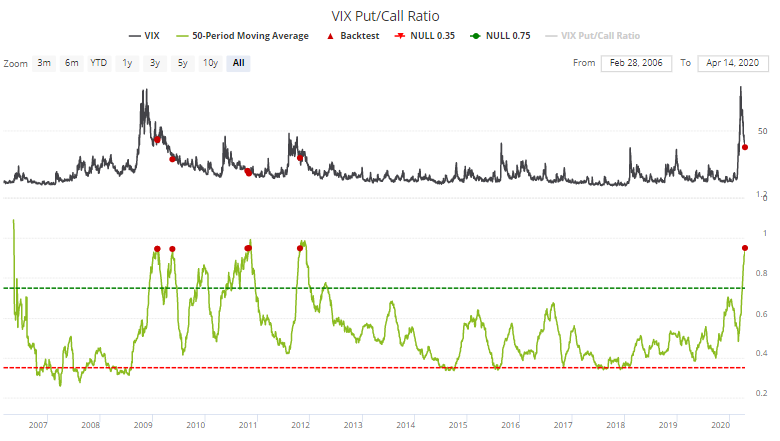

VIX Put/Call is extremely high

The VIX Put/Call ratio remains consistently high, which implies that traders are still betting on a lower VIX. Its 50 day average has now exceeded 0.95

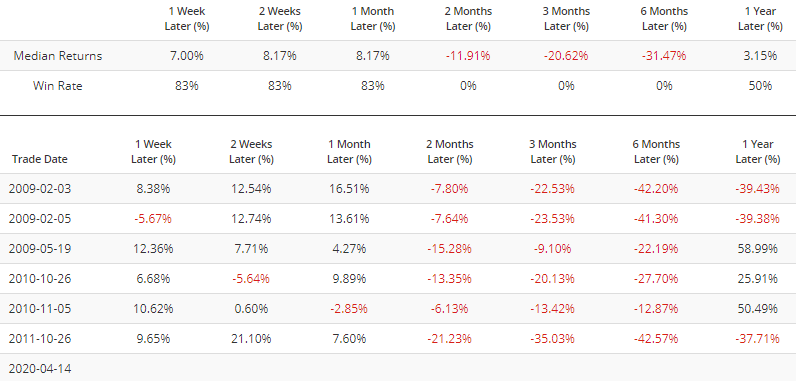

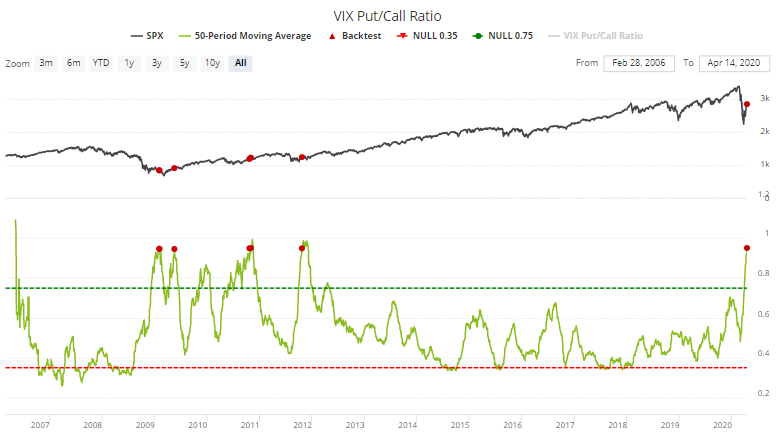

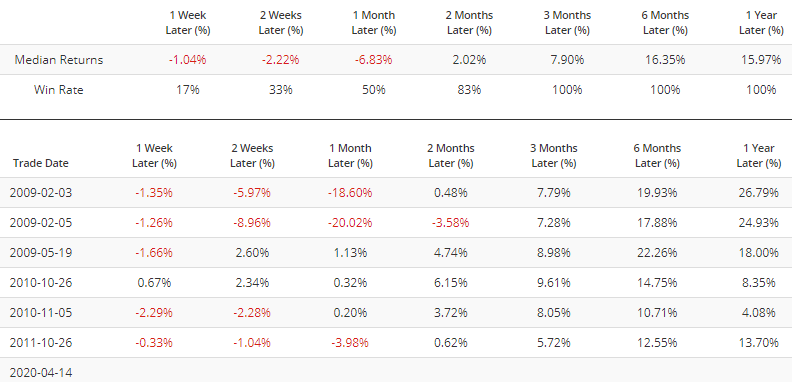

This has only happened a few other times in market history, all of which occurred around market crashes and led to further gains for the S&P 500 over the next 3+ months. As you can see in the market above, this occurred near the last bear market, the 2010 market crash, and 2011 market crash:

Since the S&P 500 and VIX usually move in opposite directions, this usually led to a decline in VIX over the next 2+ months: