Transports Shrug Off Oil As Smart Money Bets On VIX

This is an abridged version of our Daily Report.

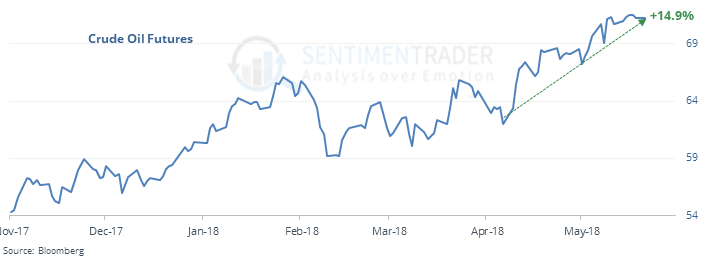

Transports shrug off oil’s rise

The Dow Transports have rallied strongly over the past 30 days even as oil jumped twice as much.

Transports have rallied enough to close at a multi-month high. When the sector has shrugged off surging oil prices before, it continued to rally shorter-term, less so longer-term.

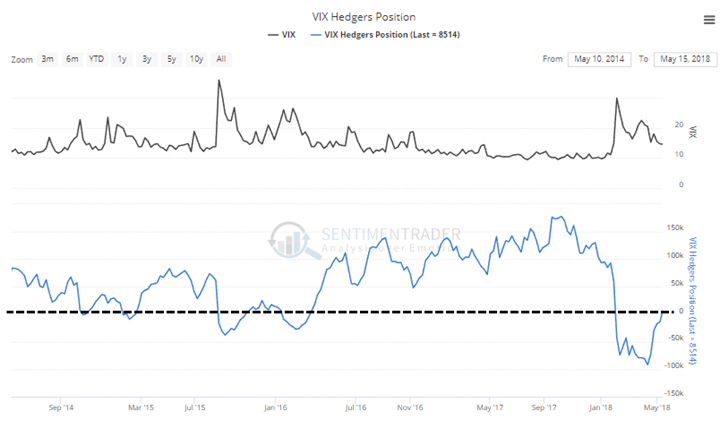

Smart money betting on the VIX

Hedgers in VIX futures are net long for the first time since January.

When they are long, the VIX tends to rise much more than when hedgers are short. While less effective, stocks also show a difference in forward returns when hedgers are long the VIX.

Memorial Day seasonality

Volatility tends to decline ahead of the holiday, with a tailwind for small-cap stocks, and there was usually some weakness in stocks the day after.

Running on fumes

Unleaded gas is now the most-loved commodity contract, taking the crown from lumber. Its Optimism Index climbed above 80 for one of the relatively few times in more than a decade.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |