Unfolding Momentum

This is an abridged version of our Daily Report.

Crash

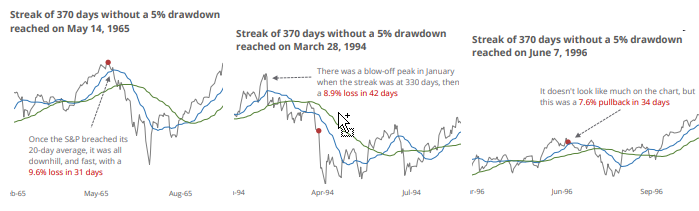

Monday’s trading – and post-close moves – are the types of action only seen a few times in history. Large, swift declines from a high have tended to lead to capitulatory moves that lead to rebounds in the medium-term. The possible liquidation of volatility products is a big wild card and will need to be watched closely. Based on other exceptional periods of momentum that we discussed in January, the current decline is about in line with the magnitude of declines that relieved pressure on buyers.

Pure fear

The “old” VIX that is priced based on S&P 100 instead of S&P 500 options saw its 2nd-largest jump in 32 years on Monday. Spikes of 50% or more have led to rallies in stocks over the next 1-6 months every time.

Big losses

The decline on Monday was not especially large, but in the context of just having been at an all-time high, they are dramatic. There have been a few times the S&P dropped 2% on consecutive days when being near a high, and about a dozen times when it dropped 6% within about a week of one. Those signals led to very positive risk/reward profiles over the medium-term, with the allowance of some short-term volatility, typically occurring almost immediately.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.