Yet Another Big Gap As Market Tries To Thrust And MLPs Rally

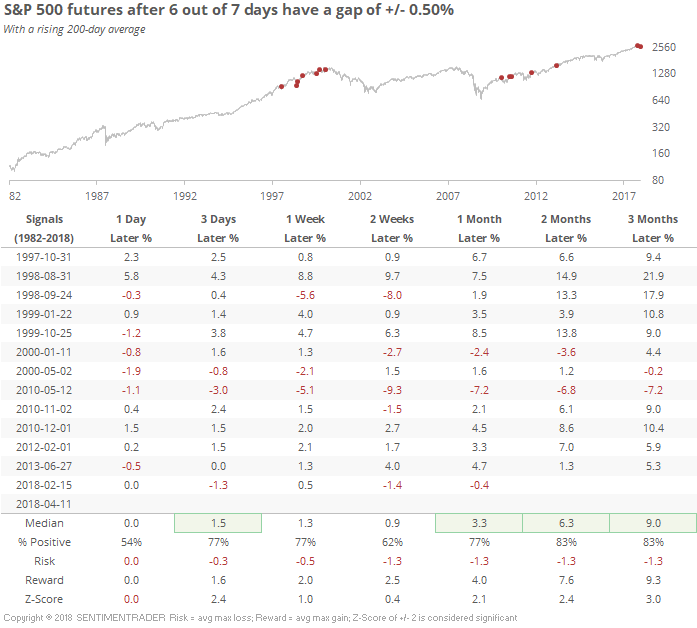

Yet another large gap down this morning as traders grapple with what seem like potential game-changers in terms of geopolitics. For the S&P 500 futures, this will mark the 6th time in 7 days that futures have opened at least 0.5% away from the prior close. We saw that kind of emotional volatility in mid-February, but prior to that, not in the past five years (including only times when the S&P's 200-day average was rising).

On a shorter-term basis, futures have typically rallied after such volatility.

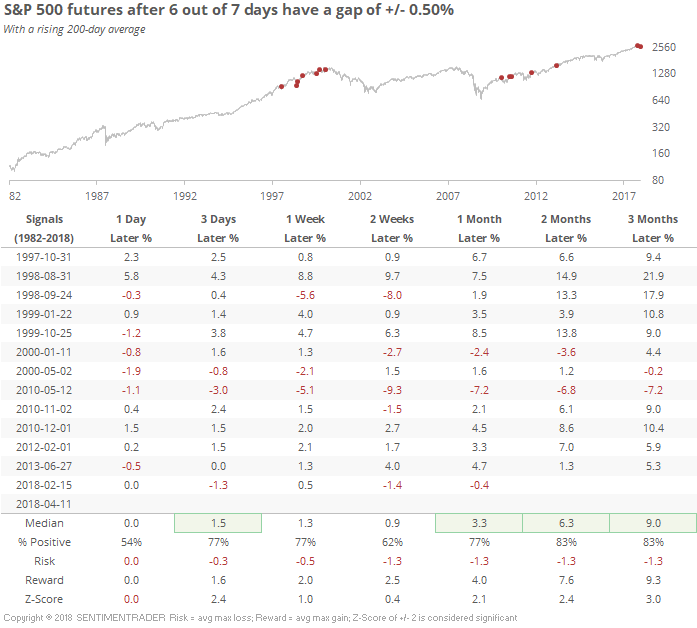

Expand the time frame and looking longer-term, even better. Only one loss six months later.

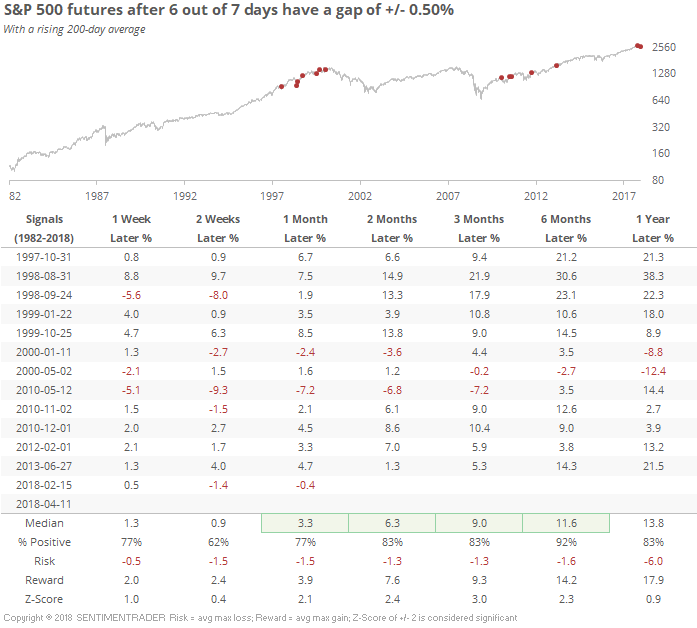

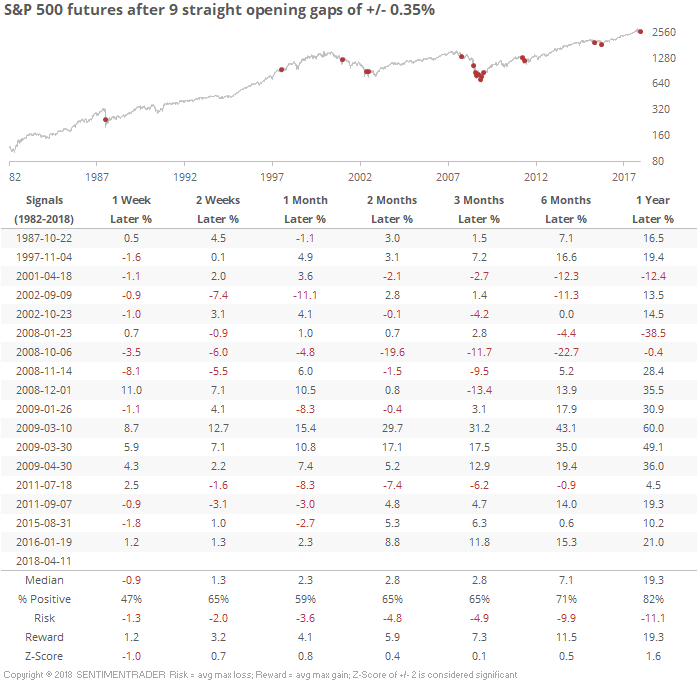

If we forget about the trend and just look at the sheer number of at least moderately large gap opens, today will market the 9th consecutive day with a gap of more than 0.35%. Again, a rarely-seen level of volatility. The shorter-term returns were not great, and there were some wide swings, but generally positive going forward. This will mark only the 3rd time it occurred with a rising 200-day average (Nov 1997 and Jul 2011 were the other two).

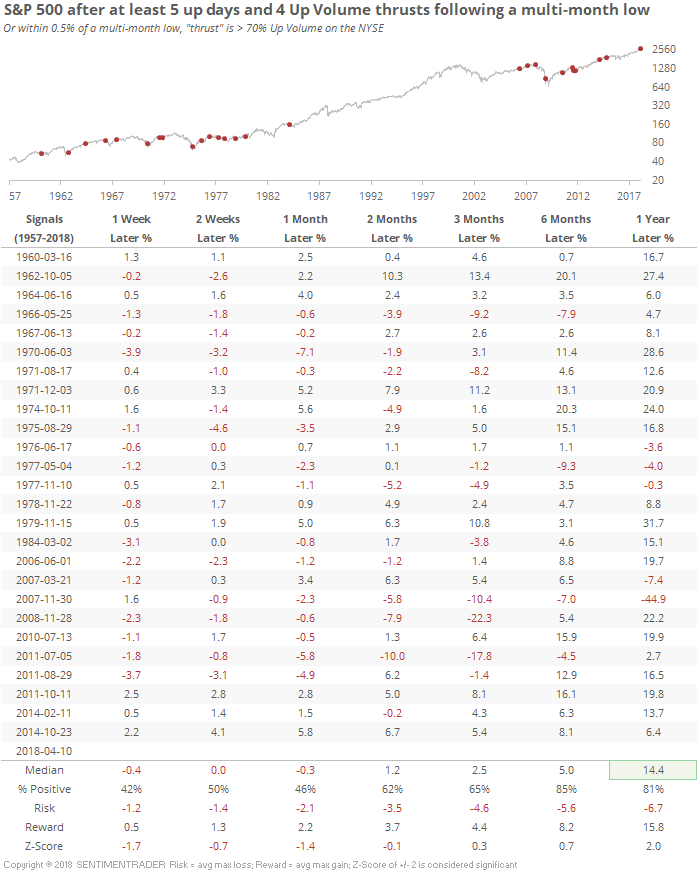

This didn't make it into the report last night, but since the S&P dipped close to a multi-month low six days ago, it has rallied 5 of the 6 days and Up Volume on the NYSE has been better than 70% on four of those. This is kind of a poor man's thrust, and while short-term returns were not good, for investors it was a good sign of excessive uncertainty.

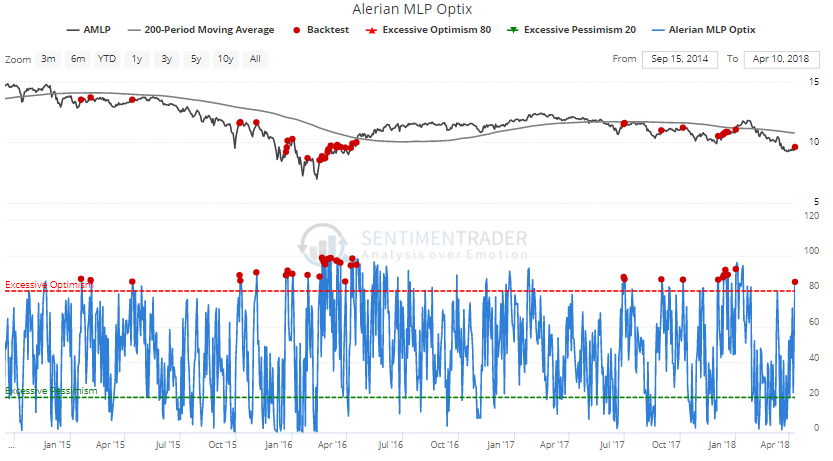

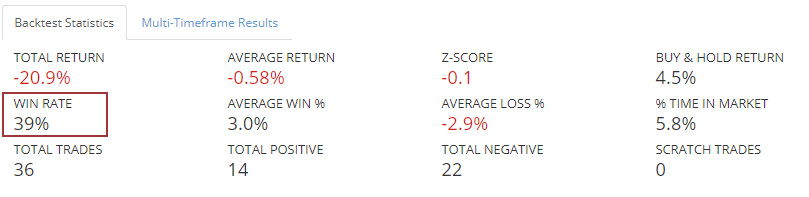

Among sectors, MLPs have been trying to rally from somewhat oversold conditions. The Optimism Index on several of them have once again reached a high level. Last week, they fell back after reaching lower optimism than they're seeing now, which is typical and doesn't tell us much. Now there is another test. On AMLP, the Optimism Index is above 85 while the fund itself is below its 200-day average. According to the Backtest Engine, that has led to a positive return over the next few days only 39% of the time.

As always, should it (and the other MLPs) rally in the coming days and buck its historical tendency, it would be a good sign that buying interest is overwhelming and should lead to higher prices longer-term.