Very strong short term uptrend

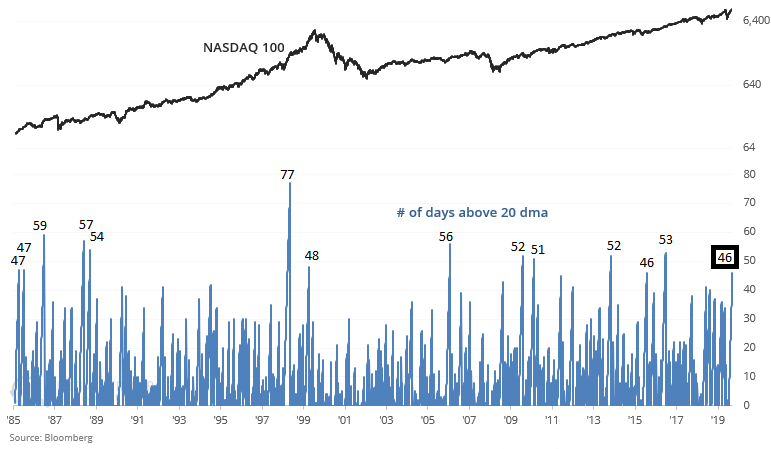

Tech stocks have been on a spectacular run recently, with the NASDAQ 100 and NASDAQ Composite making new all-time highs before other indices have. It's been 46 days without the NASDAQ 100 falling below its 20 dma (short term moving average), one of the longest streaks over the past 35 years:

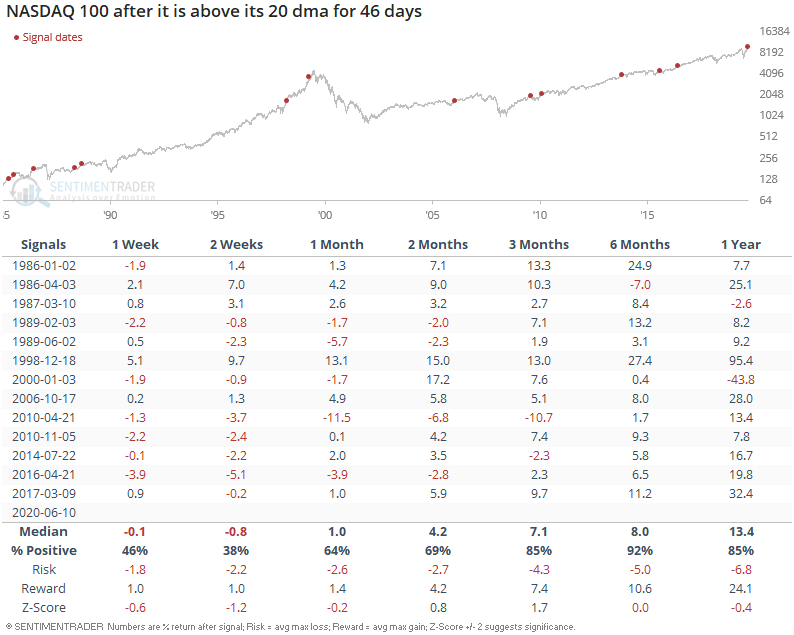

The streak can keep going, but history has not been kind to stocks when everyone fell in love with tech stocks. Perhaps it's time to get ready for a regime change.

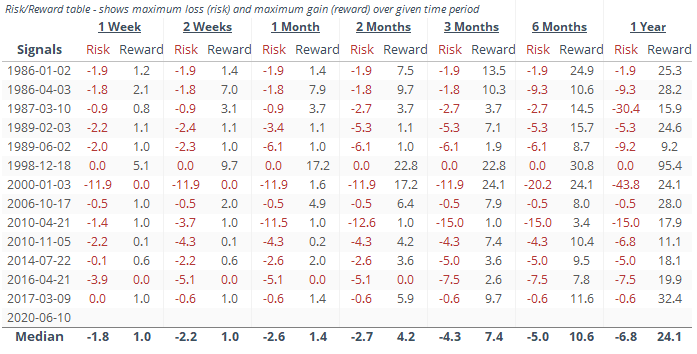

The NASDAQ 100 had a strong tendency to fall over the next 2 weeks, particularly over the past 10 years.

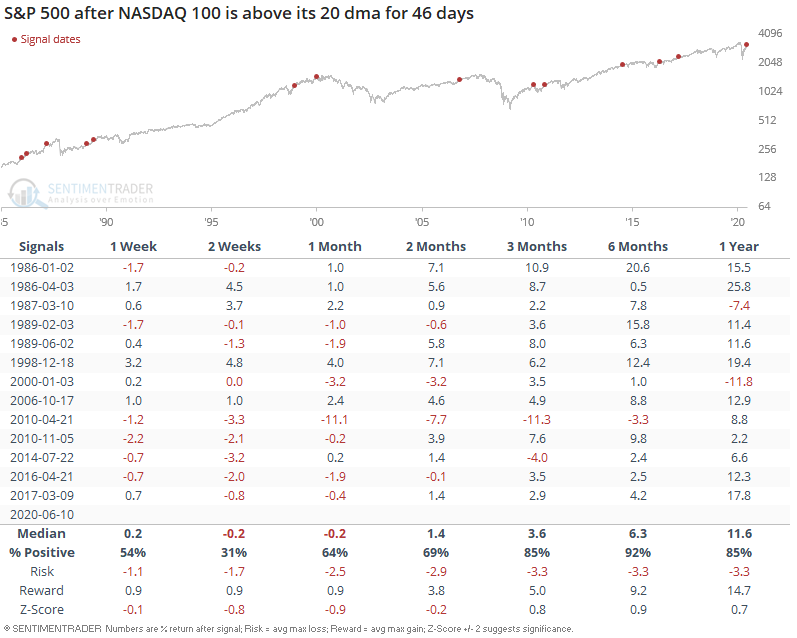

Since this wasn't good for tech stocks, and tech has driven much of the market's gain from 2009-present, this wasn't good for the S&P 500 either over the next 2 weeks:

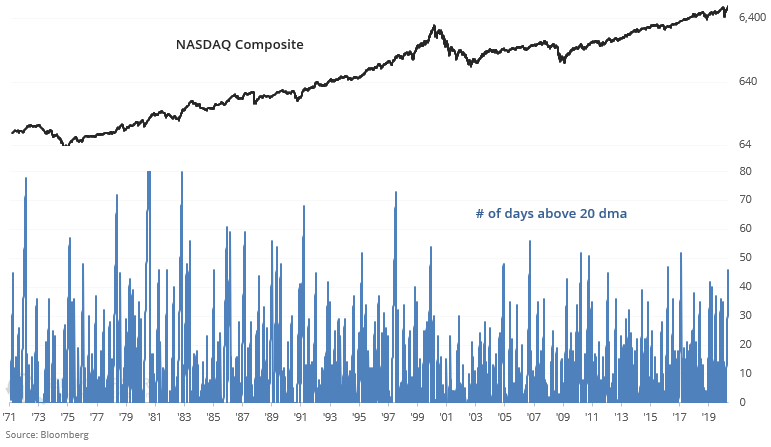

Similar to the NASDAQ 100, the NASDAQ Composite has gone 46 days without closing below its 20 dma:

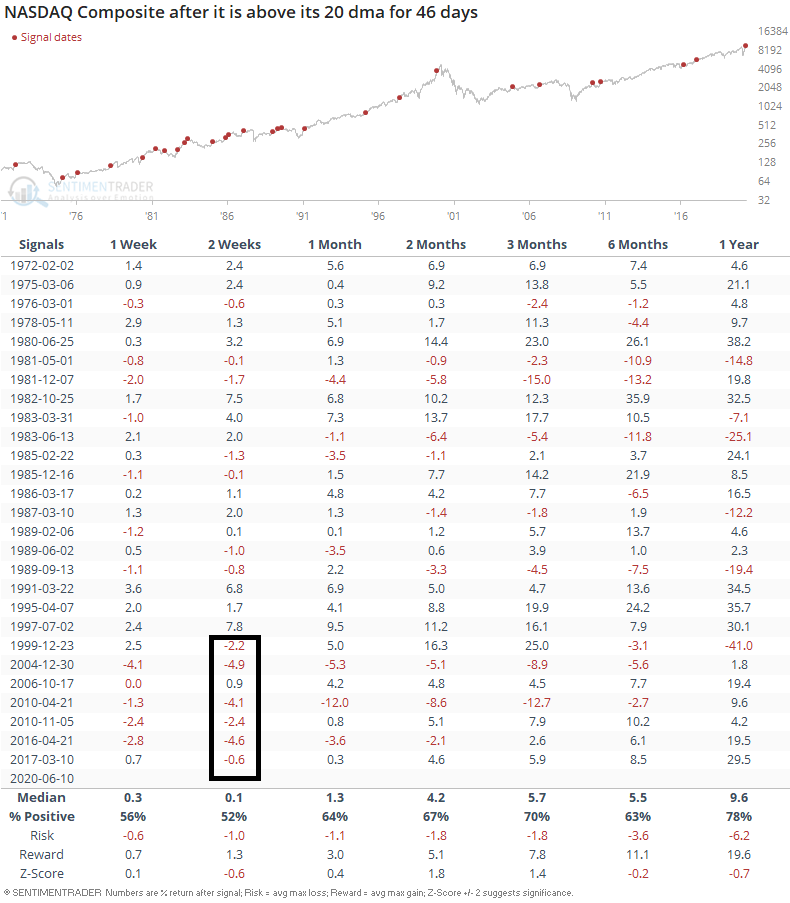

Such long streaks of undisturbed uptrends were somewhat bearish for the NASDAQ Composite over the next 2 weeks. This has been particularly true over the past 2 decades:

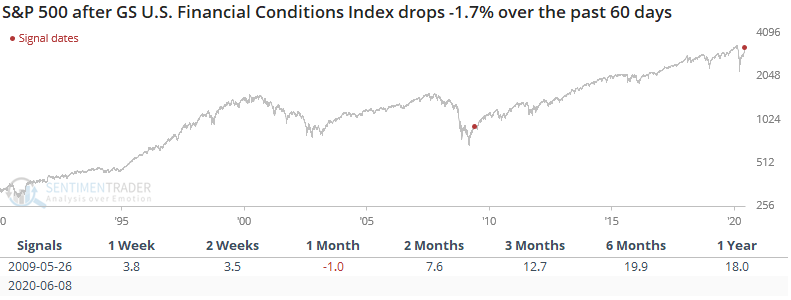

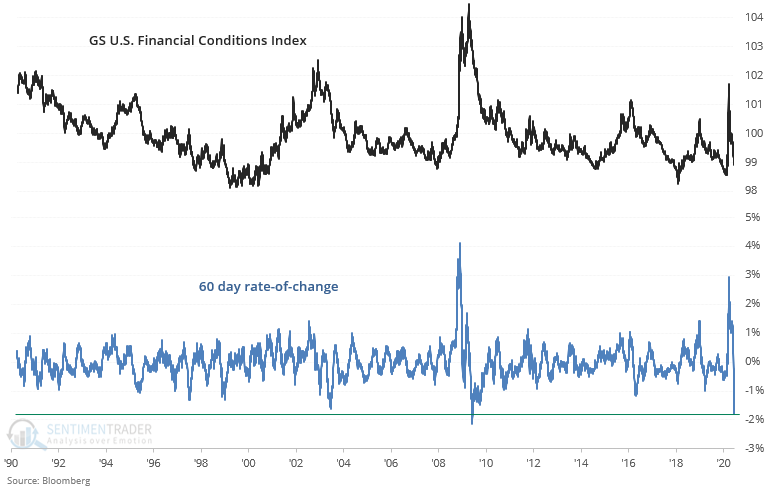

On a longer term time frame, these stats point to more gains for stocks in the coming year. The Goldman Sachs U.S. Financial Conditions Index demonstrates that financial conditions eased dramatically over the past 60 days:

The only other comparable case was in May 2009. Stocks made a short term pullback before pushing higher over the next 6-9 months: