What's the Market Message from Stocks in Defensive Sectors?

In recent notes, I've shared two risk-off methodologies I use to manage portfolio risk. I want to highlight another measure in today's post. The process identifies instances when traditionally defensive sector members outperform the broad market as the S&P 500 Index hovers near highs.

Defensive Sector Composite Indicator

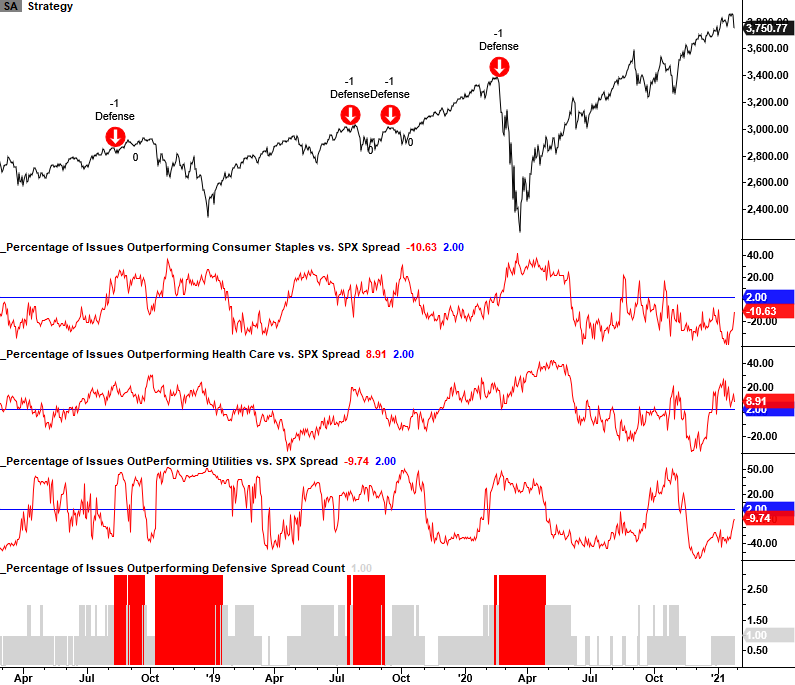

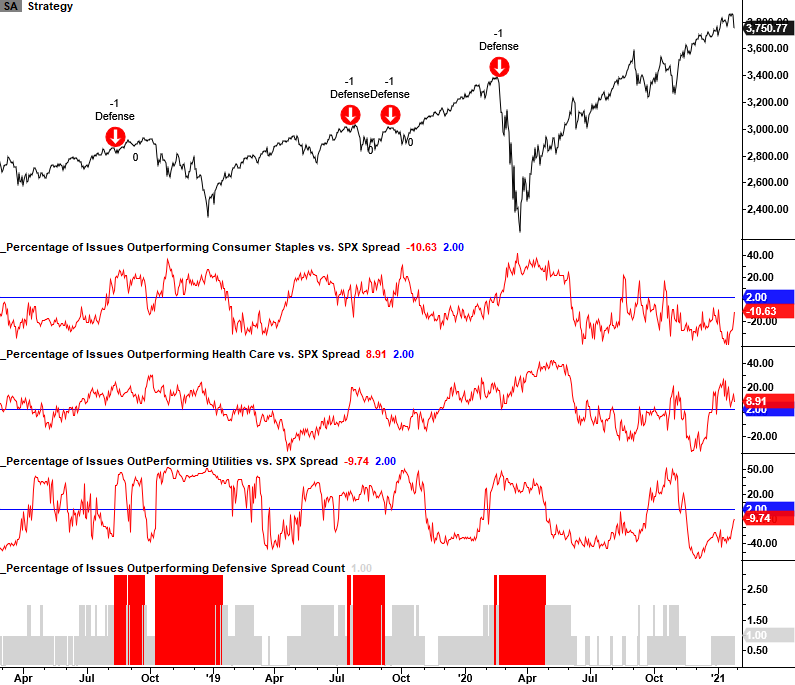

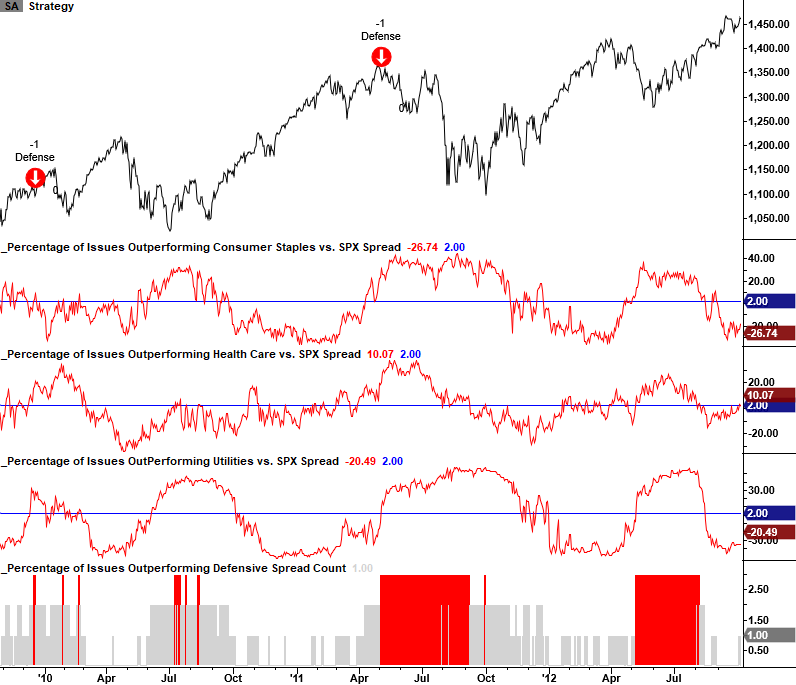

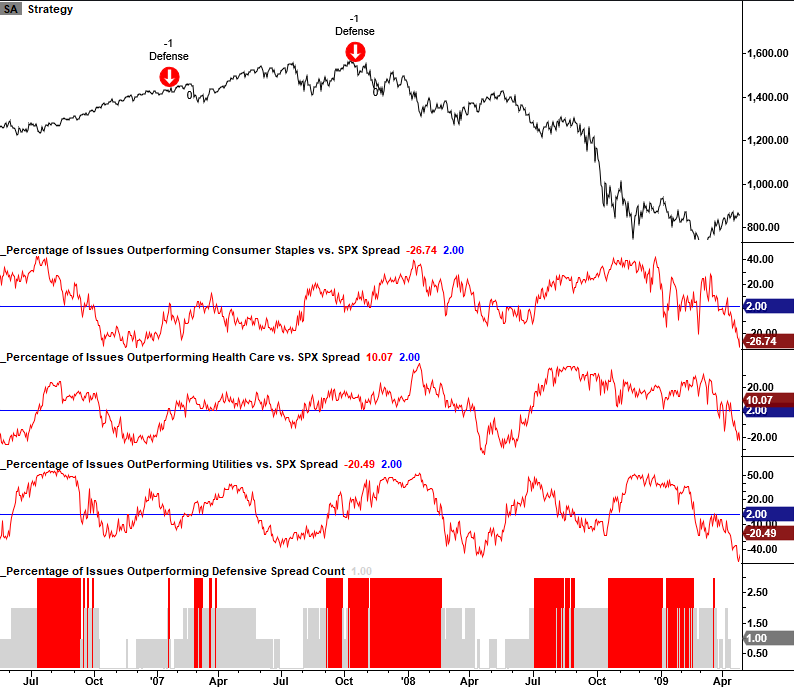

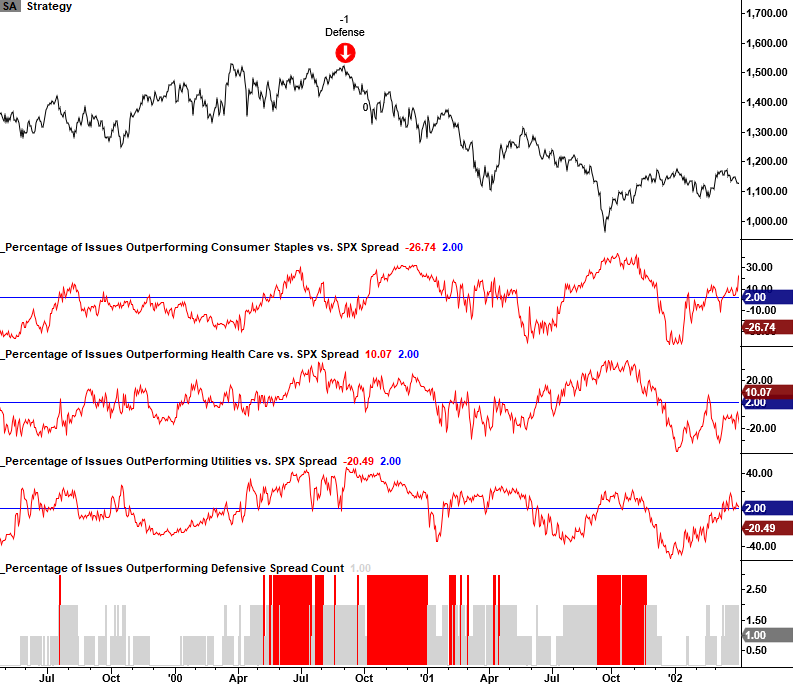

The Defensive sector composite utilizes the percentage of members outperforming the S&P 500 Index on a rolling 21-day basis across four groups.

The composite includes the following:

- Percentage of Consumer Staple Members Outperforming the S&P 500 Index

- Percentage of Health Care Members Outperforming the S&P 500 Index

- Percentage of Utility Members Outperforming the S&P 500 Index

- Percentage of S&P 500 Members Outperforming the S&P 500 Index

I calculate the composite by measuring the difference between each sector series and the S&P 500 series. I then count the number of groups with a spread above a user-defined threshold. The threshold for this model is plus two or above.

Defensive Sector Composite Signal

The Defensive sector composite risk-off signal seeks to identify the following conditions.

- The composite crosses above 2.99. i.e., defensive sector members are outperforming the broad market.

- If condition one, start days since true count.

- If days since condition one count is <= 15 and the S&P 500 Index crosses below the price range rank of 87%, and the S&P 500 Index is down less than 2% from a 252-day high, signal risk-off.

- The signal resets on a cross below 0.99. i.e., a new signal can't occur until the reset condition is true.

Note: The range rank for the S&P 500 uses a 63-day lookback period.

Current Chart and Historical Signals

The composite count remains below the threshold signal level. With the S&P 500 down greater than 2% from the most recent high, it's unlikely that a signal would trigger if the S&P 500 Index continues to correct from current levels.

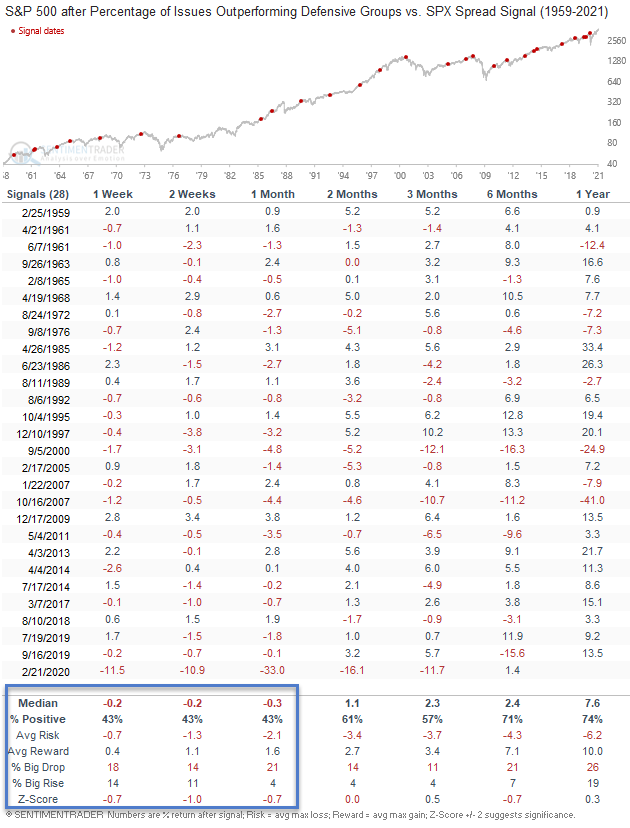

Signal Performance

As one can see in the table below, performance is fairly weak in the 1-4 week timeframe.

Conclusion: Investors have not embraced a defensive risk-off mode as measured by the composite model count. If and when a signal occurs, I want to see several other risk-off models trigger around the same time. By utilizing a weight-of-the-evidence approach, one can avoid the pitfalls associated with individual signal failures.