What rising rates mean for market breadth

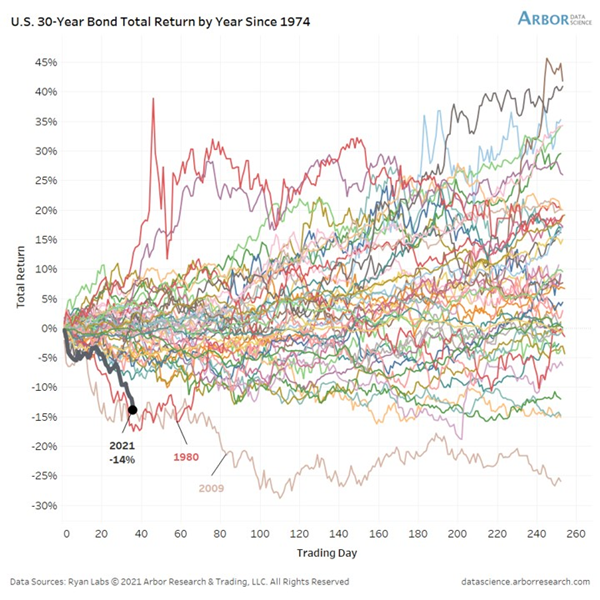

The 10-year yield registered a 252-day high on late last week. This is the first occurrence since the last 252-day low in August.

Typically, rising interest rates reflect positive trends in the economy and operate with a lag on future growth. Out of all cycles from a one-year low to one-year high in yield, this one is showing one of the smallest net changes in yield, because of its low starting level.

While forward returns in indexes were fine, there is a notable wrinkle - breadth tended to deteriorate.

The table below shows the percentage of S&P 500 members with a rising 200-day moving average after the 10-year yield cycled from a one-year low to one-year high. Please note, the numbers in the breadth table reflect the net change in the percentage of members with a rising 200-day moving average.

While most of the instances started from a high level, higher rates will impact certain industries. With policy rates on hold and the Fed conducting QE, it will be fascinating to see what happens with rates and the yield curve over the next 6-12 months. The implications for asset allocation could be profound.

What else we're looking at

- Full returns in major stock indexes, assets, and sectors following a full cycle in the 10-year yield

- An in-depth look at a "quick and dirty" hedge in QQQ

- What happens after gold suffers a loss like last week's

| Stat Box For the first time in more than 70 days, there were more securities hitting a 52-week low on the NYSE than a 52-week high. It's unusual to see this happen so soon after indexes hit record highs - it's happened only 10 other times since 1965. |

Sentiment from other perspectives

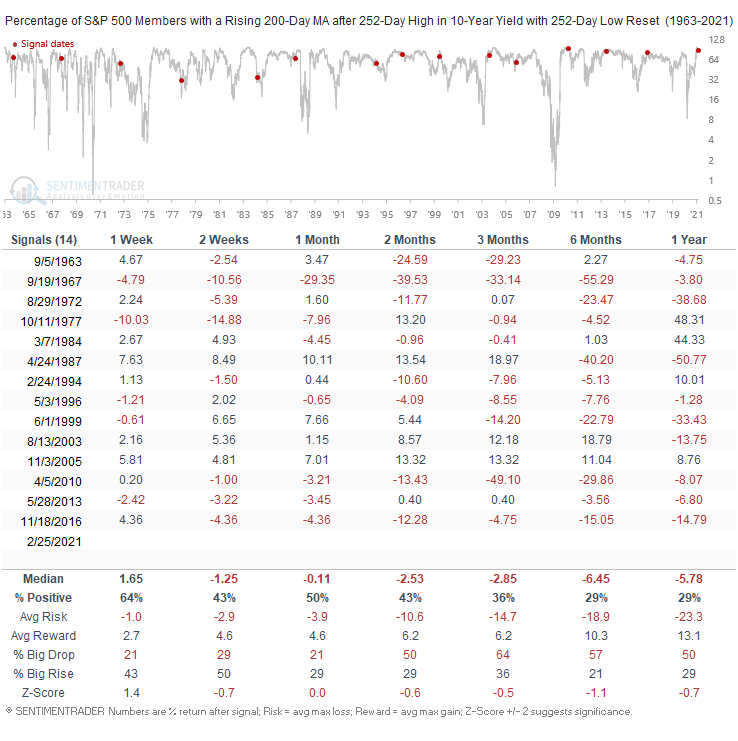

Mo' money, mo' problems. If that's still the case, then recent public offerings are in the clear, because they're not making any money. More than any time in history, investors are willing to swallow gigantic IPOs with absolutely no record of ever turning a profit. Or sales. Source: Wall Street Journal

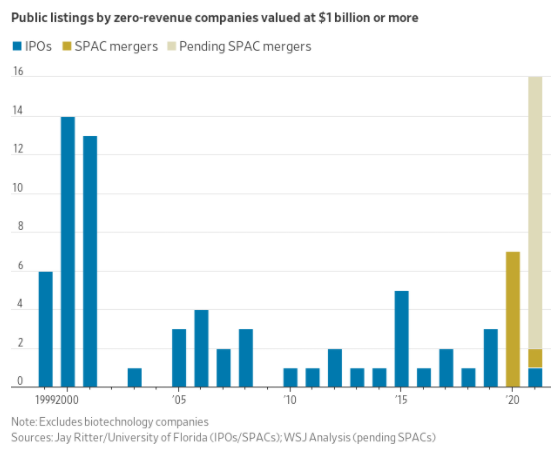

Not bullish on bonds, though. Twitter users are very optimistic on stocks (obv) which usually means they're less optimistic on other assets like bonds, which certainly seems to be the case. Source: Topdown Charts

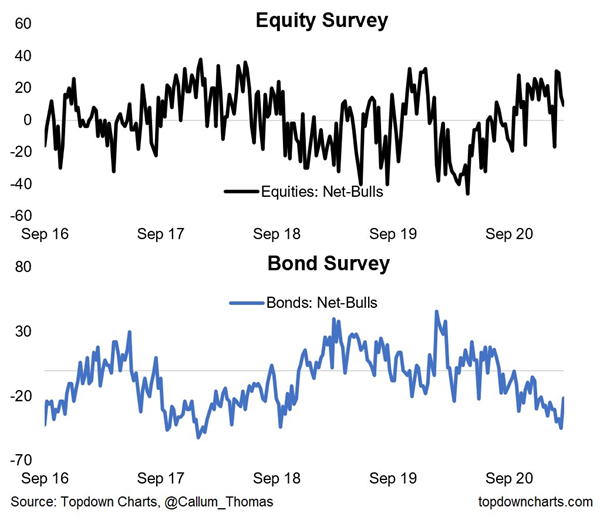

That's because they've had one of the worst starts, ever. Losses on bonds so far in 2021 are challenging some of the worst starts to a year in history. Source: Arbor Research via Jeroen Blokland