The Stock Market is at a Critical Short-Term Juncture

The stock market appears to be at an interesting - and potentially important - juncture.

- The S&P 500 Index recently hit a new all-time high

- The Nasdaq 100 is near an all-time high

- Seasonality is net negative into late June

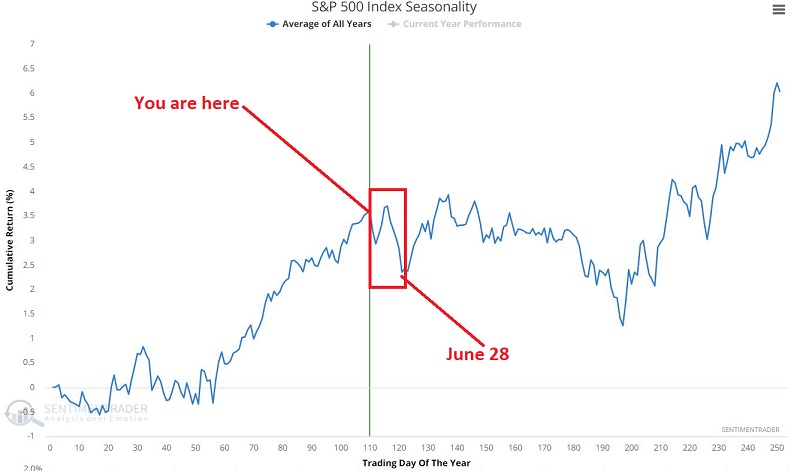

The chart below displays the annual seasonal trend for the S&P 500 Index.

Note that this year the period for potential weakness extends from 6/11 through 6/28.

The chart below (from www.Barchart.com) highlights the critical recent high of 424.63 for ticker SPY. The ETF needs to close above that level to keep the uptrend intact.

The chart below (from www.Barchart.com) highlights the critical recent high of 342.80 for ticker QQQ. The ETF needs to close above that level to keep the uptrend intact.

WHAT TO LOOK FOR

- If both of these ETFs follow through in the near term, then the trend is likely "onward and upward."

- However, if they fail to do so in the near term, the likelihood of at least a short-term pullback of some degree increases significantly.

Not exactly rocket science. And no predictions, just an alert to an apparently important decision point for the stock market.