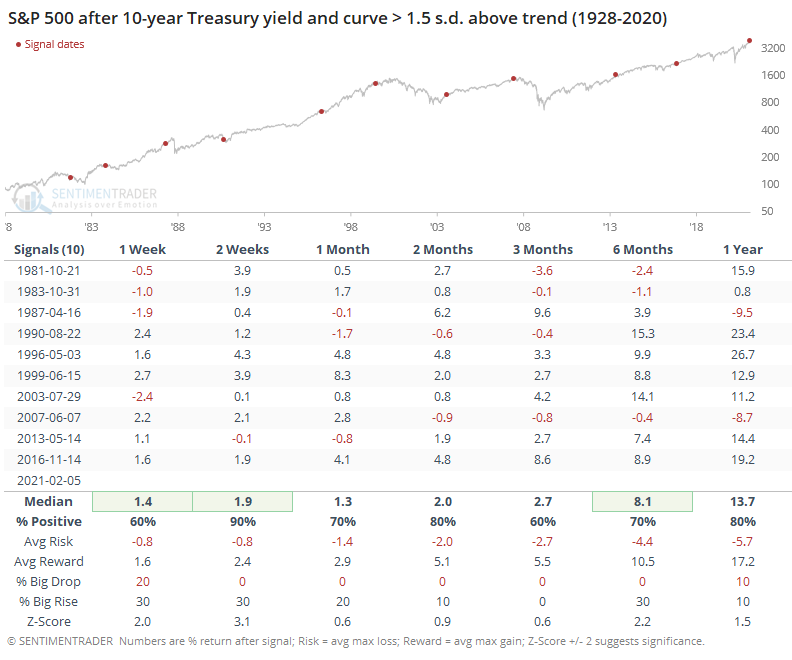

This is typically taken as a reflection of economic growth and should be a positive for stocks going forward. When both the yield on 10-year notes and the yield curve were more than 1.5 deviations above trend, that mostly proved true. Over the next couple of months, there were only a couple of small losses.

From the chart, we can see little red dots near the peaks in 1987, 2000, and 2007, but they triggered well before stocks peaked. Returns over the medium-term were middling, as was the risk/reward ratio, but overall there was a modest positive bias.

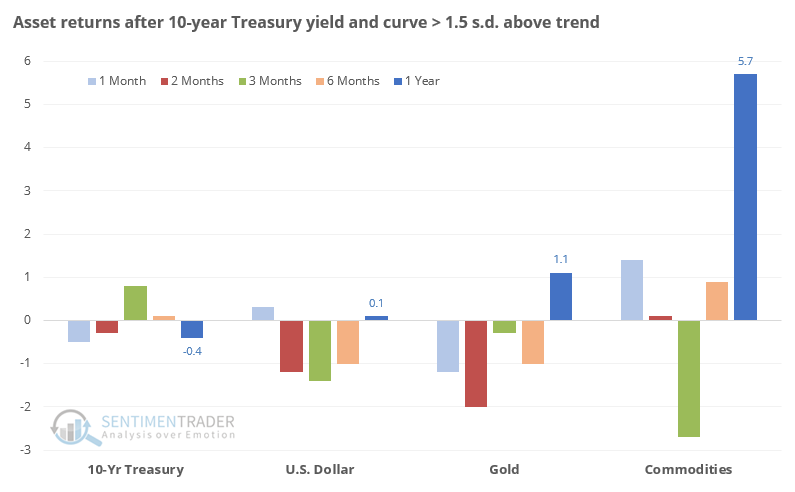

As for other assets, it preceded mostly negative returns, with commodities holding up the best over the next year. That is a general basket of commodities weighted by trading volume and world production as calculated by Bloomberg.

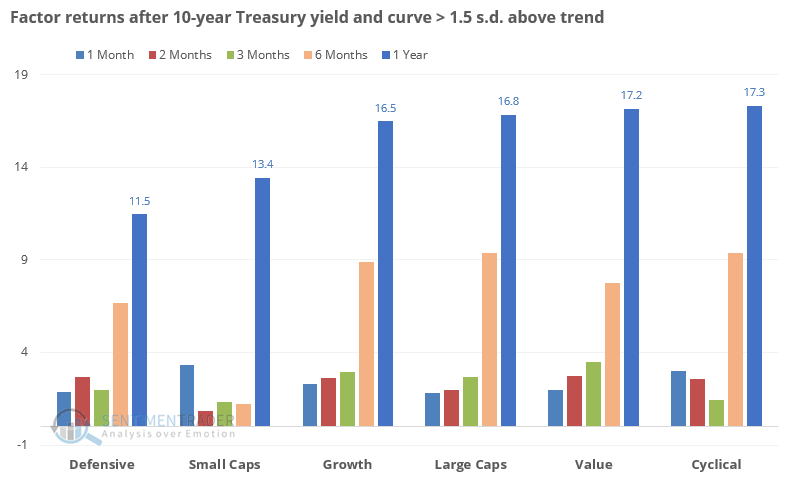

Among equity factors, returns were fairly balanced. Surprisingly so, actually. There was a bit of a medium-term blah among small-cap stocks, but other than that, there wasn't much of a bias between them.

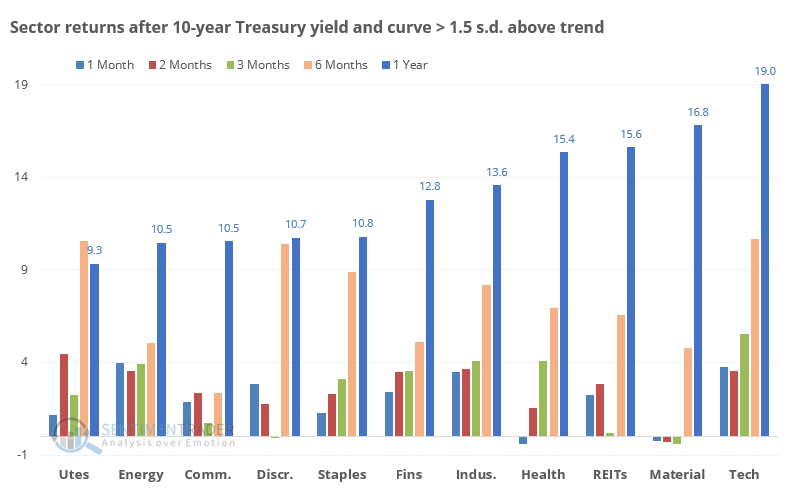

It's also perhaps surprising that among major sectors, tech stocks showed the largest gains a year later. One of the bearish arguments right now for tech is that rising rates will cause investors to reprice the risk inherent in a sector where so many companies are struggling to turn a profit. Energy, financial, and industrial stocks also held up well across time frames.

Ask 10 investors about what the rise in rates is likely to mean, and you're likely to get 10 different responses. We're at such a unique moment in history that perhaps history isn't any guide at all. From what we can determine, though, the trend of rising rates, which ostensibly signals an economic recovery, is more of a modest point in bulls' favor than bears.