Warnings spike as complacency ends

Warnings spike

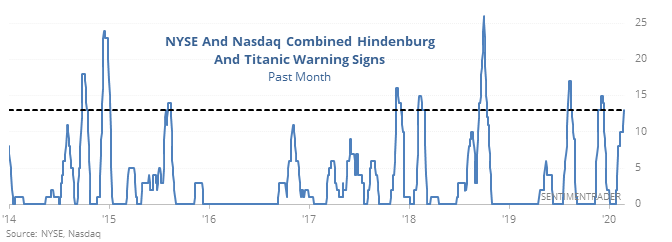

Monday’s selling pressure was enough to push many stocks to 52-week lows. Coming within a week of a day when 52-week highs dominated, this triggered another set of warnings.

If you can get past the silly names, and focus on what they’re saying, it’s worth noting since they’re designed to highlight periods when there is heavy turmoil underlying the mask of the indexes. While the origin of the signals include data-mining, they've been "in the wild" for decades and have been just as effective.

That doesn't mean they're perfect - they failed to precede any weakness in early 2017 and late 2019. But they have a long history of preceding dangerous market conditions, with poor risk relative to reward up to 6 months later.

Tech's relief

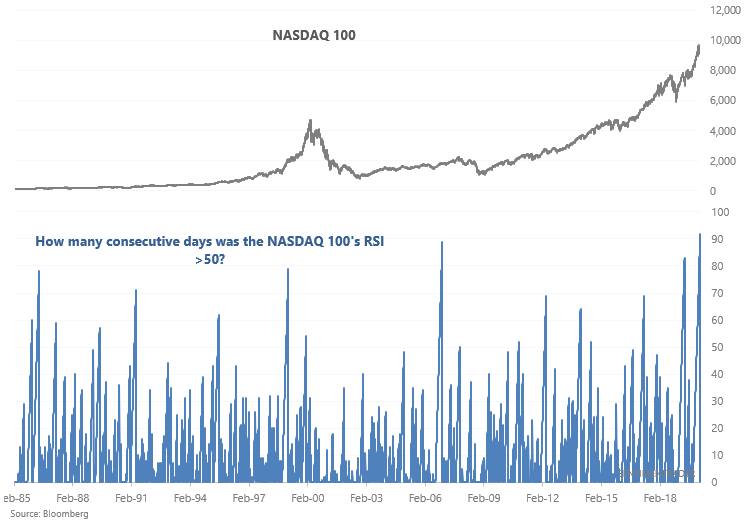

Tech - a more volatile sector than the broader stock market - has ended its uptrend, at least by one definition.

Some traders use the market's RSI and whether the RSI is above or below 50 to determine trend. The NASDAQ 100's RSI is no longer above 50 after the longest streak ever above 50:

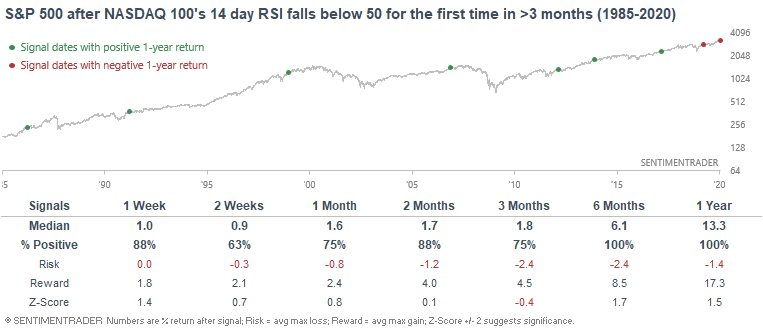

When similar streaks of bullish momentum ended, the NASDAQ 100 usually chopped sideways or fell over the next 3 months. But after that, strong momentum usually beget more gains, and it was especially positive for the broader market, defined by the S&P 500.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- What happens after the largest 1-day changes in the VIX

- The VIX Term Structure has inverted

- The NYSE ended a streak of 6 months without a 90% down volume day

- The S&P ended a streak of more than 90 days above its 50-day average

- Small traders have continued to buy speculative call options

- Last week saw a big spike in buying climaxes

- S&P 500 stocks have seen a big jump in sell signals

- The gold/silver ratio is spiking