What's the message from the junk bond market?

As Jason and I noted in several studies last week, market breadth has been healthy across many indices and exchanges. In today's note, I plan to review market breadth measures for high yield bonds.

Bond investors, as a group, are generally seen as being the smart money. While the history for market breadth bond data from FINRA TRACE is limited, I believe it still offers some great insight.

The advance-decline line for junk bond issues continues to make new highs, and the spread between the 50 and the 200-day moving average for the AD line is firmly in expansion territory. Historically, the SPY ETF annualizes at 11.3% when on a golden cross buy signal using the 50 and 200-day moving average.

New 52-week highs to continue to exceed new lows. The spread measured in percentage terms currently resides at just a shade over 9%. If I buy the S&P 500 whenever the spread between highs and lows crosses above 10%, the S&P 500 annualizes at an impressive 29.3%.

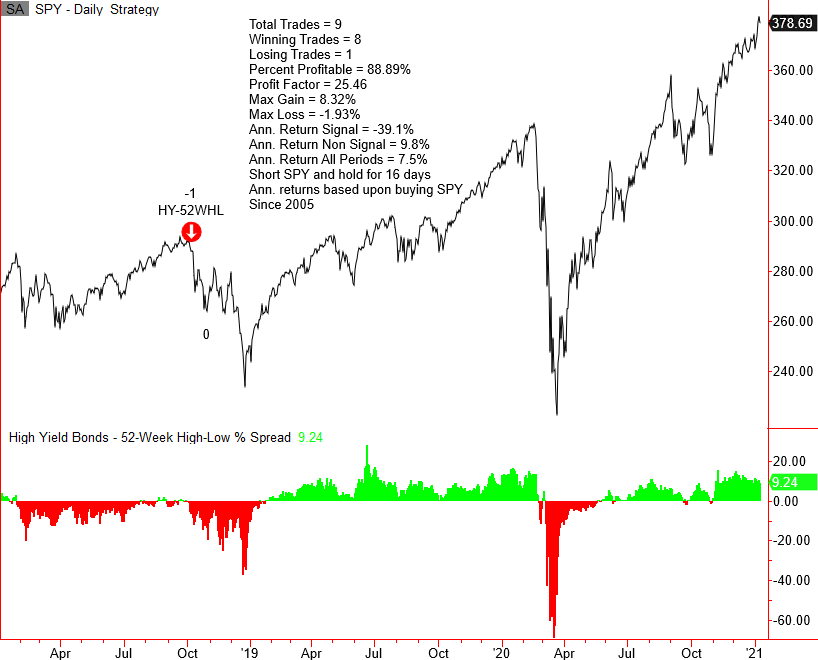

New highs are an essential measure of market breadth, but I keep a close eye on new lows when the markets are trending higher. When an index is near a high and lows are expanding, take note. Currently, high yield new lows are minimal. The risk-off signal in the chart below measures instances when the 52-week high-low % spread for high yield issues crosses below -5%, and the SPY ETF is trading 2.25% or less below a closing high.

The 2014-16 period provides a perfect example of why I monitor the new high-low % spread.

Several years ago, I created a high yield timing system that incorporates breadth and trend components. One feature utilizes the McClellan Summation Index. As the chart below shows, the indicator is well below levels associated with risk-off periods.

Bottom line: market breadth measures for high yield issues remain constructive and nowhere near levels associated with risk-off periods.