What I'm looking at - utilities, sector breadth, Hang Seng, copper's plunge

Here's what I'm looking at:

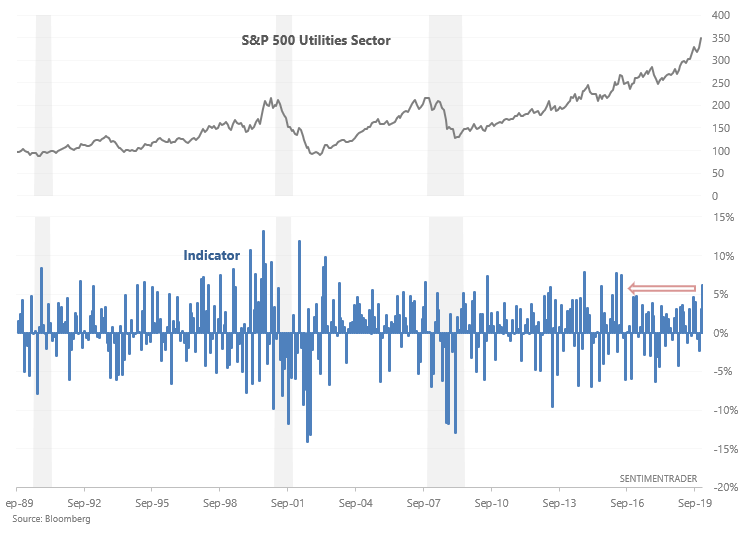

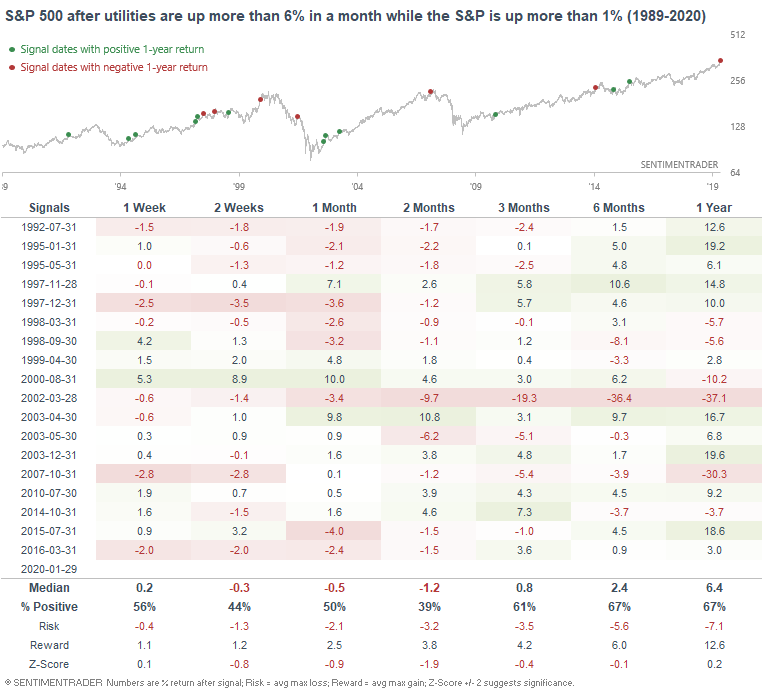

Big month for utilities

As the WSJ noted, utilities have rallied significantly this month as the broad U.S. stock market's rally stalled. While the S&P 500 is up just 1.3%, the S&P 500 Utilities Sector has rallied more than 6%:

When the utilities sector rallied this much in a month while the S&P also went up (albeit much less), utilities often suffered over the next 2 months:

Sector breadth

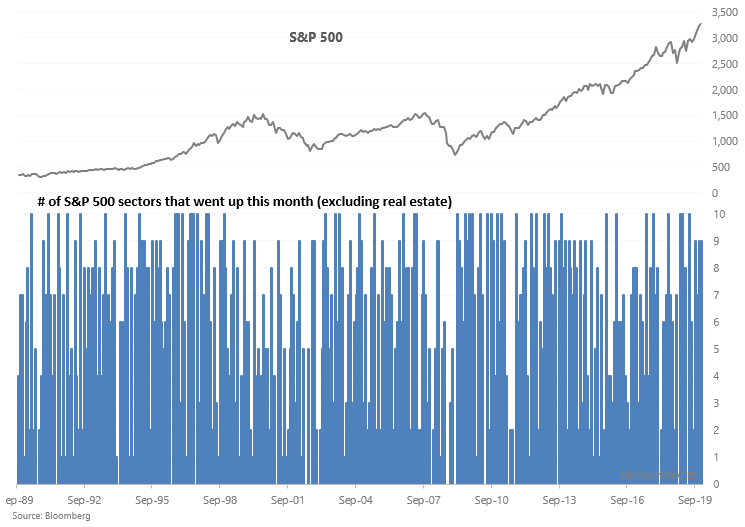

While the S&P 500 rallied strongly from September-December 2019, at least 7 of the S&P 500's 10 sectors (excluding real estate) went up each month. In other words, most sectors were participating in the market's rally.

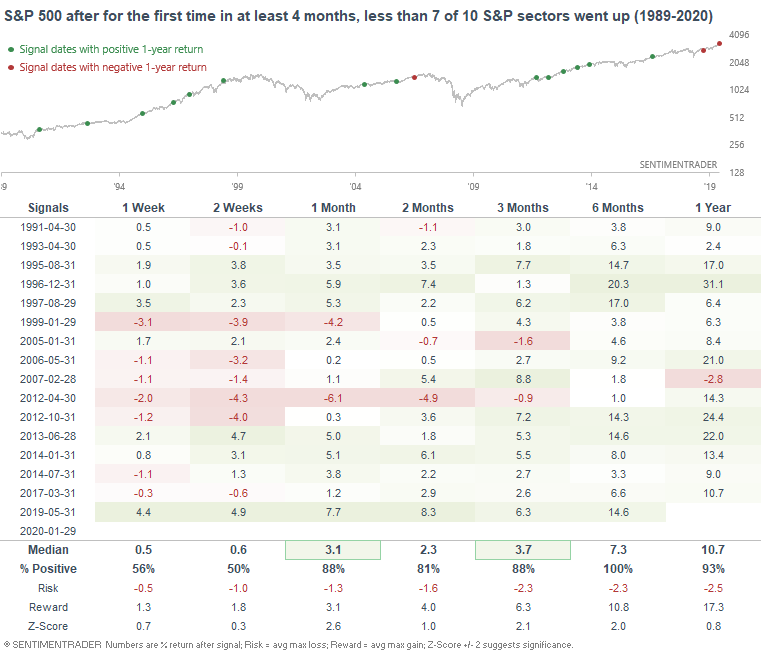

But now that the U.S. stock market's rally has stalled in January, only 5 of these 10 sectors went up this month. When streaks of strong sector breadth ended in the past, the S&P's returns over the next 6 months were consistently bullish. This is another example of a bullish momentum study:

Hong Kong

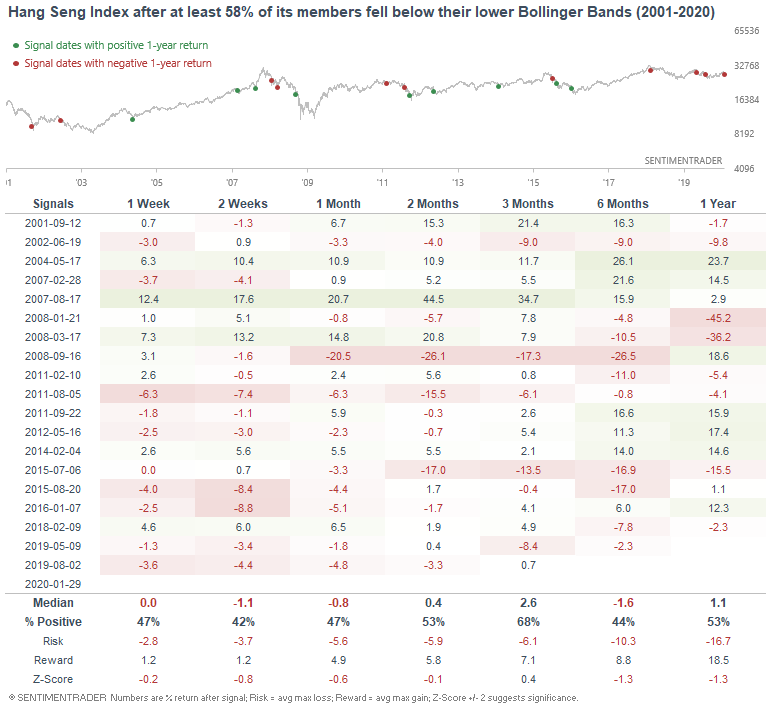

As Hong Kong stocks drop after the Chinese New Year holiday, 58% of the Hang Seng Index's members are now below their lower Bollinger Bands:

When a large number of stocks suddenly plunged in the past, the Hang Seng Index's returns over the next few weeks were worse than random:

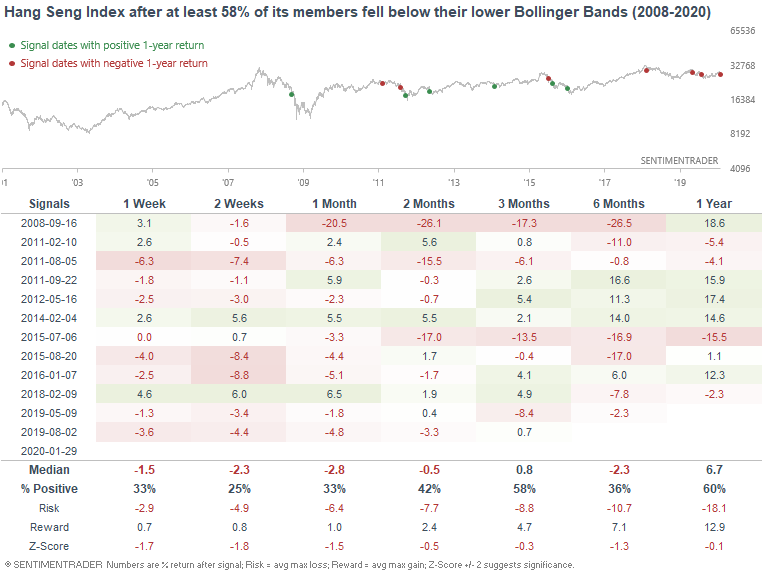

This has been particularly true from 2008-present:

Here are the Hang Seng Index's max drawdowns:

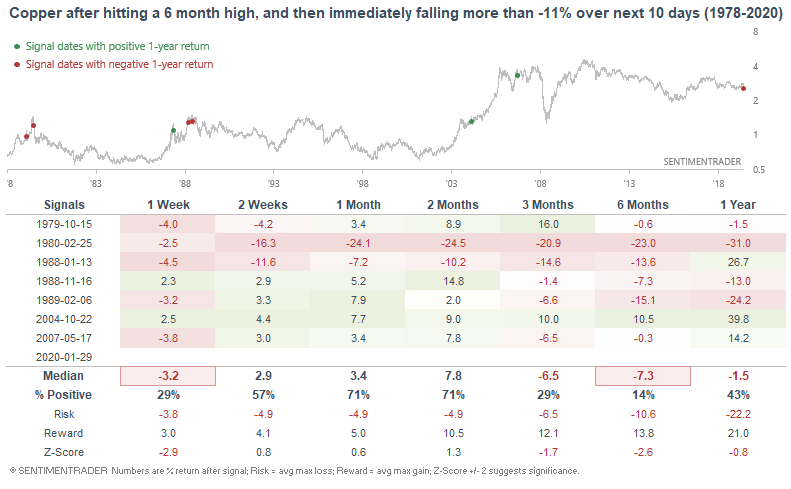

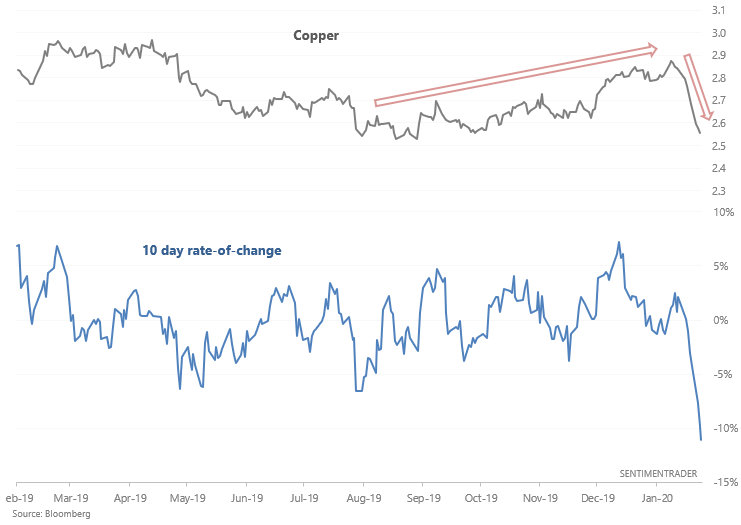

Copper

And lastly, copper continues to fall on increasing coronavirus fears. Copper's 10 day rate-of-change is now -11%. While there were 39 such historical cases, most of them occurred after copper had been sliding for a while (examples of last minute panic selling). Only 7 historical cases occurred after copper hit a 6 month high.

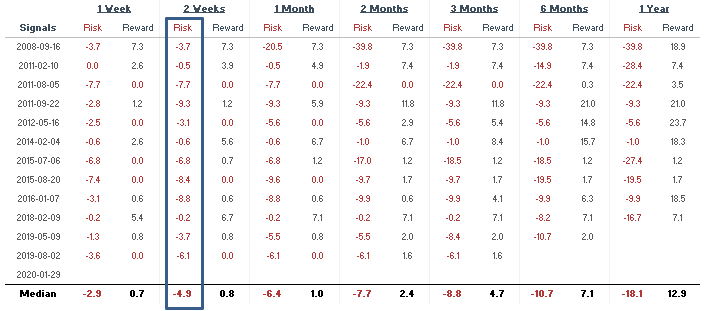

When copper tanked immediately after rising to a 6 month high, its returns over the next week and 6 months were decidedly bearish: