Why a low VIX is nothing to fear

Key points:

- The VIX "fear gauge" has been holding around or below 17 since mid-October

- That's commonly believed to be a sign of complacency

- Testing shows that a VIX below 17 allowed the S&P to grow steadily and consistently

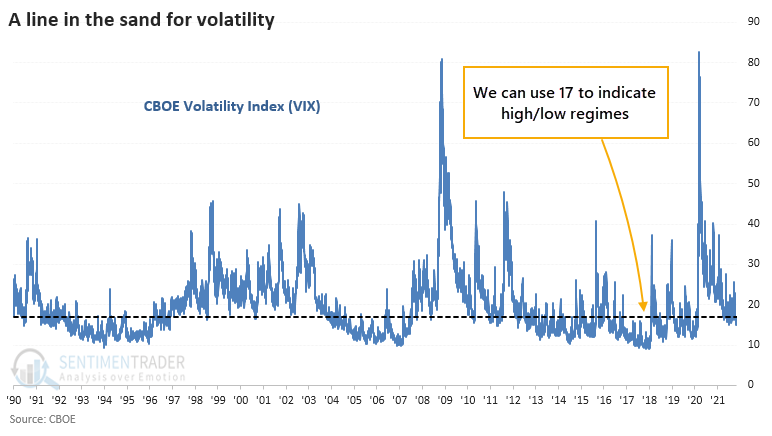

Drawing a "line in the sand"

The chart below shows a monthly chart for the VIX Index with the 17 level as our cutoff between implied volatility being high or not.

We will look at returns in the S&P 500 after 2 buckets:

- When the previous day ended with the VIX below 17

- When the previous day ended with the VIX at or above 17

Bear markets occur when VIX is above 17

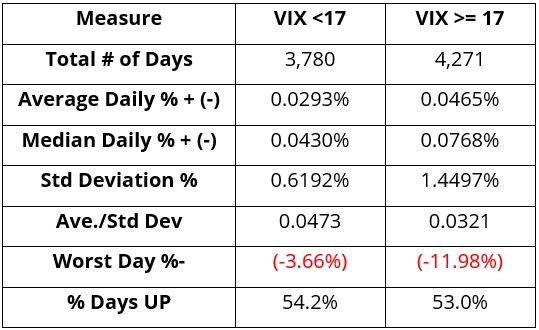

From January 1990 through the present, 3,780 trading days (47%) fell into Bucket #1, and 4,271 (53%) fell into Bucket #2. Trading days following VIX < 17 readings have:

- Lower average and median daily returns

- Much lower average volatility and downside

- A slightly higher percentage of up days

Consider the statistics in the table below.

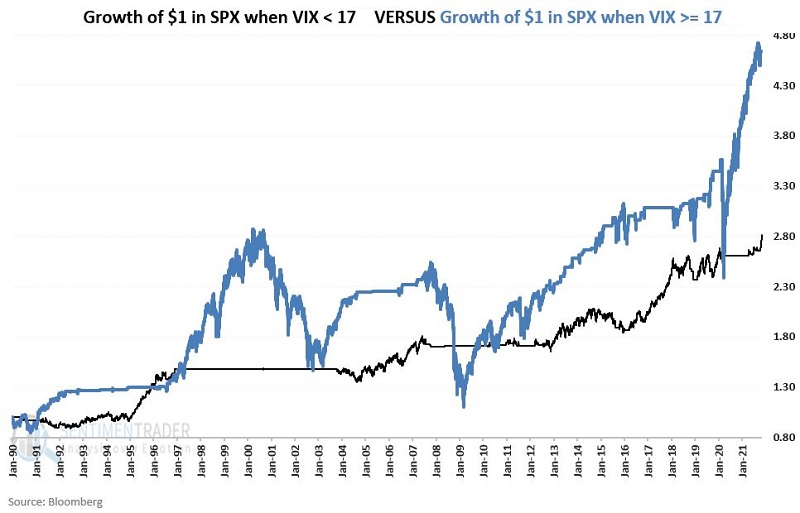

To get a better picture, the chart below displays the cumulative growth of $1 invested in the S&P 500 Index for trading days after VIX is above (blue) and below (black) 17.

Days above 17 have a higher total return, but days below 17 are overall much less volatile. The bulk of the last 3 bear markets occurred when VIX > 17.

When VIX < 17, stocks compounded in a slow, steady way

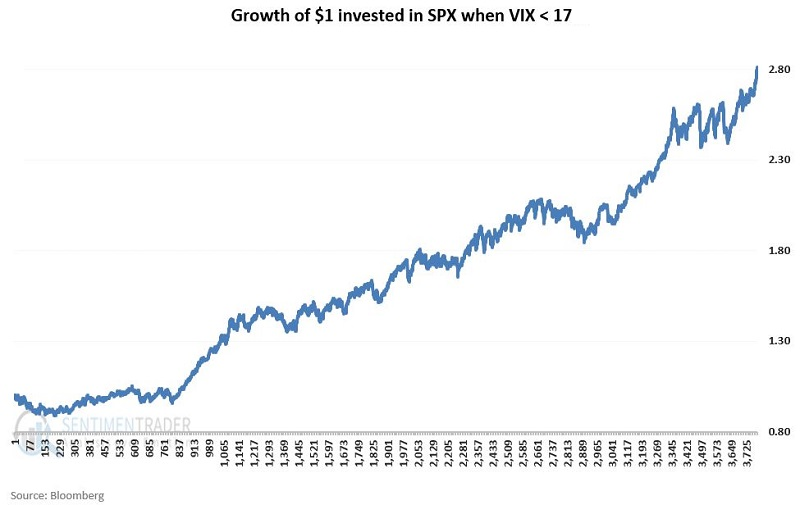

To test the argument that low VIX readings are worrisome for stocks, we will eliminate all days when VIX is >=17 and string together the performance for the S&P 500 Index only on days when VIX is < 17.

The cumulative growth of $1 invested in the S&P 500 Index only when VIX < 17 appears in the chart below. There is a steady march from lower left to upper right.

What the research shows…

The assertion that a low VIX reading is a warning sign to investors is misplaced. While returns may not be spectacular when VIX is < 17, they are surprisingly smooth, consistent, and non-volatile. Yes, the stock market can decline when VIX is < 17, but the mere existence of low implied options volatility among S&P 500 stocks does not appear to be a factor in creating market weakness.