All equity funds are showing negative flows

What's it going to take for investors to embrace equity funds again?

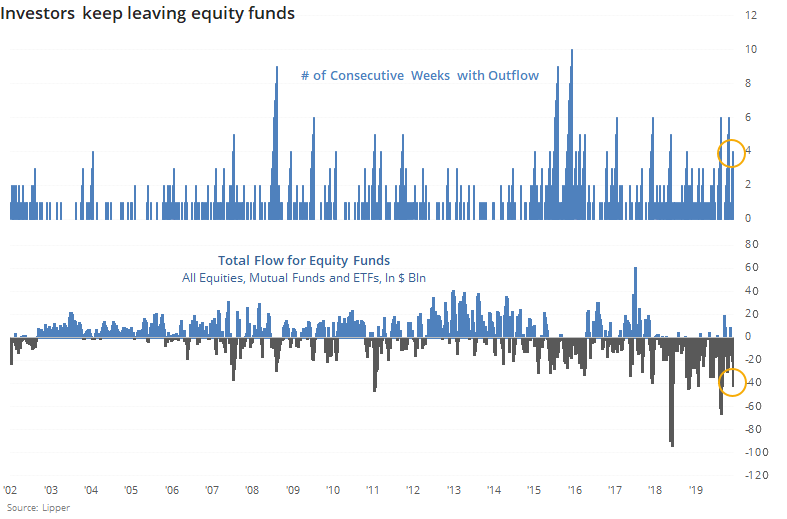

They're leaving emerging markets funds, overseas funds, and inexplicably even domestic ones. Lipper reported another outflow of more than a billion dollars from all equity funds this week, the 4th consecutive outflow. The total outflow over the four weeks is over $40 billion, ranking among the largest in nearly 20 years. That's quite remarkable given how resilient parts of the equity market have been.

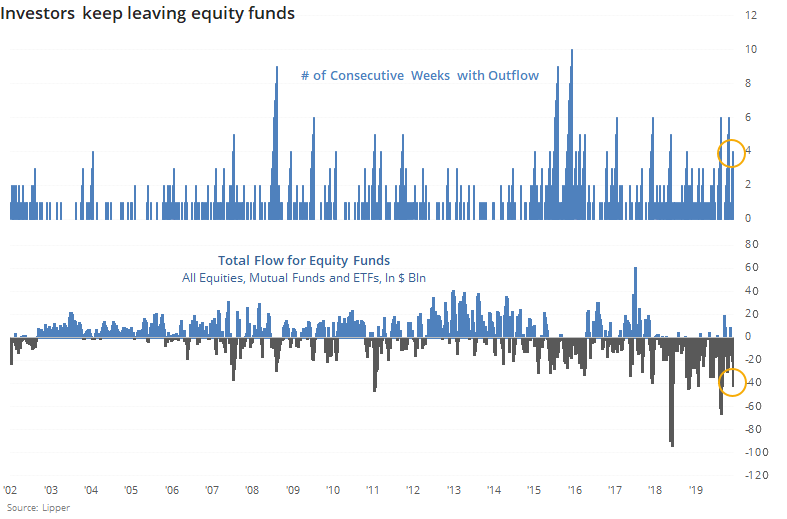

Generally, big outflows are a decent contrary indicator. Below, we can see every date when there were four straight weeks of outflows, totaling at least $10 billion.

While fund flows don't move perfectly in step with prices, we usually see inflows during rallies and outflows during declines. This year, not so much, and that's a moderately positive sign for stocks over the medium- to long-term.

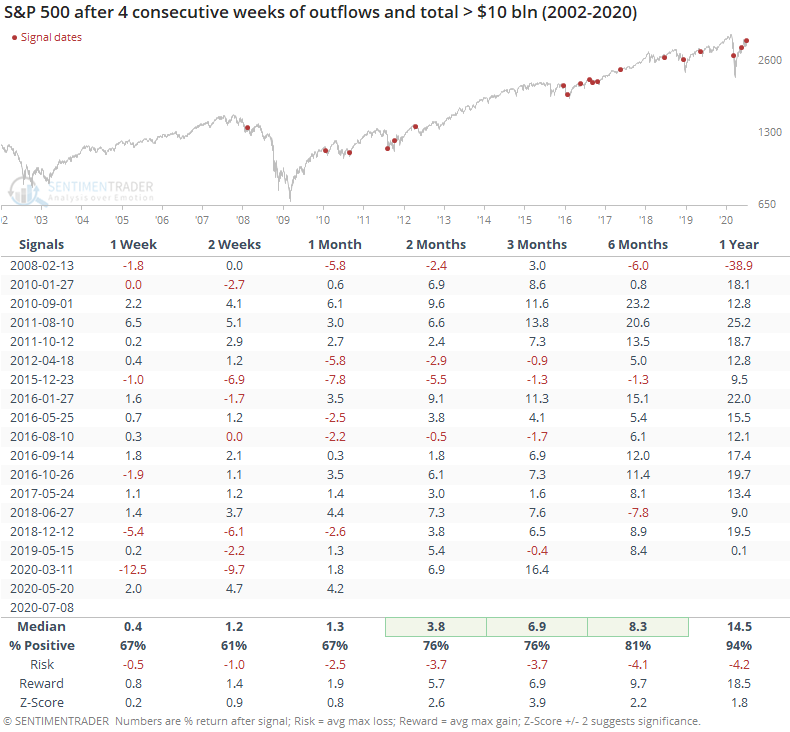

There are certainly some conflicting data points when it comes to sentiment. We're seeing outflows like this, and insiders are buying. Yet there have also been pockets of historic speculation. Ultimately, these contrasting indicators are washed out in models like Smart and Dumb Money Confidence, where the spread has been hanging around -25%.

On the Dashboard, we calculate every combination of the two models and show what the S&P's median return over (or under) a random return has been over the next two months given where the models close that day.

With the current levels of the models where they are, the S&P has under-performed a random return by 1.1% over the next couple of months since 1999. So the few positives among the indicators we follow haven't been enough to offset the multitude of negatives.

The most positive aspects of this market have been the thrusts, recoveries, and trend changes that have an almost unblemished record at preceding higher prices over a 6-12 month time frame. It's the short- to medium-term that has been more of an issue since late May.