The tech and growth story

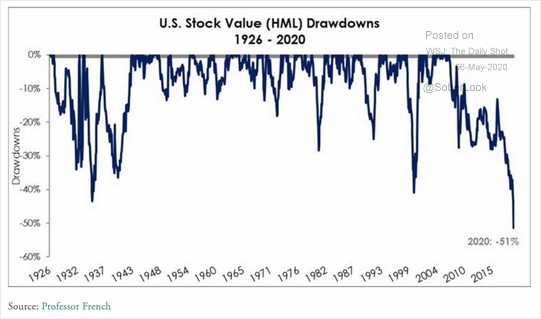

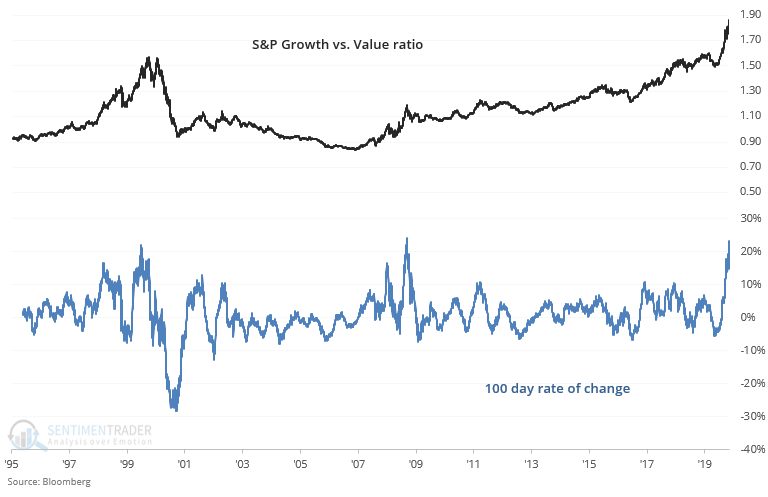

As plenty of market watchers include those at the WSJ have noted, the value factor continues to lag growth significantly. This is one of the longest periods of underperformance ever:

Value investors have repeatedly called for their favorite factor to outperform over the years, but so far this has failed to materialize. Perhaps now is finally the time?

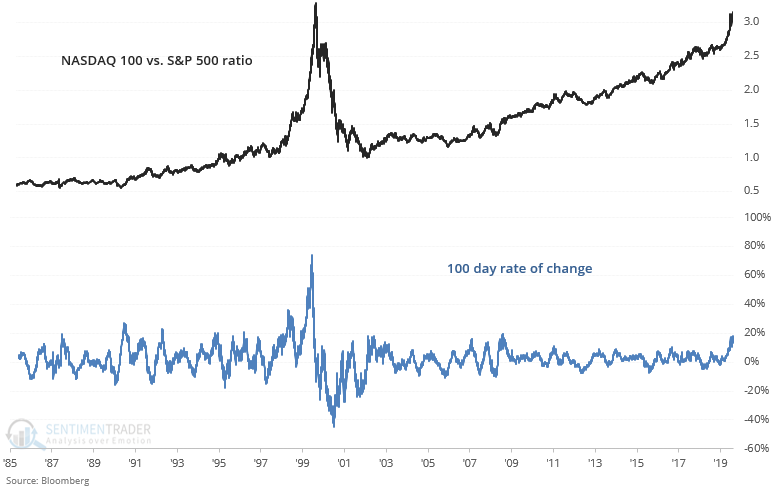

The following chart is the NASDAQ 100 vs. the S&P 500 ratio, which is *at its highest since 2000*:

While these charts are extremely popular, they highlight one of the biggest problems with charts - they can be made to tell any narrative you want. For example, this chart doesn't take into account the fact that the S&P 500's dividend yield is higher than the NASDAQ 100's dividend yield. Comparing total return indices demonstrates that today is not "just like 2000".

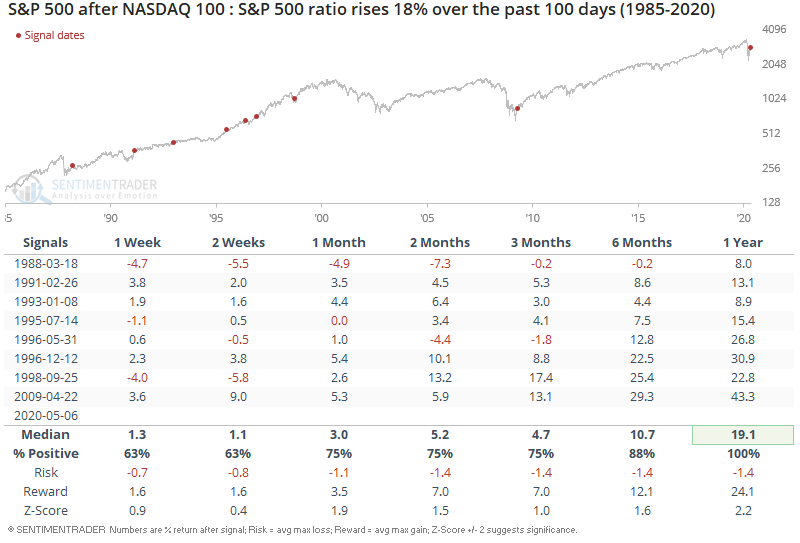

Regardless of absolute values, the NASDAQ 100 vs. S&P 500 ratio's 100 day rate of change is extremely high. When this happened in the past, it wasn't a guaranteed bearish sign for the S&P 500 on any time frame. In fact, 1 year later this was consistently bullish for stocks:

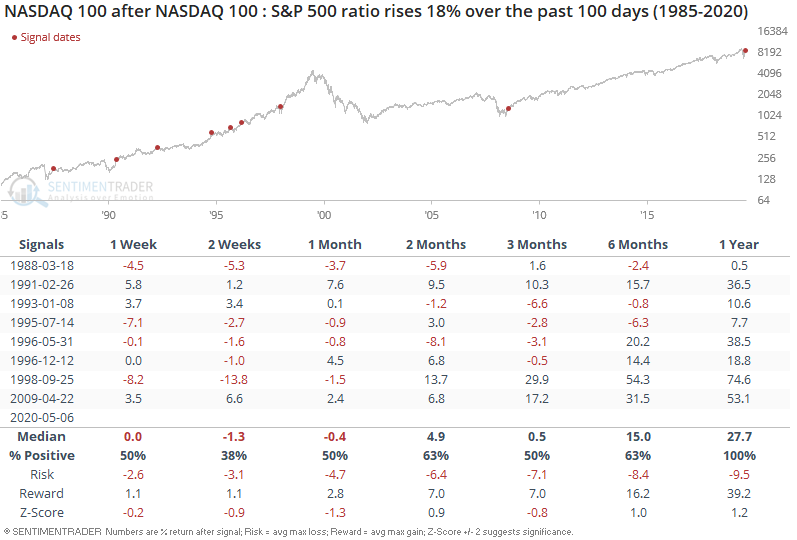

As for the NASDAQ 100, this could lead to short term weakness:

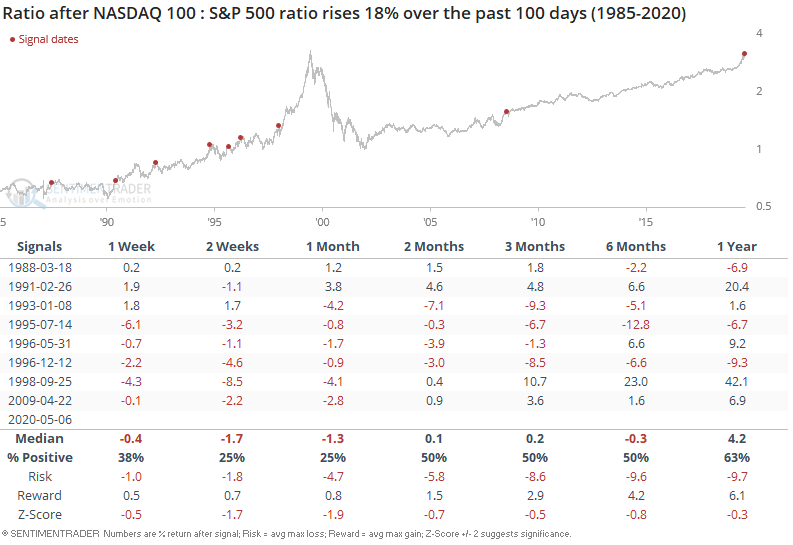

Which is why the NASDAQ vs. S&P 500 typically pulled back in the short term:

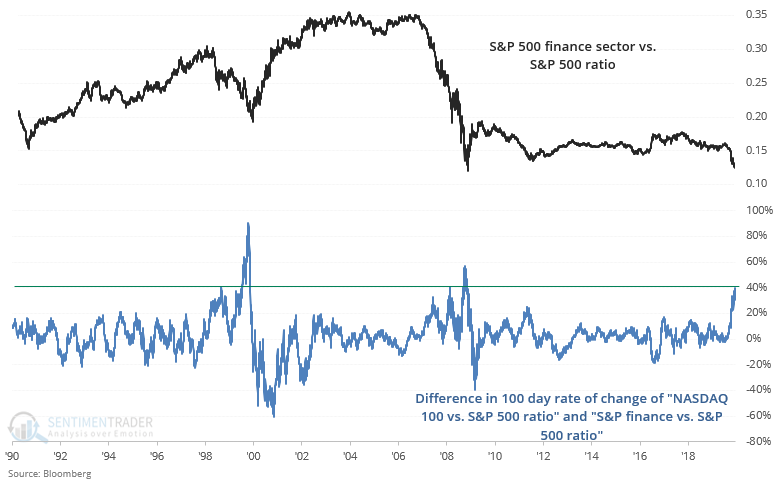

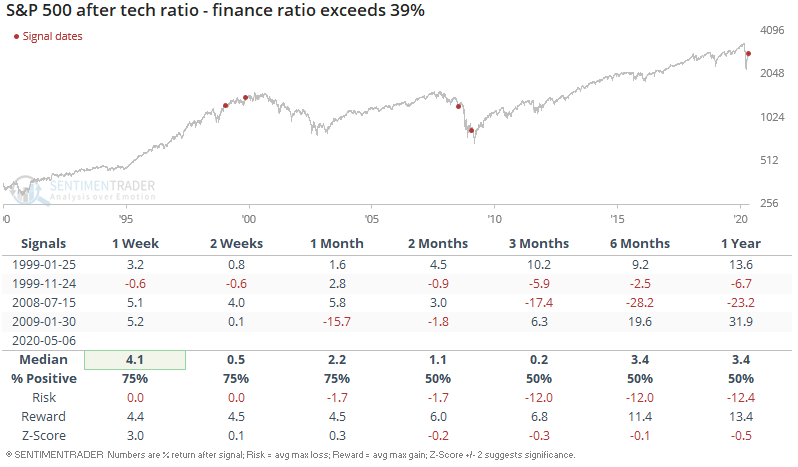

Tech stocks remain strong while the financial sector is one of the weakest sectors. This has caused the "NASDAQ vs. S&P ratio" to significantly outperform the "Finance vs. S&P ratio":

While this is quite an extreme situation, it hasn't been consistently bullish or bearish for stocks.

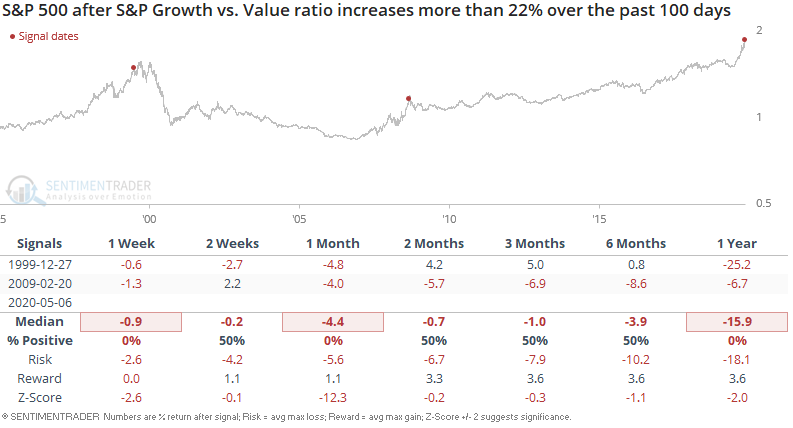

And lastly, the S&P 500 Growth Index has significantly outperformed the S&P 500 Value Index

This happened near the stock market's top in late-1999 and also near the stock market's bottom in early-2009. So while this isn't consistently bullish or bearish for stocks, in both cases in led to value stocks outperforming growth stocks over the next year: