When it comes to markets, "book learnin'" isn't necessarily a good thing

The Federal Reserve Bank of New York (FRBNY) has been conducting an in-depth survey of consumers for about 7 years. One part of the survey asks for opinions about whether stocks will rise over the next year.

The latest data of about 1,300 consumers, out on Monday, showed an uptick in optimism, with the most-ever percentage of consumers expecting stocks to rise. Sounds troubling, so let's look.

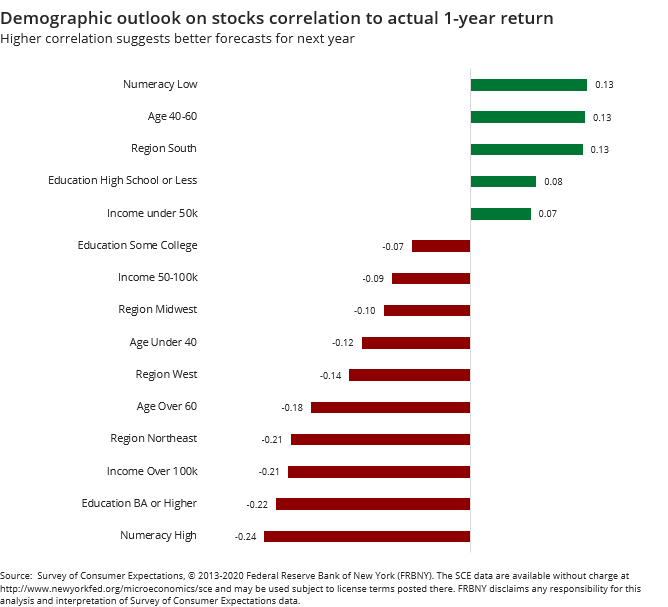

The FRBNY isolates consumers' outlook about stocks over the next year by about a dozen demographic identifiers. The interesting thing is that when we look at each group's success at predicting the next year in stocks, the best-performing groups are the ones that should have the least knowledge. The worst-performing groups are the ones that should have the most.

None of them were especially successful at being bulling or bearish at the right times. But among the few demographics that showed a positive correlation were those with low numeracy (the confidence and skill to use numbers to solve problems in everyday life), those with at most a high school education, and those with incomes under $50,000/year.

The demographics with the worst forecasting records were those with high numeracy, high education, and high incomes. Most of us would probably think it should be the exact opposite, but markets don't necessarily reward book smarts.

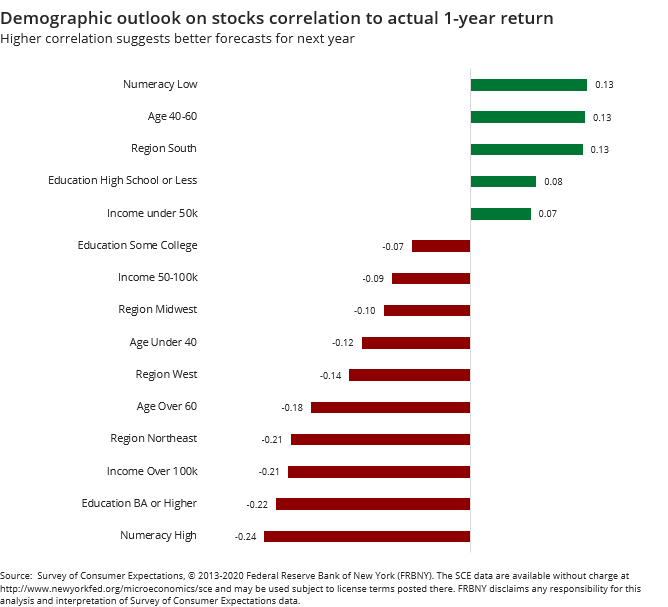

If we look at the current optimism among those with "book smarts", it's well off the highs compared to those with "street smarts."

When the spread has been high over the past 7 years, meaning when those with high income, education, and numeracy were much more optimistic than those with low income, education, and numeracy, stocks actually tended to suffer. When the book smart group was relatively pessimistic, stocks did well, mainly in 2014 and 2017.

The annualized return when the spread was above 9 was only +1.0% versus +12.2% when the spread was below 9, which is where it is now.

It's not like there's a super-wide divergence between the two at the moment. One might think that given the disproportion share of job losses among the "street smart" group, they would be much more pessimistic than the "book smart" group, but that's not the case. And it's probably a good thing, too, since they've had a better record at predicting the market than their more educated peers.

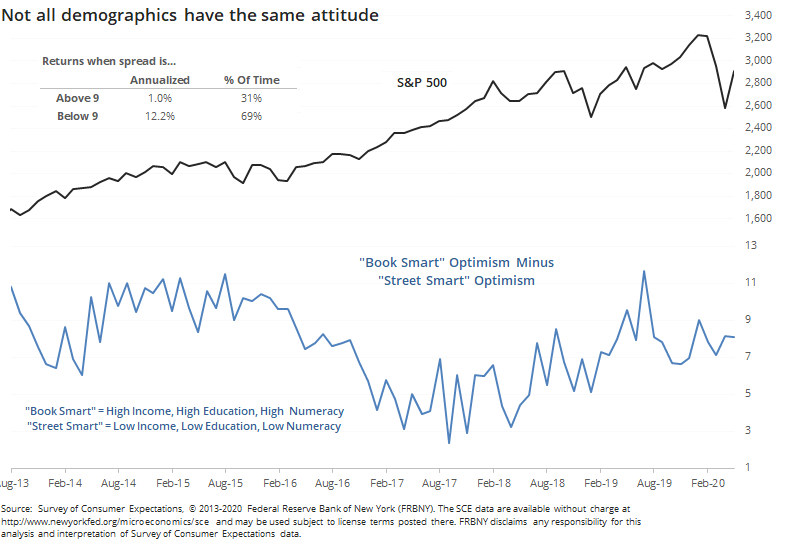

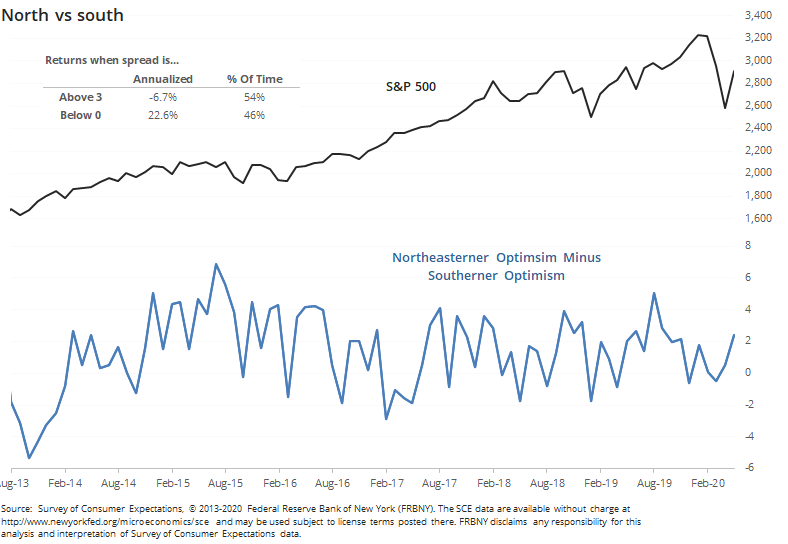

We can see a similar pattern when "sophisticates" in the northeast are more optimistic than "bumpkins" from the Midwest. This is coming from a lifelong midwest resident, so I would be firmly in the bumpkin category.

The spread between the two was about average for April, but it's interesting to note that when it's above 3, meaning those in the northeast are much more optimistic than midwesterners, the S&P's annualized return was much less than when those of us in flyover country were more positive.

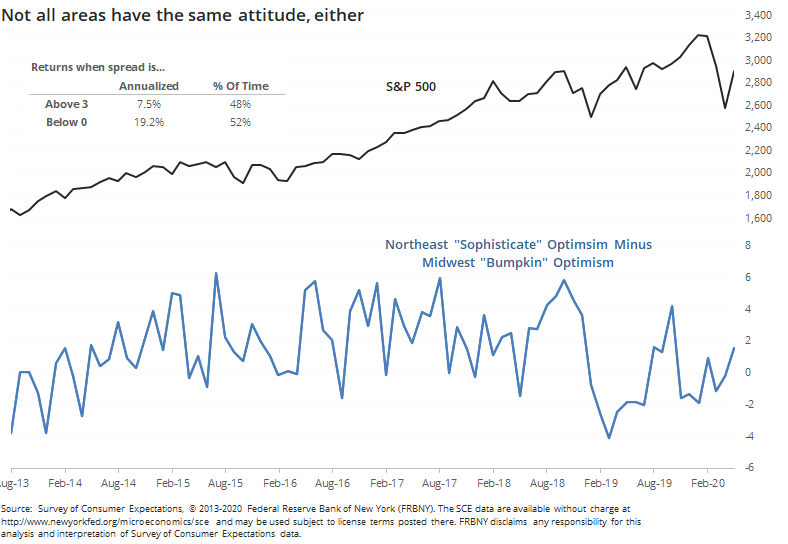

There was even more of a stark divergence in north vs south optimism.

Whenever those in the northeast were more than 3 percentage points more optimistic than those in the south, the S&P's annualized return was a wretched -6.7%. When southerners were more optimistic, that shot up to +22.6%.

Highly developed cities, especially those with exchanges, see a kind of sociological agglomeration of services for finance types, likely helping to form a sense of groupthink and herd mentality. While there are developed cities and exchanges in the midwest and elsewhere, there is much less of a focus on finance and markets. For the past 7 years at least, that seems to be a good thing. Consumers without that focus have had a better record at sensing the risks and opportunities in stocks than those more directly impacted by their movements.

As of now, that appears to be a slight positive. When the sophisticates and book smart folks become a lot more optimistic, then it will be more of a worry.