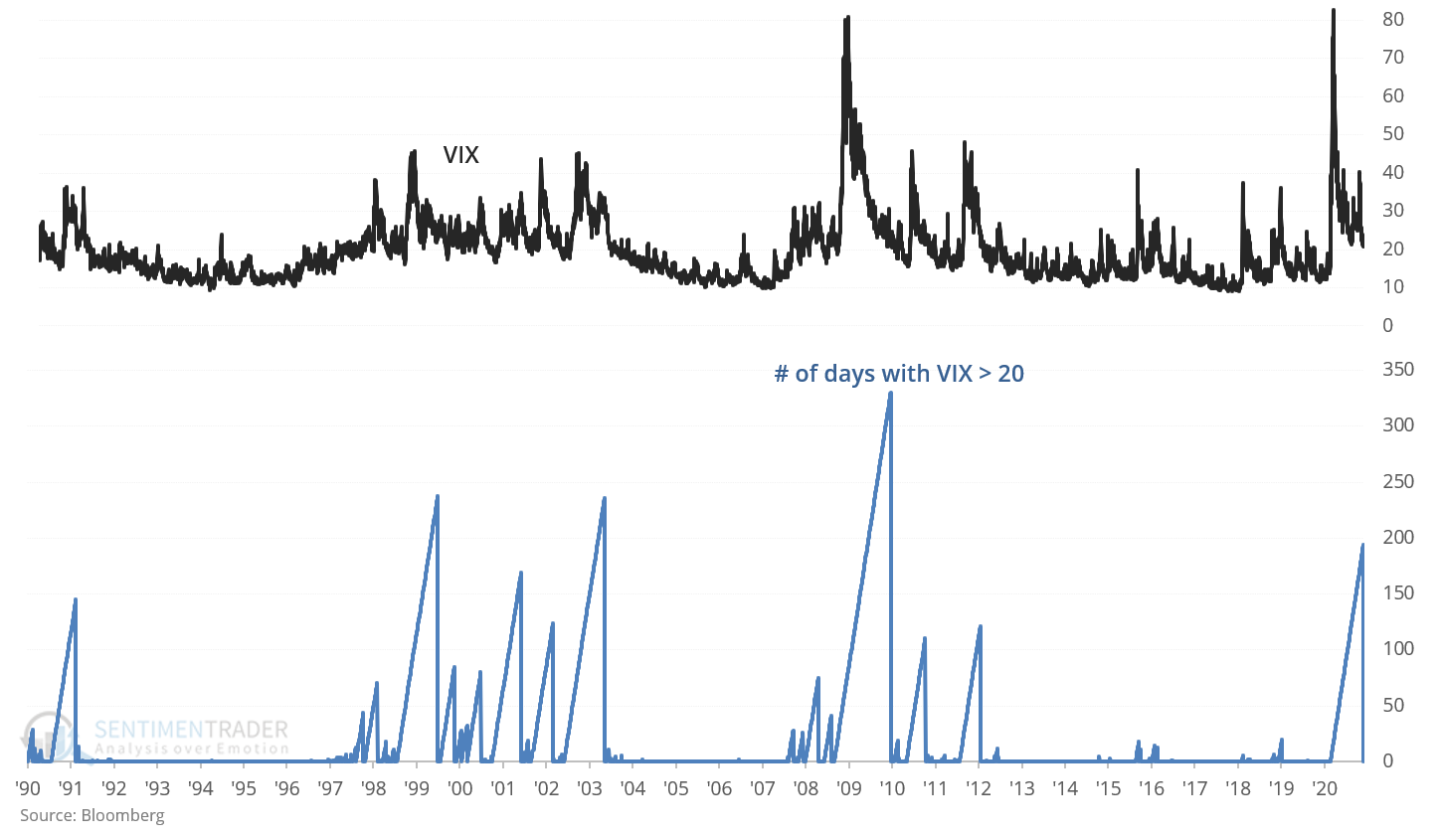

The VIX "fear gauge" hasn't done this since the end of the last bear market

Stocks and commodities continue to rally around the world despite a worsening pandemic. If the past 2 years has shown anything, it's that traders and investors will continuously charge from one extreme to another, pushing the boundaries of what was traditionally considered "extreme".

The stock market rally coincided with VIX dipping below 20 on the intraday for the first time since the pandemic began:

When this happened in the past, VIX's forward returns over the next month were mostly in line with average but the S&P 500 consistently saw a short-term pullback before rallying further in the months ahead.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Full returns in the VIX and S&P when volatility falls for the first time in a long while

- What happens when agriculture contracts become severely overbought

- The copper / gold ratio is getting stretched

| Stat Box The Russell 2000 of small-cap stocks is on track for its best month ever. Of the 16 times in its history when it has rallied 10% or more in a single month, it added to its gains over the next 6 months 15 times. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

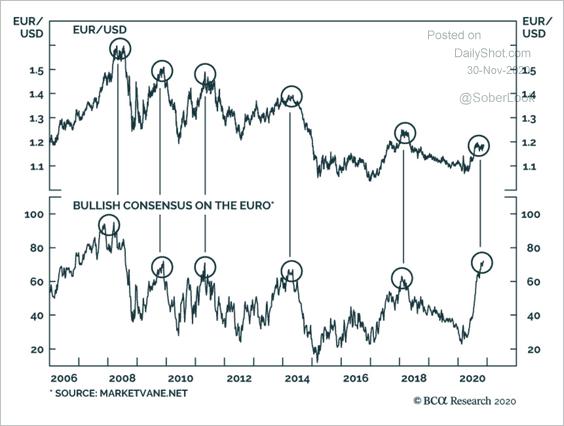

1. Futures traders have become quite enamored with the euro. A survey from Market Vane, Inc. shows a high percentage of them expect the euro to keep gaining. The Bullish Consensus® measures the futures market sentiment each day by following the trading recommendations of leading Commodity Trading Advisors. [BCA Research via Daily Shot]

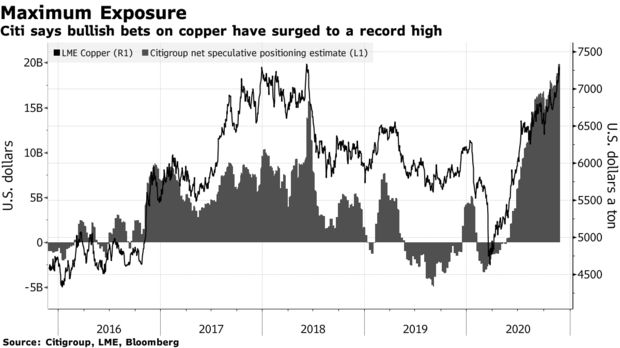

2. The rise in the euro = fall in the dollar, which has helped some commodities and metals like copper. Speculators seem to think that's going to keep going, with record bets on long copper futures. [Bloomberg]

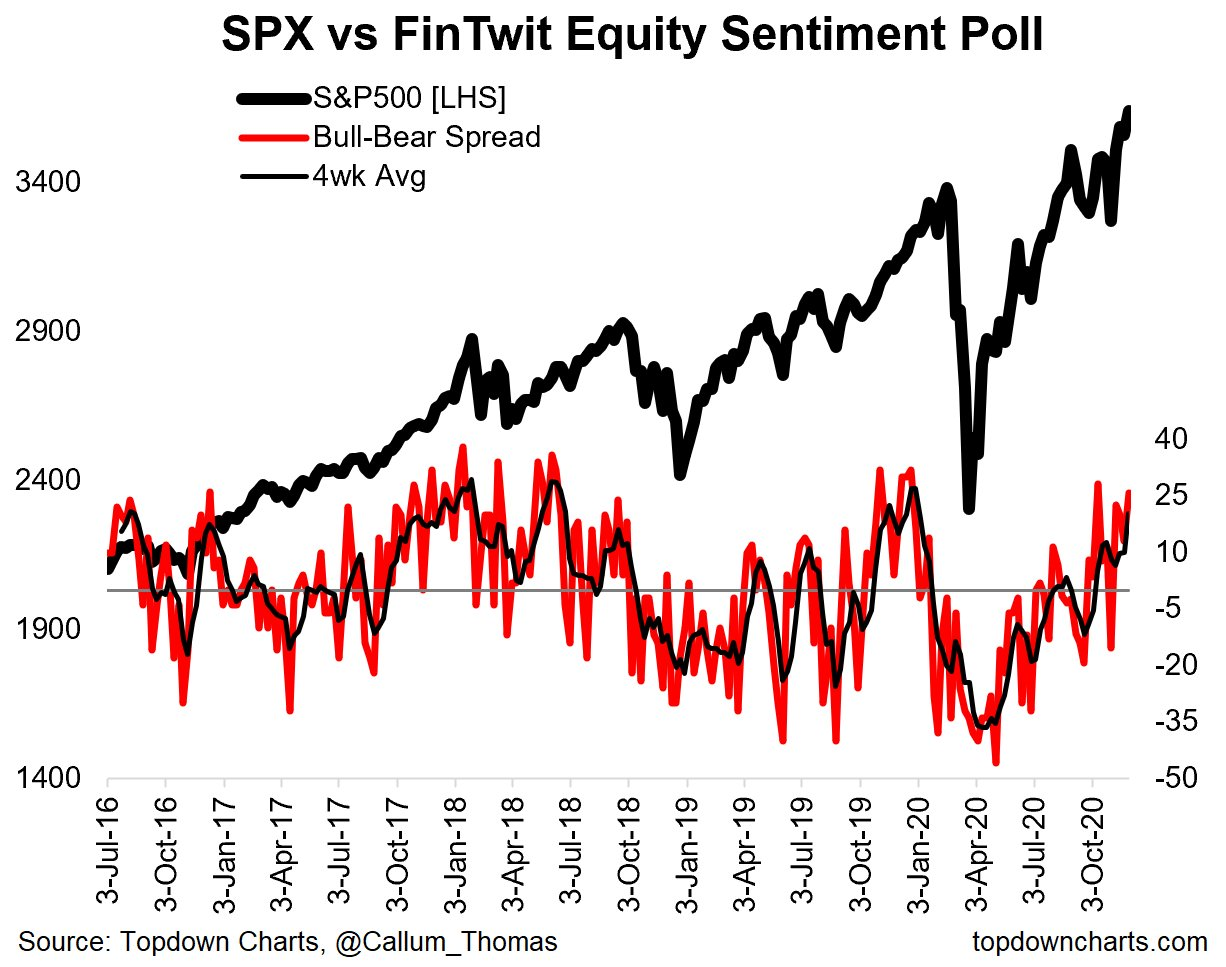

3. Twitter folks are pretty bulled up about stocks, too. The 4-week bull-bear spread is the widest since late '19. [Topdown Charts]