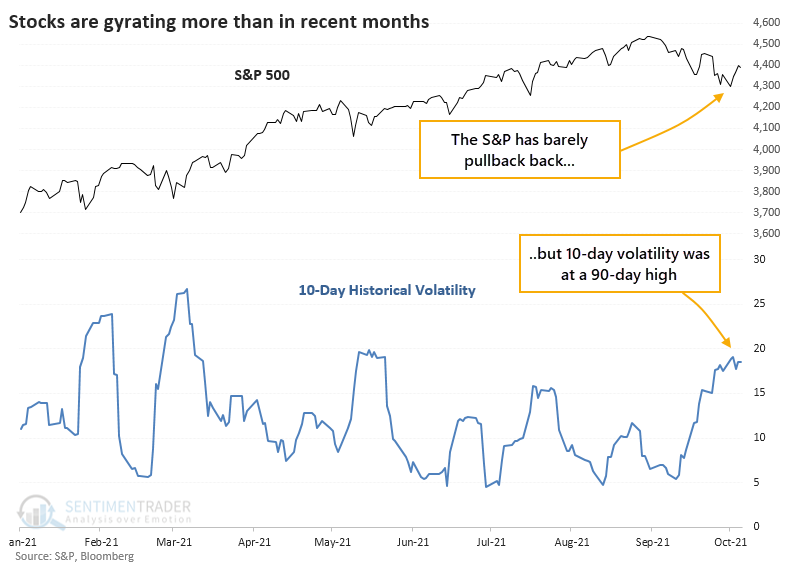

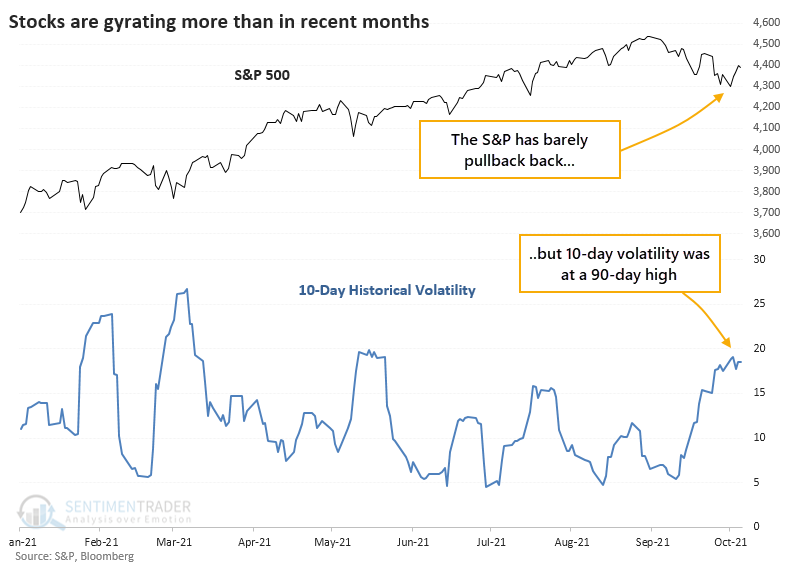

Volatility Spikes as Stocks Gyrate Near Highs

For those who were indoctrinated on technical analysis textbooks, we were taught that when stocks turn volatile during a bull market, then trouble is brewing.

Unfortunately, much of what passes for knowledge in that community is based on pretty pictures, unfounded heuristics, and cherry-picked examples. Almost nothing in the entire canon is consistently predictive.

The idea that it's bearish to see volatility after stocks make a big run is yet another one of those incorrect assumptions.

It's an issue now because the S&P 500 is mired in its longest pullback in a year. Despite a relatively shallow pullback, though, the index has been gyrating wildly, with over a week of days with 1% daily moves. That has pushed the index's 10-day realized volatility to a 90-day high.

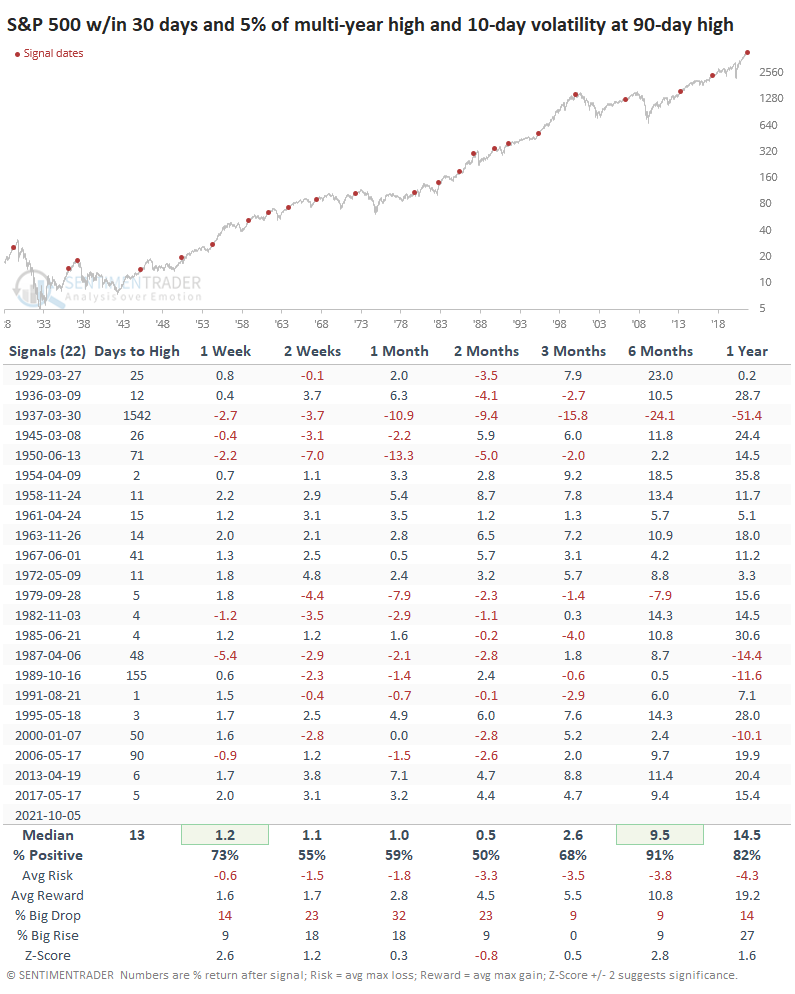

Instead of reading tea leaves, let's look at the evidence. The table below shows every time when the S&P was within 30 days of a multi-year high, no more than 5% from its peak, and yet its 10-day volatility rose to a 90-day high.

To be fair, the S&P's returns over the next two months were nothing special. It showed a positive return only half the time, with a median return well below random. But that was about it for the bearish side of things.

Over the next six months, the index rose after 20 out of 22 signals. More specifically, only one of the signals preceded an imminent bear market, which is what this heightened volatility was supposed to tip us off to. Granted, several of the other signals ultimately led to a protracted decline, but they were months if not years away.

On average, it took 13 trading days until the S&P recorded its next multi-year high. Out of the 22 signals, only 2 of them took longer than 90 days and 15 of them took fewer than 30 days.

As we head into earnings season, the uptick in volatility may be the tipping point before we finally suffer through an honest-to-goodness correction. We try hard to deal in probabilities instead of possibilities, though, and based solely on the rise in volatility, it's not a good reason in and of itself to batten the hatches just yet.