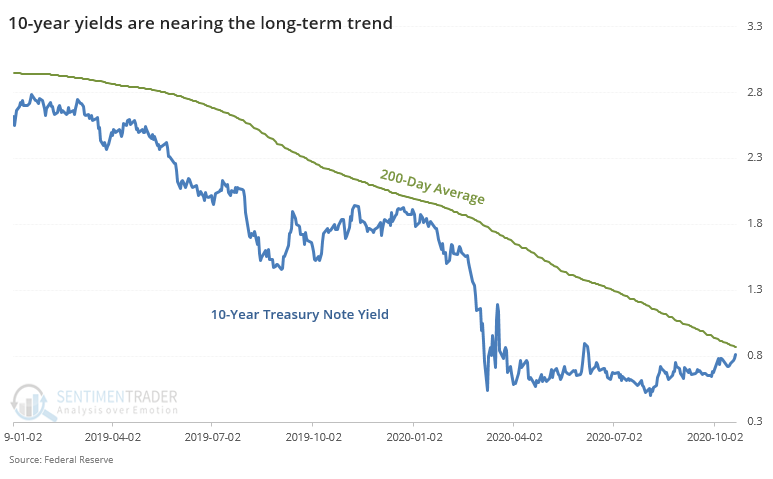

Yields near their long-term average

As investors weigh the potential for a new administration, another round of stimulus, and (hopefully) good news on the pandemic, yields on longer-term Treasuries have quietly risen.

Now, for the first time in more than 200 days, the yield on 10-year Treasury notes is nearing its 200-day moving average.

It's been more than 9 months since the yield was within 10 basis points of its average. That's one of the longest streaks in nearly 60 years, with only a handful of dates eclipsing it.

When a streak of more than 6 months of being at least 10 basis points under its 200-day average finally ended, it usually did not precede a further rise in yields - there was no time frame in which the 10-year yield rose more than half the time.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Signals showing future 10-year yield when it nears its 200-day average for the first time in a long while

- Forward returns in stocks, the dollar, and gold, too

- No utility stocks were above their 200-day average a few months ago, and now more than 80% of them are - what happens next

- Leading economic indicators are showing signs of recovery

- For the first time in months, more "mom and pop" investors are bullish than bearish

| Stat Box Half of all utility stocks are now overbought, according to the Relative Strength Indicator. Over the past 20 years, this has happened on 115 other days, leading to an average return of -2.6% over the next 2 months. |

Special Announcement

Today I have some exciting news to share with you!

Brad Lamensdorf has been a friend and SentimenTrader client for many years. Over the years, as a hedge fund manager and market timer, Brad has developed some unique insights into the markets.

Recently, Brad and I teamed up to research those insights in-depth and create and long / short trading program. Brad has launched the Active Alts SentimenTrader long / short strategy and I wanted to share that announcement with you. I am excited to work with Brad and wanted him to tell you more about it.

So, let me turn it over to Brad...

--------------------------------------------------------

Thank you Jason,

Yes, Jason is right. We do have some exciting news to share with you!

As some of you may know, I have over 30 years of experience in the markets. I’ve worked for some heavyweights in the industry as well as successfully managed my own hedge fund.

Over that time, I have honed my skills and trusty indicators. After a lot of hard work in fine tuning those indicators and stock selection, I have launched the Active Alts SentimenTrader Long / Short Strategy.

I’ve teamed up with SentimenTrader, which you know is a proven research and analytics firm with over 20 years of experience and 3,500 clients in over 50 countries around the world.

Officially, the strategy launched on January 1, 2020. Now I am ready to go live to a wider audience. And, I’m excited to share the details of the strategy with you. The Strategy has performed 14.94% year to date.

I think that now is the best time in decades for both stock selection and risk management. There will be plenty of winners and losers post-COVID.

I believe my strategy can help you navigate these waters ahead. Many of you have read my free research and insights on market sentiment and trends for years now.

I value your readership and I have never asked for anything from you. I'm going to do something very few money managers ever do. I'm going to open my schedule for the next couple of weeks to have one on one phone calls with you, the investor.

I want to learn more about you and the investment challenges you are faced with in the post COVID / election year environment and discuss with you how this strategy can best position your investments.

I’d like you to schedule a phone meeting with me. It’s simple. There’s no customer service in some far-flung corner of the world. Just me personally. Throughout my investment career, I always wished I could have direct access to the money managers running the strategies I was interested in to help me make investment decisions. They were difficult to reach and often too busy to speak with the investors directly. I am changing that with this strategy.

You now have access to speak to me directly. Get on my calendar and schedule a call with me.

Check out the following link to my calendar to schedule your call.

I can't wait to speak with you.

Many thanks,

Brad Lamensdorf

Founder

ActiveAlts.com

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

1. Money managers are betting on copper to a historic degree - Mike McGlone via Daily Shot

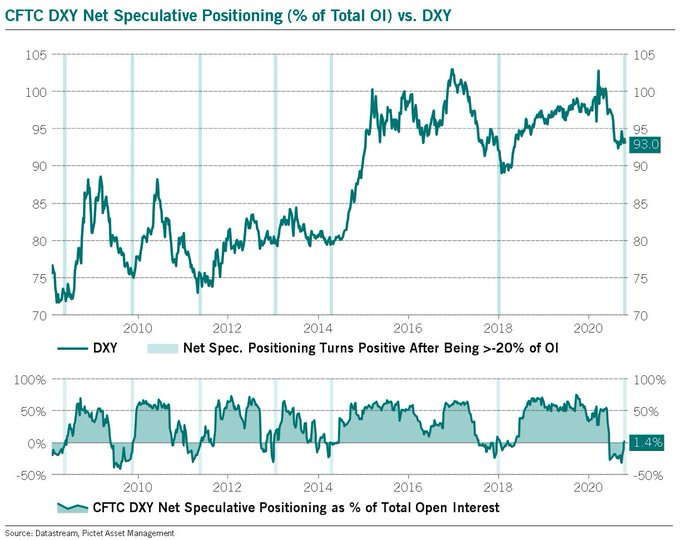

2. Speculators are long the dollar for the first time in months - Pictet

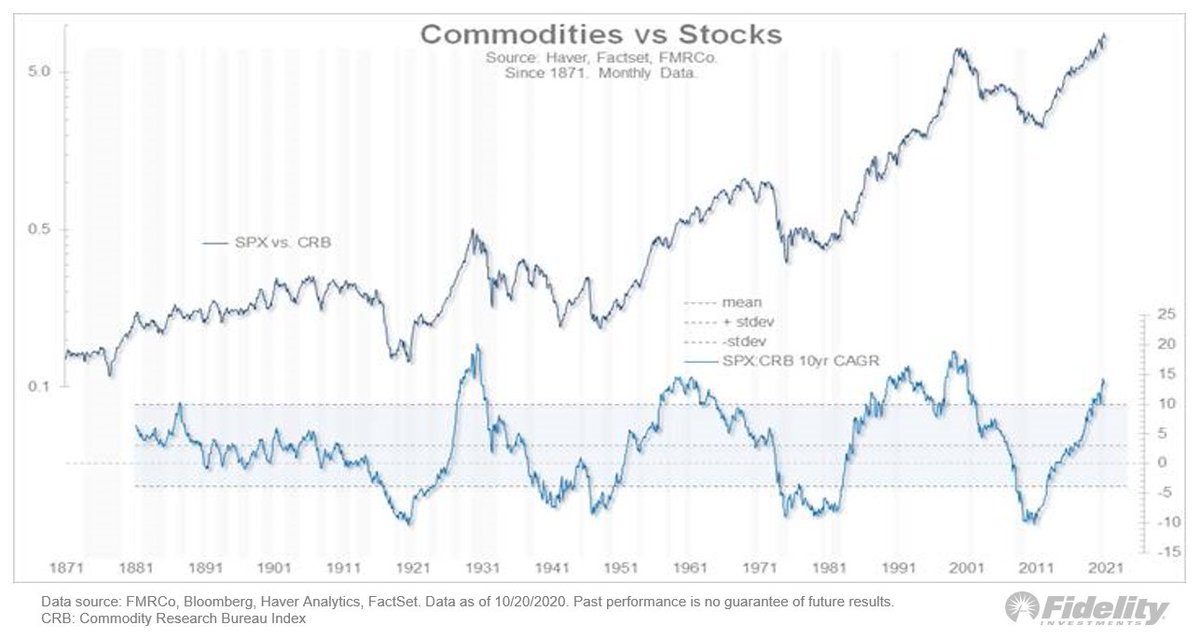

3. Optimistic stock investors - and pessimistic commodity investors - have driven the stock/commodity ratio to an extreme - Fidelity