Wall Street Sentiment As Few Fidelity Funds Beat Cash

This is an abridged version of our Daily Report.

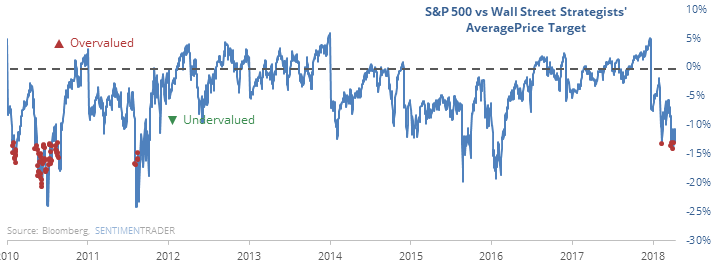

An undervalued market

Stocks are undervalued, at least according to Wall Street strategists. They expect the S&P 500 to end the year more than 10% above where it is, enough to suggest they think the index is undervalued.

When they’ve been so adamant about a higher market since 1999, it has usually accommodated. At the same time, Wall Street analysts have been busy lowering price estimates on the stocks they cover, with a net 150 downgrades during the past week, one of the highest amounts in 7 years.

Cash beats (almost) all

There have been few Fidelity Select sector mutual funds that have beat the return on cash lately. Fewer than 10% of them have had a better return, an abnormally low number, especially in a bull market. According to the Backtest Engine, that has led to a positive 6-month return after 433 of 462 days.

Energy breaks out

The energy sector finally broke out of a long trading range. The width between its Bollinger Bands (a measure of price volatility) has been suppressed but on Tuesday the sector broke well above its upper Band. The S&P 500 Energy sector has done this 24 other times since 1990.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.