The S&P 500 and dollar undergo trend changes

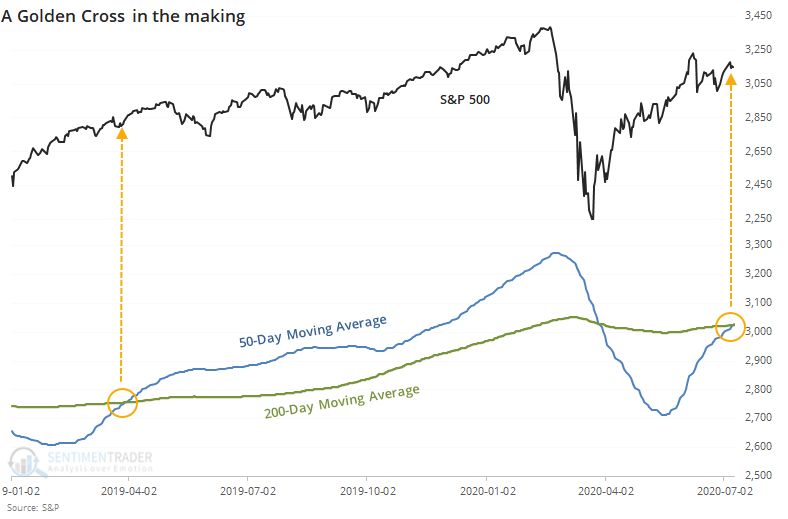

Barring some kind of disaster on Thursday, the S&P 500 will enjoy a Golden Cross, where the 50-day average moves above the 200-day average.

This interpretation is kind of a bastardized version of the averages that ostensibly originated in ancient Japan, but Americans, in particular, have an affinity for round numbers, and these two have become the standard.

We've looked at these kinds of technical signals across markets for decades, with the grudging conclusion that they're barely useful. When this triggered in 2019, stocks rallied...then gave it all back, so whether it was successful or not depends on one's time frame.

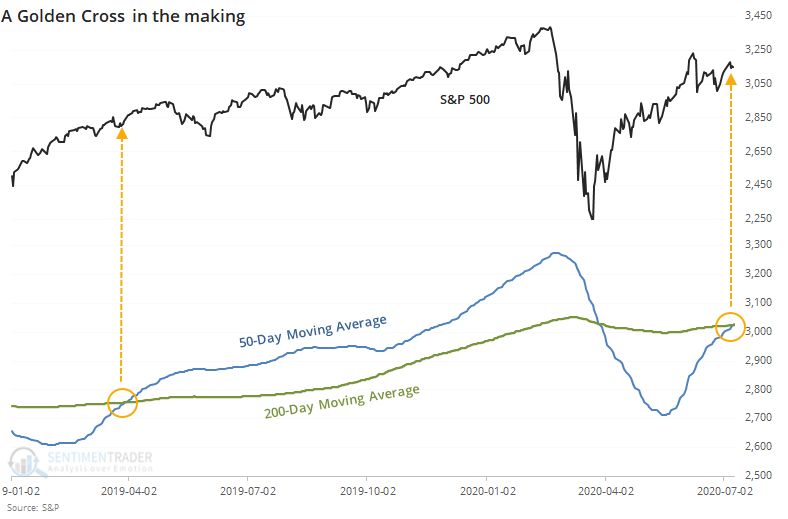

As streaks go, this was one of the shorter ones. The 50-day average was below the 200-day for only 70 sessions. The worst declines saw this go for 500 days or longer.

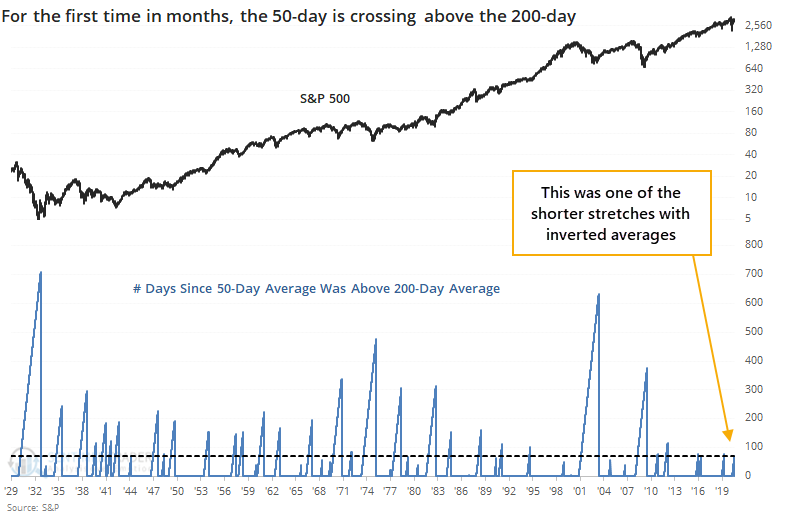

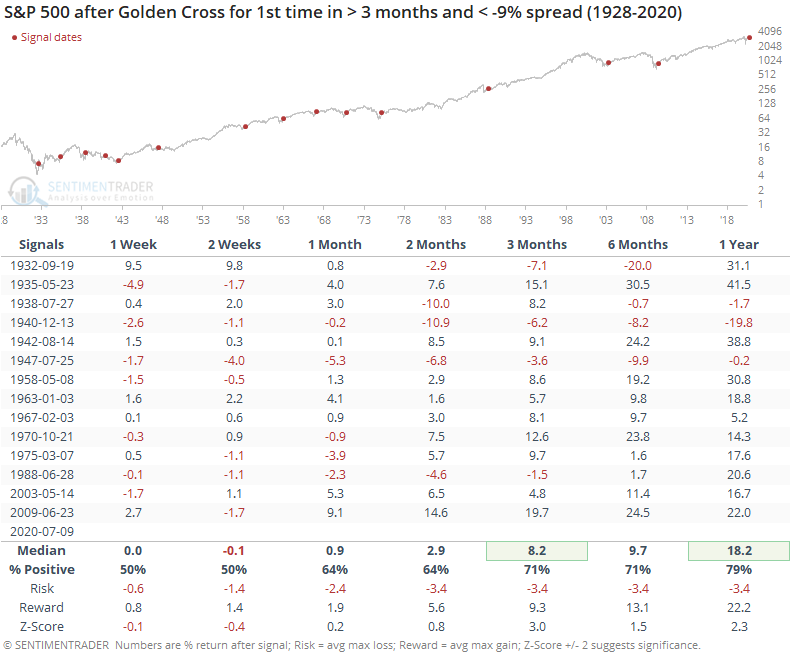

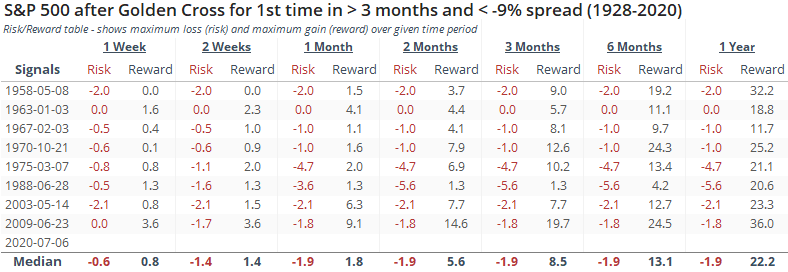

If we further stipulate that both moving averages must be rising, then the table below shows every signal since 1928 when the 50-day was below the 200-day for anywhere between 30 and 90 days.

Future returns were okay. Median returns were about in line with random, and while reward was higher than risk, it wasn't positively skewed enough to consider it a big edge.

This one might be notable for another reason - it reversed what had been a very negative spread between the two averages. The S&P's 50-day average had dropped more than 9% below the 200-day average before reversing.

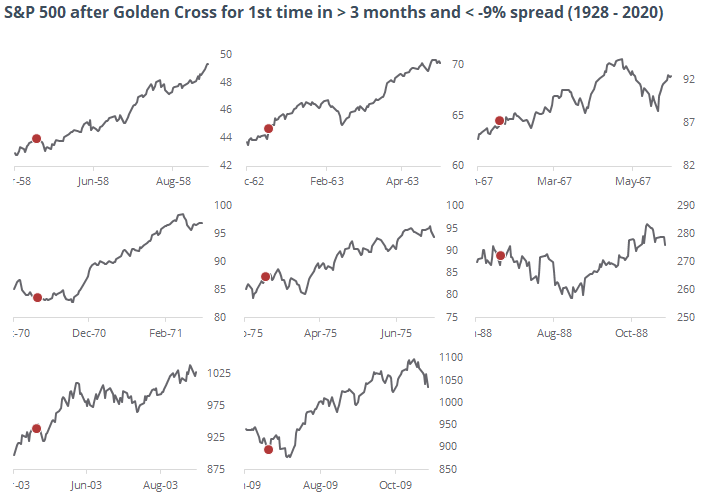

Shorter-term returns were sketchy, but from three months and beyond, mostly positive. This has been particularly positive since 1950, with extremely small risk relative to reward.

We wouldn't put a lot of faith in the Golden Cross by itself. The biggest reason for optimism is that it has reversed what had been a very negative medium- vs long-term trend, and that has led to big gains over the next 6-12 months every time over the past 70 years. During modern times, these signals marked the end of every major bear market.

EDIT: The following thumbnail chart was added after this post was originally published.

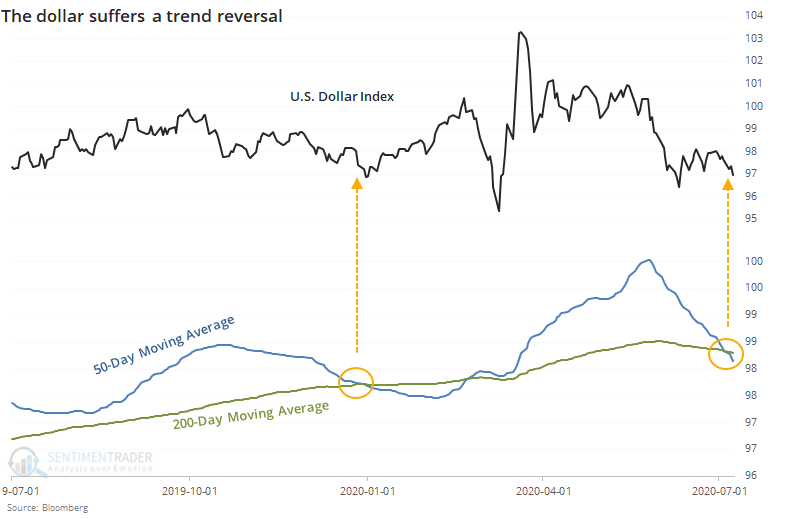

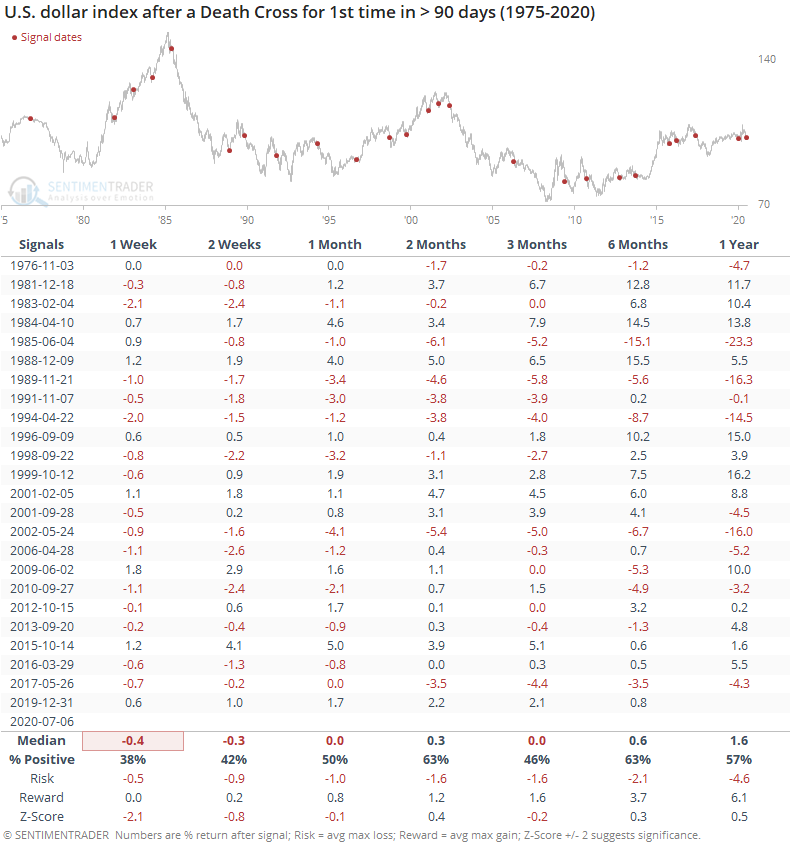

At the same time that the S&P's trend is turning positive, the U.S. dollar's is turning negative. The 50-day average just crossed below the 200-day average.

When this happened for the first time in at least 90 days, the buck had trouble regaining a positive trend.

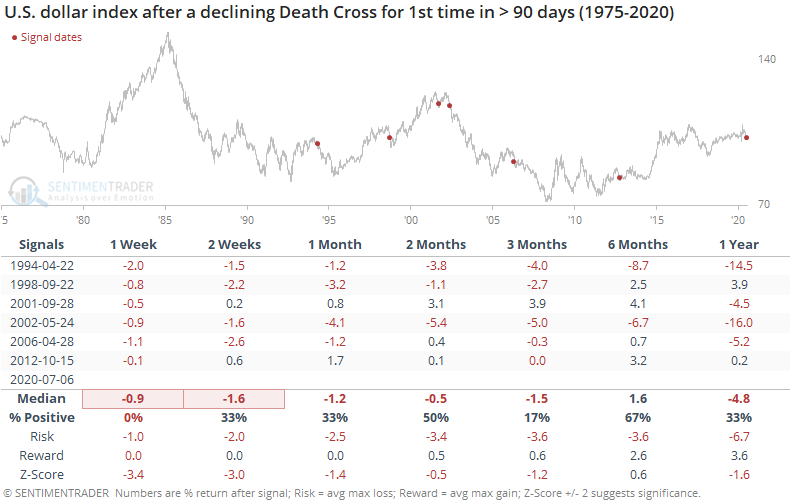

That was especially true if both moving averages were declining at the time of the cross, as they are now.

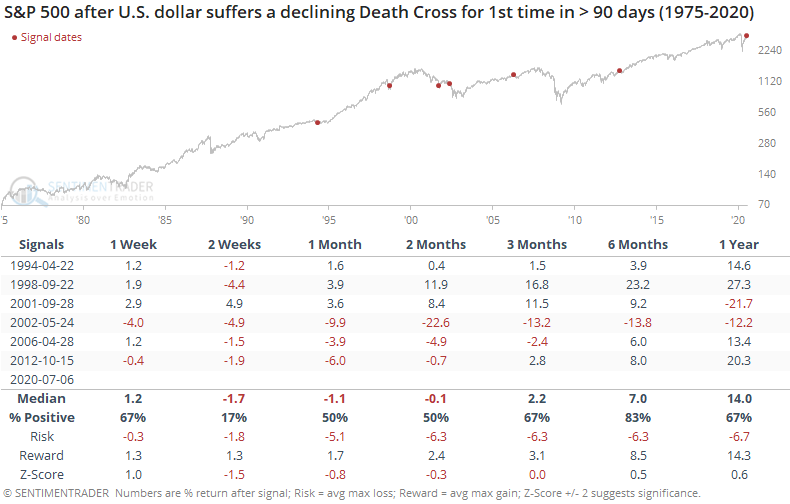

These signals preceded some short-term heartburn for the S&P 500, but not much beyond the first couple of months.

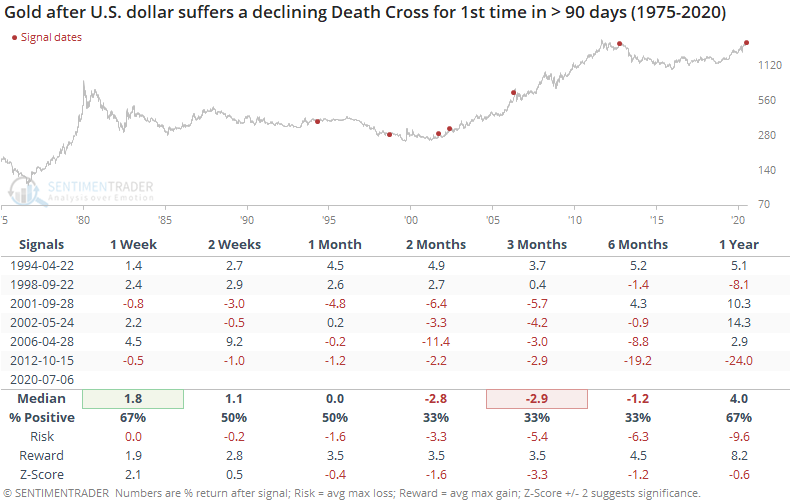

Surprisingly, gold didn't benefit that much from further declines in the dollar in the months ahead.

We'd take this potential trend change more as a bad sign for the dollar than as a good (or bad) sign for stocks or gold.