Volatility flip

It's a volatile market, and not just in the typical ways.

Traders usually price in bigger moves in higher-beta stocks, because by their very nature they move up and down more than the broader market. But an interesting thing has been happening over the past few weeks. As noted by the Wall Street Journal, options traders are pricing in smaller moves in the tech-laden Nasdaq 100 (NDX) than for the S&P 500 (SPX).

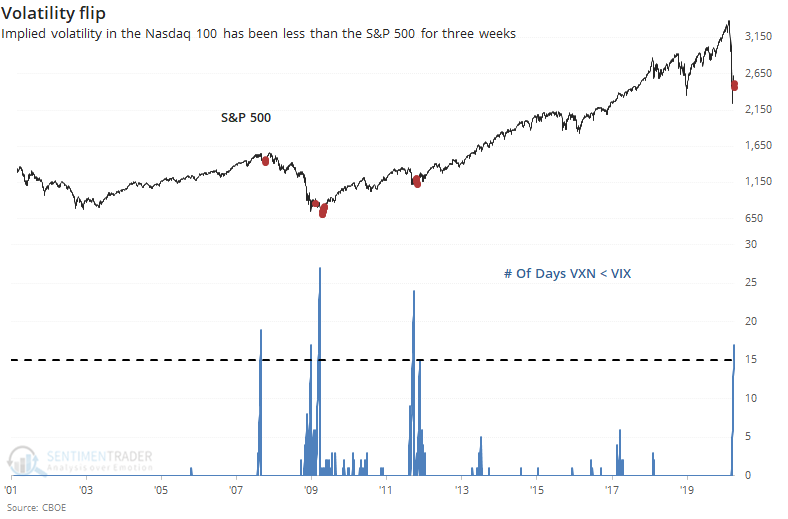

Volatility in the NDX has historically been higher than the SPX, both because there are fewer stocks in the index and the big tech firms that make up the NDX just tend to move around a lot more due to the nature of their businesses. But because some of these firms have benefited from the stay-at-home orders, tech stocks have held up relatively well, and traders have been pricing in smaller moves.

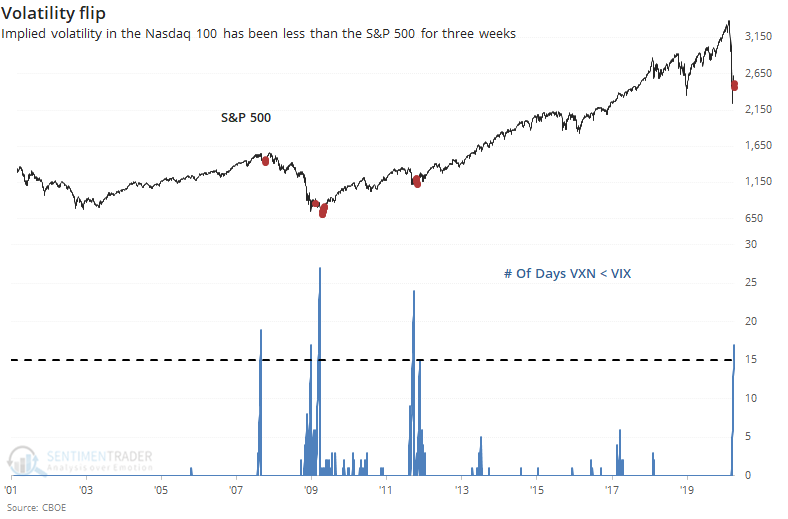

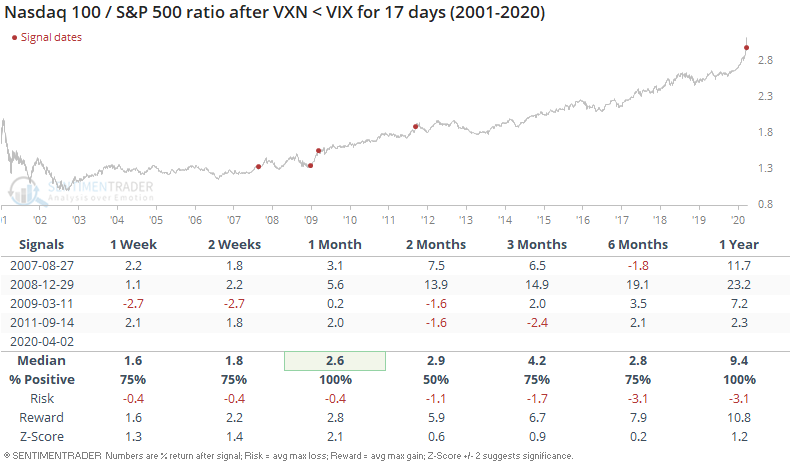

As a result, implied volatility for the Nasdaq 100, the VXN, has been below that for the S&P 500, the VIX, for the past 3 weeks. This is highly unusual.

The spread between them is at a record.

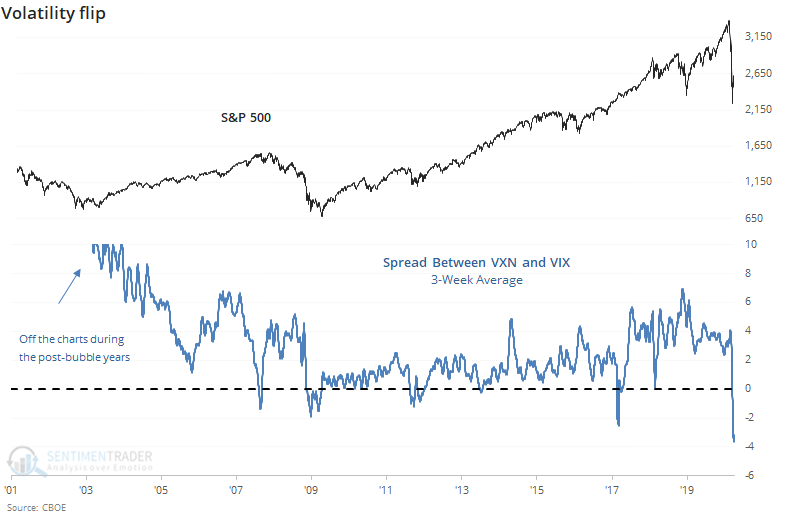

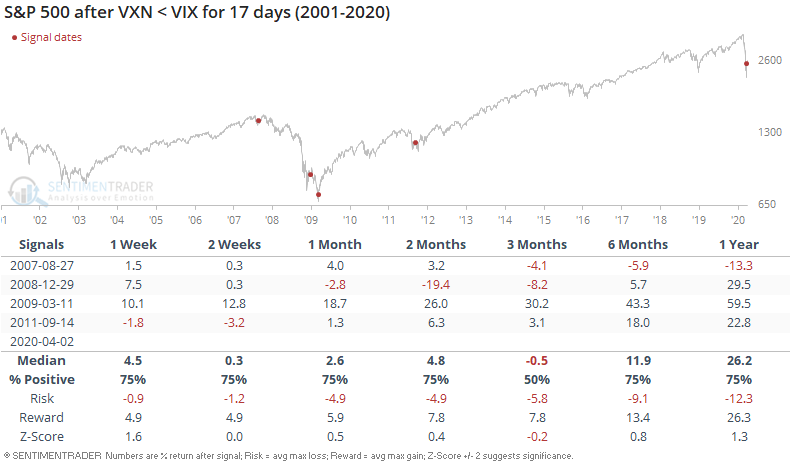

By the time the spread between the two implied volatility gauges had been negative for this many days, the S&P rebounded quickly three times (then failed twice) and sold off quickly once then rallied strongly.

The Nasdaq 100 fared better.

Even though the ratio of the Nasdaq 100 to S&P 500 has gone parabolic, these implied volatility flips tended to lead to even more out-performance in the NDX vs SPX.

This should be a good sign for stocks in general, and tech in particular.