Wednesday Midday Color - Tech Breakout & Breadth, Screens

Here's what's piquing my interest so far on yet another potential reversal day.

Breakout

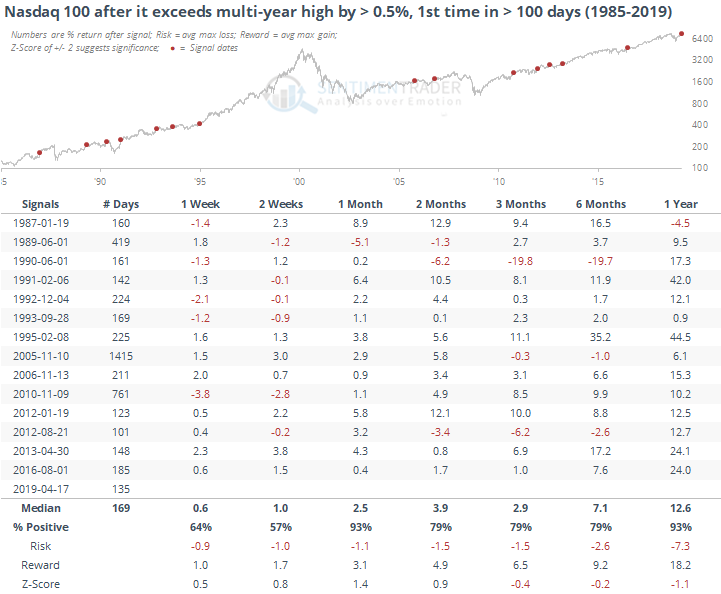

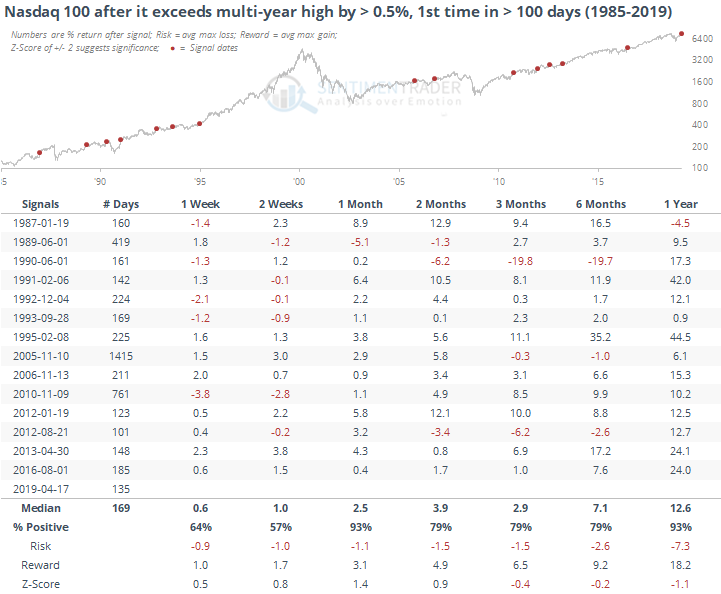

Even if the rally in tech fades, on an intraday basis the Nasdaq 100 has bested its prior multi-year high by at least 0.5%. The most bullish aspects about this market aren't fundamental, and they're certainly not sentiment-related, but price action has been pristine and it's been hard to find that kind of action.

It's been good for the S&P 500 as well. Which is somewhere between hard and impossible to fully reconcile with the strong negatives we're currently seeing from past reactions to extremely optimistic sentiment.

Breadth Review

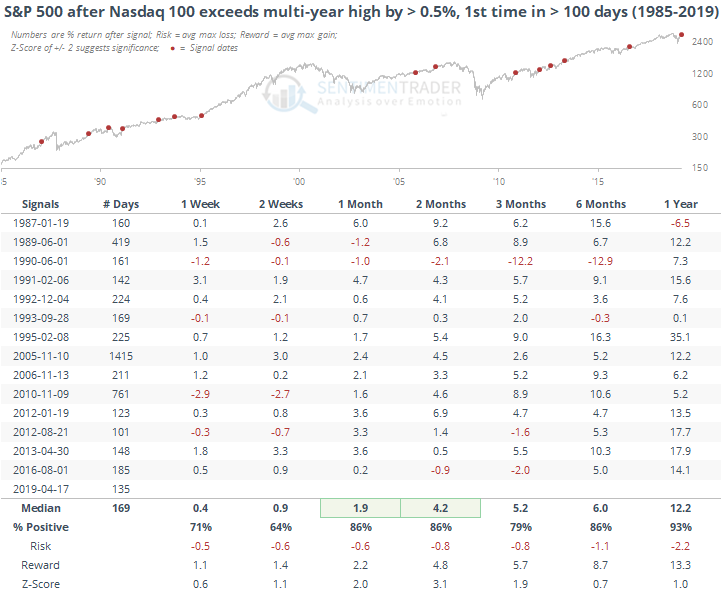

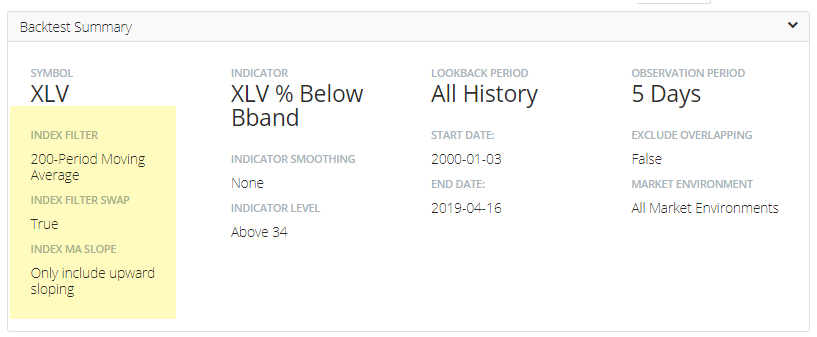

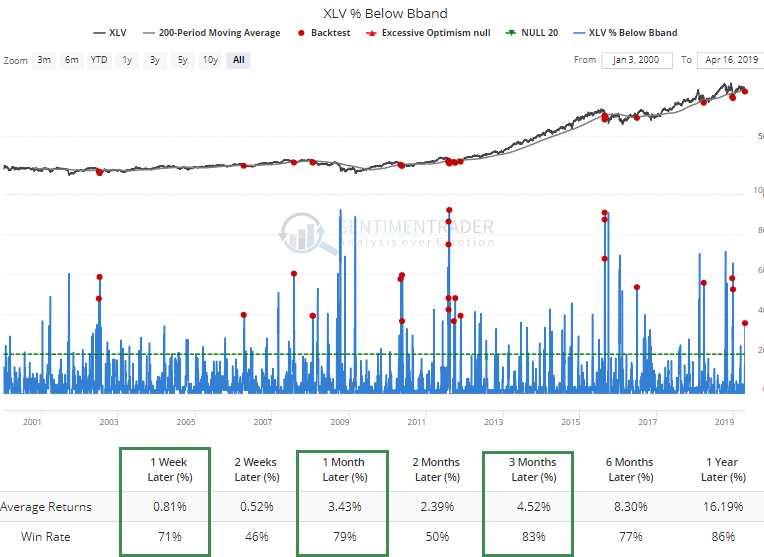

One of the unique things with the Backtest Engine is that it allows a user to look at different market contexts, which can have a big impact on what an indicator is suggesting. Take health care, for example.

More than a third of the component stocks in the index dropped enough on Tuesday that they fell below their lower Bollinger Bands. But the XLV fund is still in a general uptrend, defined by its 200-day average rising, even though prices fell through that rising average this week.

When so many of the stocks have closed below their Bands while XLV is below its rising average, it has tended to rebound.

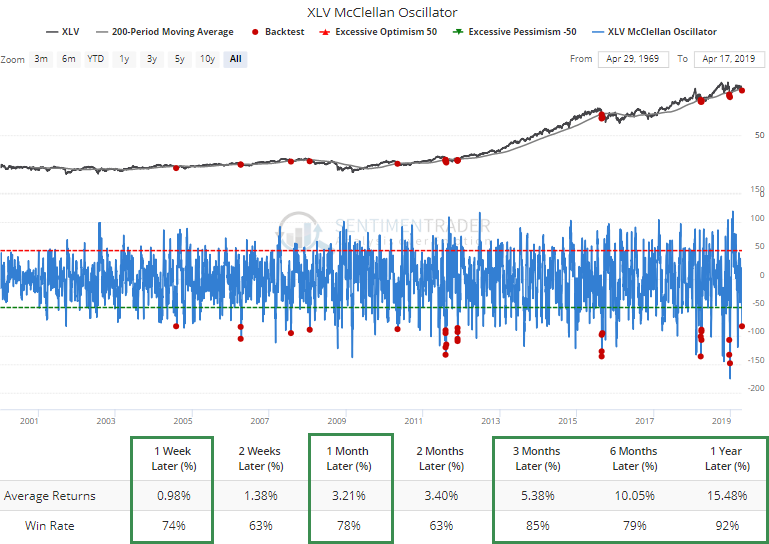

The same thing is being suggested by how far the McClellan Oscillator has declined.

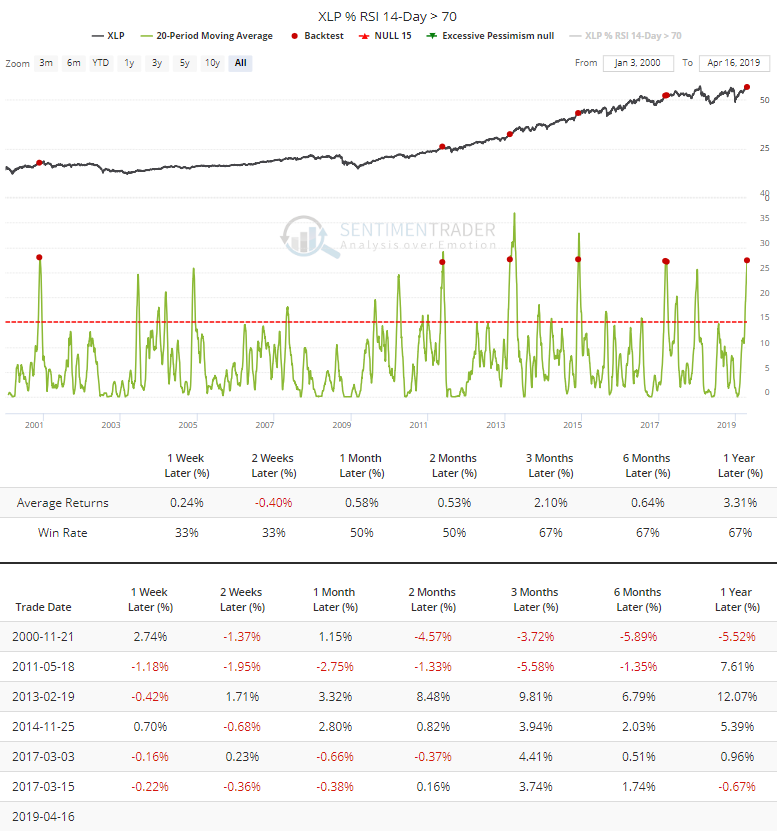

Among consumer staples stocks, 27% of them have been overbought on an average day over the past month. That's among the most persistently high readings in almost 20 years. Other times the sector put in this kind of performance, it struggled to maintain the momentum.

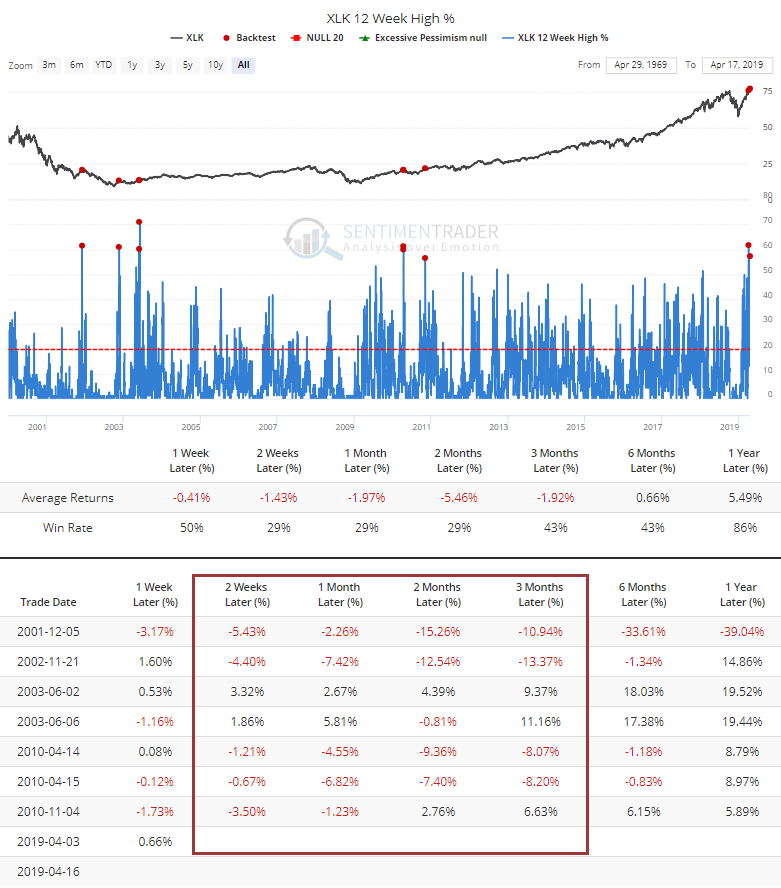

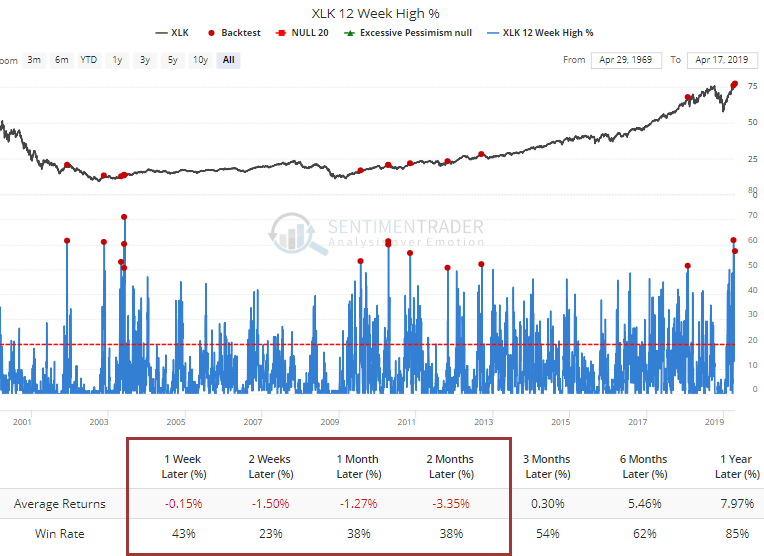

More than 55% of tech stocks hit a multi-month high on Tuesday. That hasn't happened very often.

Even when "only" 50% of them hit a new multi-month high together, funds like XLK have struggled to hold up.

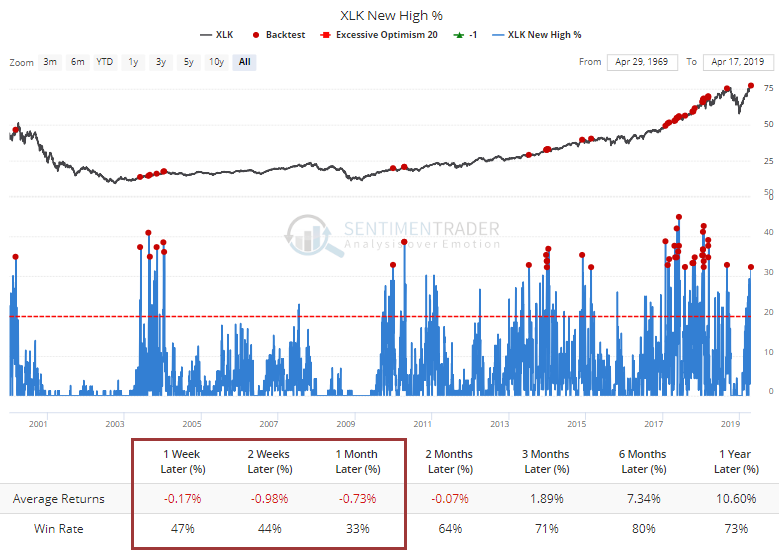

It's not just multi-month highs. Almost a third of tech stocks have reached new 52-week highs. Again, it's been tough to maintain that kind of wholesale momentum.

Screens

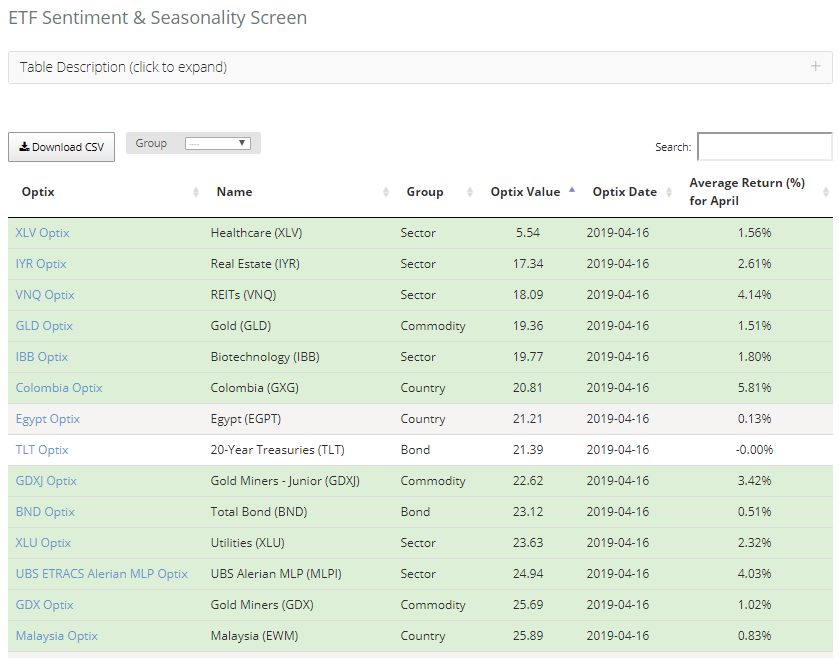

It's interesting to note that a lot of the funds that are showing up in green (excessive pessimism) in the Sentiment & Seasonality screen...

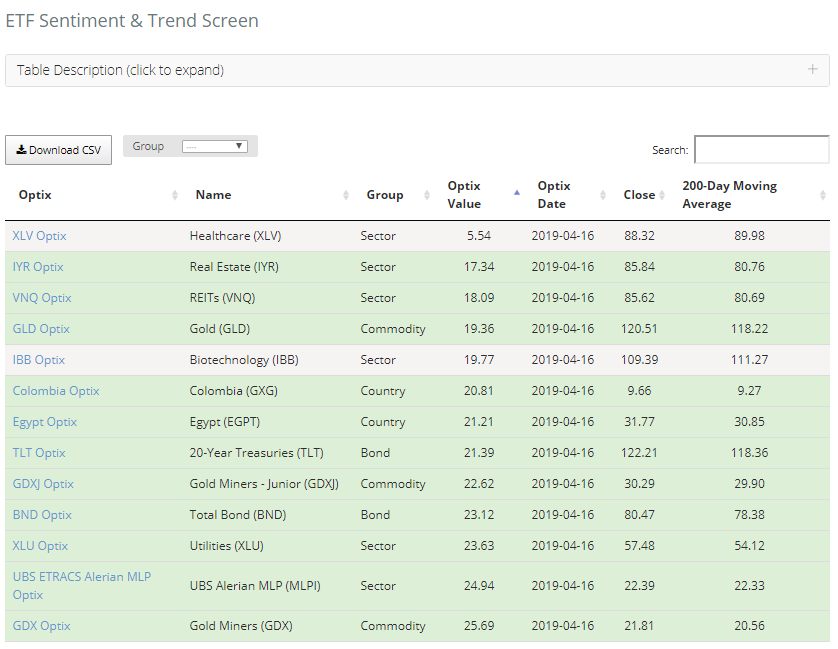

...are also showing up in the Sentiment & Trend screen.

The former highlights funds with an Optimism Index below 30 but with better-than-average seasonal returns in April, while the latter highlights those with low optimism while the fund is still trading above its 200-day average.