What the S&P's 10-and-10 correction suggests for the next few months

A 10-and-10 decline with no exhaustive selling pressure

It's been less than 3 months, but it feels much longer. As investors heralded the end of 2021, stocks were sitting at all-time highs, and the outlook (according to most) was excellent.

Now 10 weeks removed from the last weekly closing high in the S&P 500, the most benchmarked index in the world is still sitting more than 10% below its high point. Buyers' apathy and inability to build on even minor rallies is a hallmark of bear markets, and that fear is building by the day.

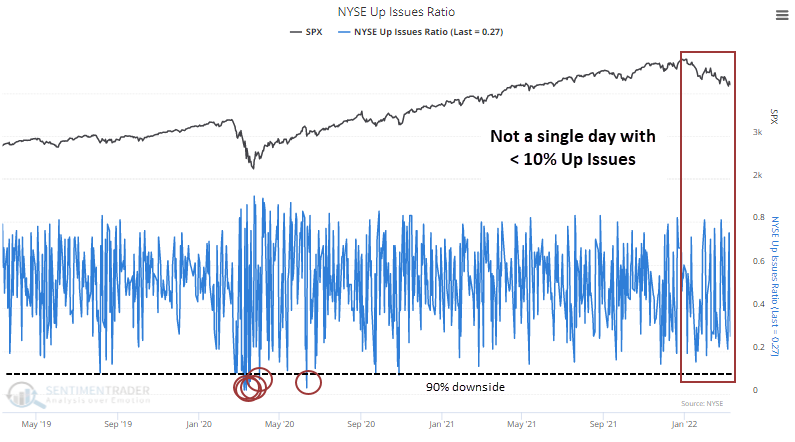

Curiously, there have been no days with truly exhaustive selling pressure during this entire stretch. Despite the large (but not extreme) price swings, there have been zero days with more than 90% selling pressure. The NYSE Up Issues Ratio has remained above 10% the entire time, unlike the pandemic crash and its aftermath.

Volume is more volatile, but even so, there haven't been any days with less than 10% Up Volume. The persistent selling pressure is causing sentiment to stay weak. Or rather, weak sentiment is causing rally attempts to falter quickly: chicken and egg.

At least some investors seem to be stepping up. With commercial hedgers covering some of their historic short positions against major equity index futures, Smart Money Confidence has been able to rise. It has now surpassed the peak from the pandemic.

We took a look at forward market returns after each of these developments, and they were all consistent in their message.

No positive trends in the eurozone

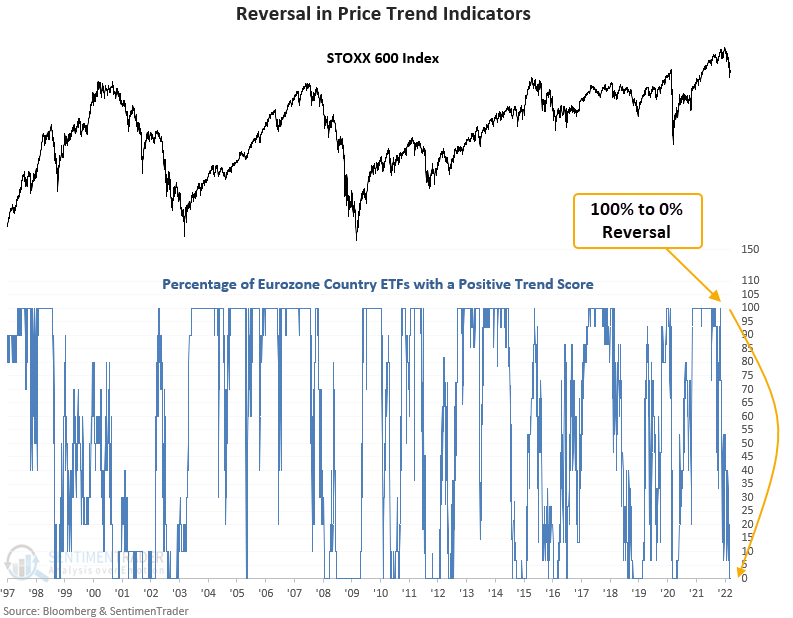

The number of Eurozone ETFs outperforming the S&P 500 on a YTD basis contracted sharply. Dean showed that price trend indicators for Eurozone countries show a significant reversal from positive to negative.

Applying a composite trend model to each Eurozone ETF shows all 15 countries with a positive score as recently as November 2021. Today, that same basket shows zero ETFs with a positive trend score.

This signal has triggered 12 other times over the past 24 years. Returns in the STOXX 600 after those signals was not exactly what people who buy "oversold" indicators would expect.