Writers Have Been Right As Stocks Emerge From Bear Markets

Right-way writers

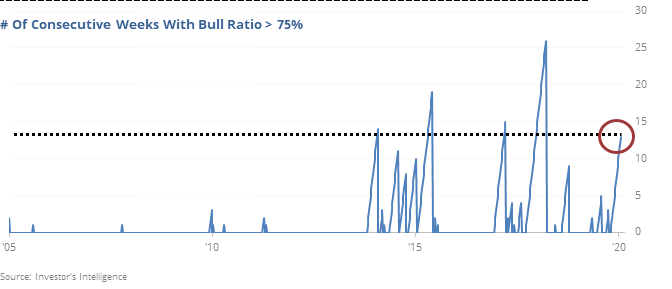

Newsletter writers have been predominantly bullish for more than 3 months, a good thing given how stocks have performed. Their Bull Ratio has now been above 75% for 13 consecutive weeks, the longest streak since the end of 2017, and one of the longest stretches in 50 years.

It’s not a huge surprise that forward returns after similar streaks weren’t great. The S&P’s average across all time frames was below random, significantly so over the next year.

More troubling is the risk/reward, which was bad considering stocks’ long-term trend over the study period.

Fewer bear markets

For the first time in almost 2 years, fewer than 10% of stocks within the S&P 500 are in individual bear markets, roughly defined as being more than 20% off their 52-week highs.

This kind of recovery tended to be a good sign, especially over the longer-term. While the S&P’s returns over the shorter-term, up to about a month later, were above average, the risk/reward was not very good – barely positive, in fact.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- SPY has recorded its 10th consecutive day with a record intraday high