Utilities stocks have come back after a sudden surge

At various points this year, utilities stocks were market darlings, especially in January.

That shine has worn off. As the Wall Street Journal recently noted,

"That is because of concerns about falling power demand and the spike in unemployment following the lockdowns put in place to curb the outbreak, analysts said. Millions of people have lost their jobs in recent months, prompting concerns that they may stop paying their bills. As dozens of companies cut or suspended their dividends to preserve their cash piles, some investors wondered if the major utilities could be next."

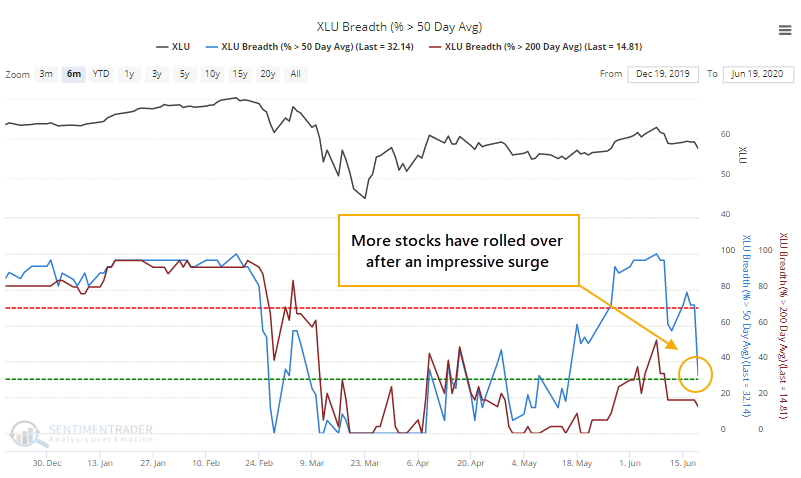

Over the past few sessions, more and more utilities have declined, and now less than a third of them are trading above their 50-day moving averages. This comes quickly on the heels of a surge when all of them had been above their averages. Like we saw last week, though, all of this is in the context of what so far has been an unhealthy market. Less than 60% of utilities were able to move above their long-term 200-day moving averages, even during the medium-term surge.

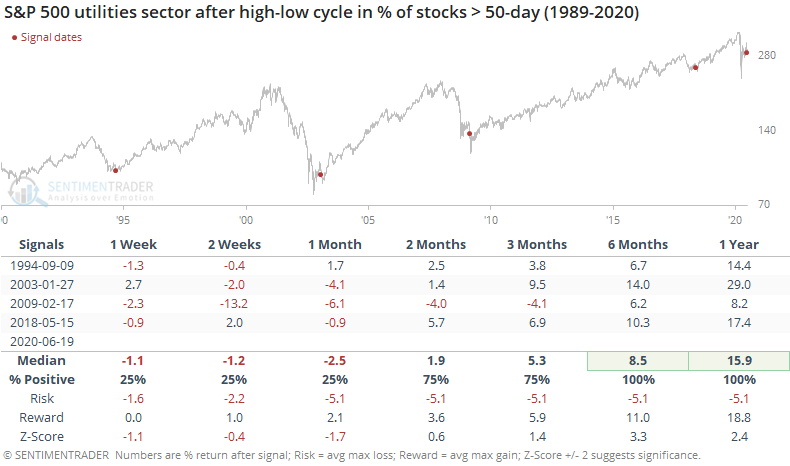

Below, we can see every time when more than 85% of these stocks traded above their 50-day average, then there was a selloff so that fewer than 35% of them were above that average. The entire time, no more than 60% of them traded above their 200-day averages.

All four prior occurrences triggered during times of upheaval for utilities, and short-term returns were volatile, with a downside bias. But they were all excellent longer-term opportunities, as the sector gained consistently over the next 6-12 months.

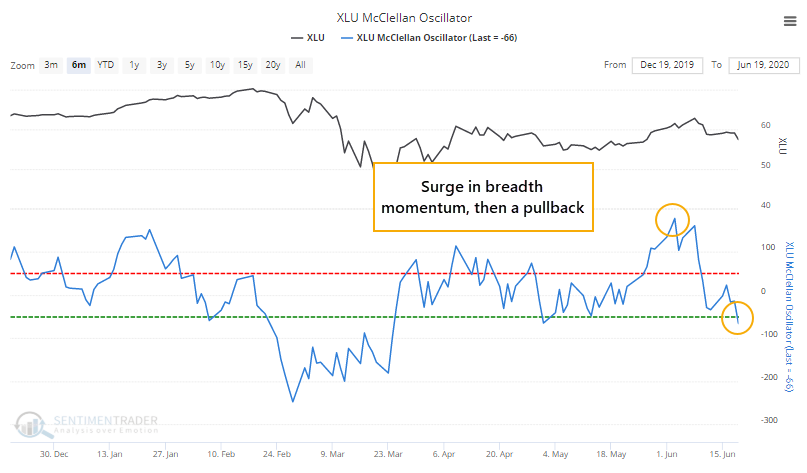

There has been a similar reflection of this surge-then-pause when looking at the sector's McClellan Oscillator, an indication of the momentum in underlying breadth. It recently jumped above +150, the highest since 2013, and on Friday declined enough to become oversold.

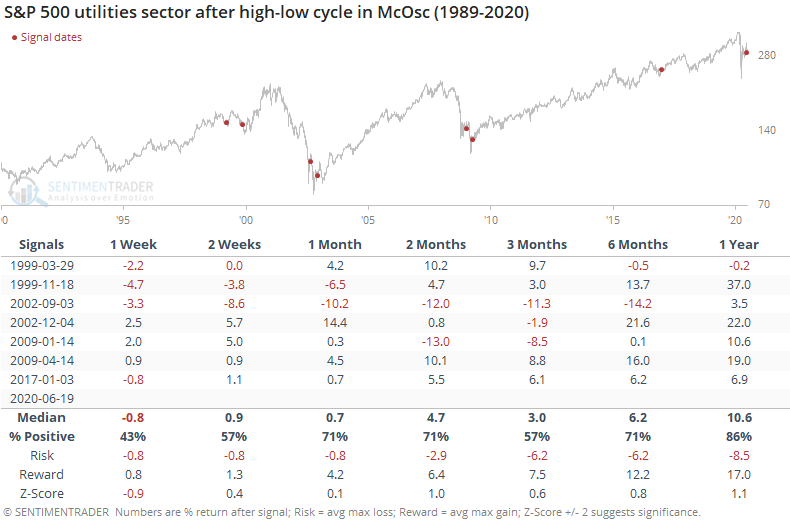

Like we saw above, when there has been a surge-then-pause, all within an "unhealthy" market where less than 60% of the stocks can move above their 200-day averages, it has preceded some rocky short-term returns, but positive longer-term ones.

This kind of activity hasn't been enjoyable for investors in the short-term, with highly volatile swings in utilities. For those that held out, though, the sector tended to recover strongly.