World equity market breakout

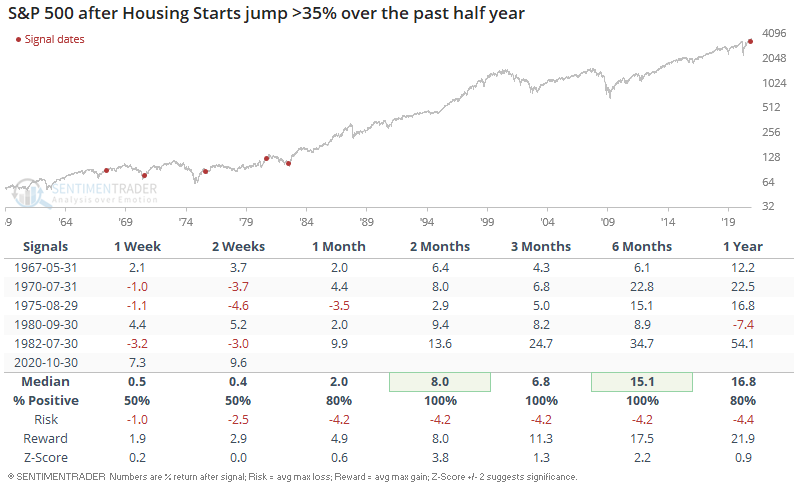

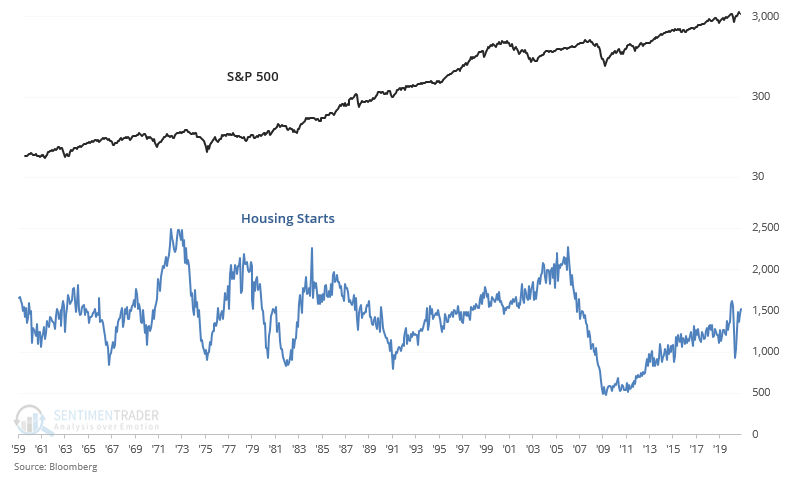

U.S. economic conditions continue to improve (this may change depending on how the pandemic plays out). Past-looking data series are still trending upwards. For example, Housing Starts is almost at its pre-pandemic highs:

Historical cases of the housing market rebounding this strongly usually occurred after a recession (as it did this time). As a result, the S&P 500's forward returns over the next 2-6 months were universally bullish:

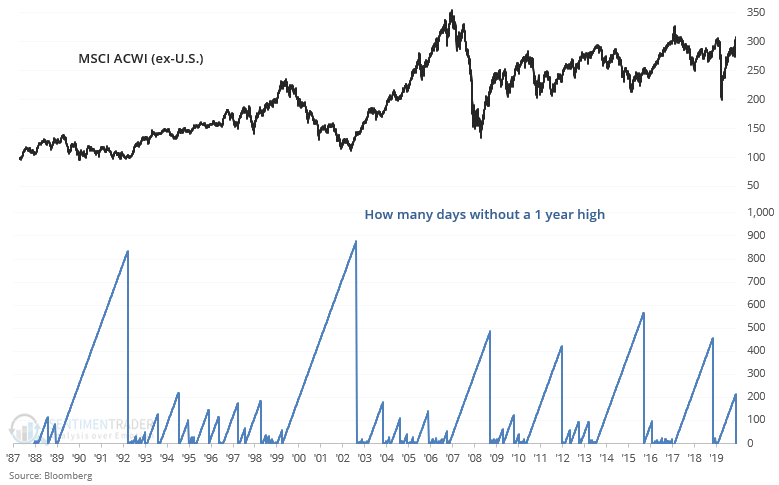

Outside the U.S., the MSCI All Country World Index (excluding-U.S.) broke above its pre-pandemic high to a new 1 year high. This is the first 52 week high in more than 200 days:

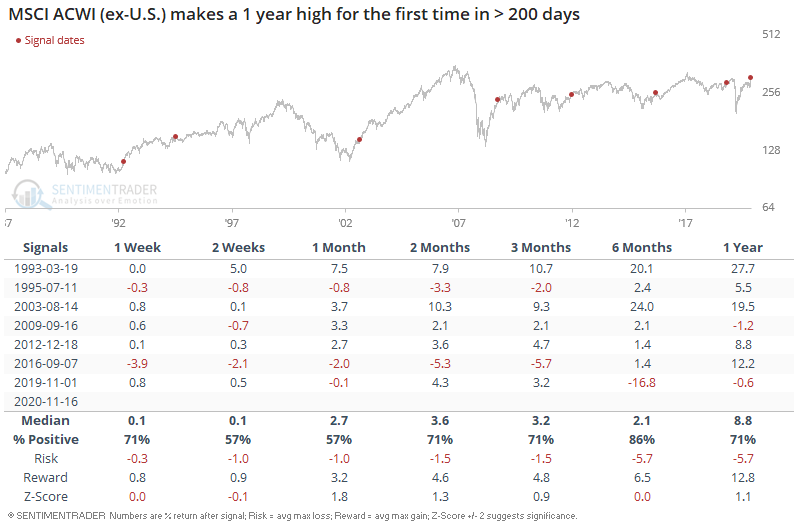

When such breakouts occurred in the past, it wasn't an all-clear sign for ex-U.S. stocks going forward. Sometimes stocks would continue to go up, but more often than not the rally slowed down:

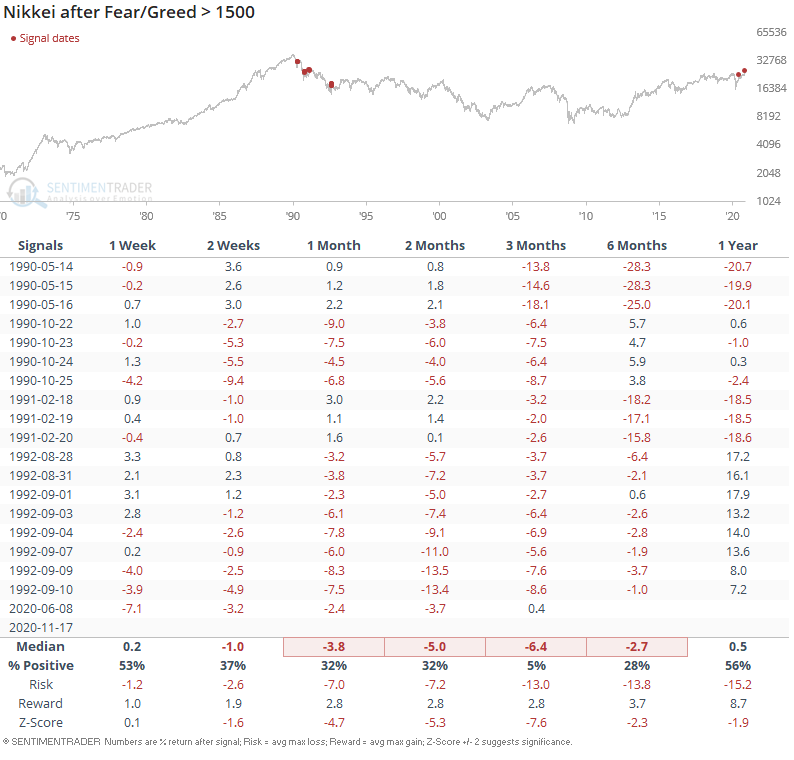

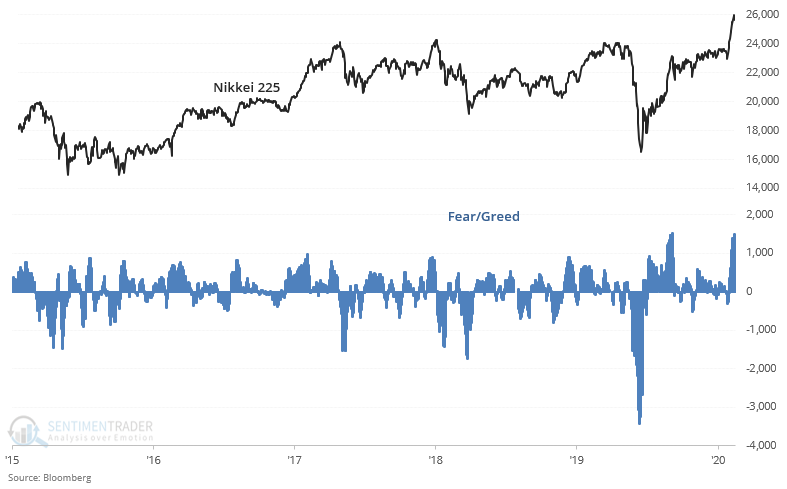

Japanese stocks are at multi-decade highs, pushing Bloomberg's Fear/Greed indicator to one of its highest readings of all-time:

Such extreme readings only occurred during the great 1990s bear market. As a result, the Nikkei consistently fell over the next 2-3 months: